Investors navigate a labyrinth of strategies, each catering to distinct preferences. However, the market predominantly revolves around three primary ideologies: income, growth, and value.

Diving deeper into each strategy sheds light on their unique characteristics and appeals to various investor personas.

Income Investing: Harvesting Passive Rewards

The cornerstone of income investing entails cultivating passive income streams. Enthusiasts of this strategy favor dividend-paying stocks, bonds, REITs, and other income-generating securities.

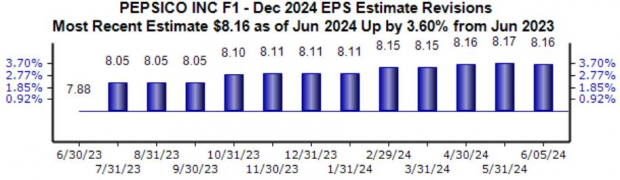

One coveted group within income investing is the renowned Dividend Aristocrats, whose members, part of the S&P 500, have increased dividends for a minimum of 25 consecutive years. Notable among these is PepsiCo, currently flaunting a promising Zacks Rank #2 (Buy).

Income investing typically magnetizes conservative investors due to the steadiness associated with dividend-paying stocks.

Growth Investing: Nurturing Potential Unicorns

Growth investing emerges as a prevailing strategy, drawing investors towards companies poised to escalate their earnings and revenues at an accelerated pace. This trajectory often culminates in soaring share performance.

Entities following this strategy frequently reinvest earnings for expansion, fostering substantial efficiency gains. Many such companies lead the charge in innovation, ushering in new technologies and upending traditional industry norms. Noteworthy exemplars include NVIDIA in recent times and Tesla over the past decade.

Underpinning the appeal of high-growth entities are rich valuations reflective of anticipated expansion, encapsulating a volatile yet potentially rewarding journey best suited for investors with a robust risk appetite.

Value Investing: Unearthing Hidden Gems

Value investing revolves around procuring stocks at discounted rates, premised on the belief that the market will eventually rectify undervaluation, paving the way for substantial gains. Indeed, who doesn’t relish a bargain?

Such stocks typically trade at lower valuations compared to counterparts, as denoted by metrics like P/E, P/B, and P/S ratios. Executing this strategy mandates unwavering patience, awaiting the crucial moment when the stock’s intrinsic worth dawns on the larger market. Tenet Healthcare exemplifies a stock with a Zacks Rank #1 (Strong Buy) and a stellar Value Style Score of ‘A’.

Concluding Thoughts

Investing arenas teem with diverse styles, with income, growth, and value taking center stage. Income aficionados relish the stability of regular payouts, growth enthusiasts chase high-fliers, while value seekers scout for tantalizing bargains.

Zacks Names “Single Best Pick to Double”

From a multitude of stocks, 5 Zacks specialists handpick their favorites anticipating a +100% surge or more shortly. Among these, Director of Research Sheraz Mian singles out one poised for the most explosive upside. An obscure chemical company, up 65% in the past year, yet still a steal. Fueled by incessant demand, surging 2022 earnings estimates, and a hefty $1.5 billion earmarked for share buybacks, retail investors could jump aboard anytime.

Could this contender outshine recent Zacks’ Stocks Set to Double like Boston Beer Company’s staggering +143.0% ascent in a mere 9 months or NVIDIA’s striking +175.9% surge within a year?