Even amidst the recent resurgence of “meme stock mania,” exemplified by GameStop (GME), the enduring buzz surrounding semiconductor giant Nvidia towers above, illuminating Wall Street’s horizon. Celebrated for its cutting-edge semiconductors, Nvidia, under the stewardship of CEO Jensen Huang since its 1993 inception, stands as a testament to one of Wall Street’s most remarkable sagas, tracing back to its 1999 IPO.

Securing a coveted position in the fiercely competitive semiconductor domain, Zacks Rank #1 (Strong Buy) entity Nvidia (NVDA) has consistently surpassed industry rivals like Advanced Micro Devices (AMD) and Intel (INTC). In a landscape characterized by unbridled competition, Nvidia has recently rekindled investor fervor, riding the wave of artificial intelligence (AI) market expansion. Fueled by exponential growth from tech behemoths such as Microsoft (MSFT) and Tesla (TSLA), Nvidia emerges as a global market colossus, boasting a stock surge of over 3,000% in the past five years. The latest stir in the financial realm surrounds Nvidia’s 10-for-1 stock split.

Decoding Stock Splits: Demystifying the Mechanism

A stock split, an organizational maneuver, entails augmenting existing shareholders’ share count while diminishing individual share value.

The Inner Workings of a Stock Split

Analogous to swapping two nickels for a dime (symbolizing a 2-for-1 split), a stock split simplifies into the redistribution of shares without altering overall market capitalization. In Nvidia’s recent case, shareholders received ten shares for each share they previously held – a 10-for-1 split. Conversely, a reverse split signifies a share price escalation alongside a reduction in investors’ share count, maintaining the stock’s fundamental value post-split.

The Rationality Behind Stock Splits

Firms resort to stock splits to render shares more appealing to investors, catering to disparate preferences; retail investors may favor lower-priced stocks, while institutional counterparts might eschew penny stocks due to perceived inferiority or institutional constraints.

Stock Splits: A Bullish Endeavor?

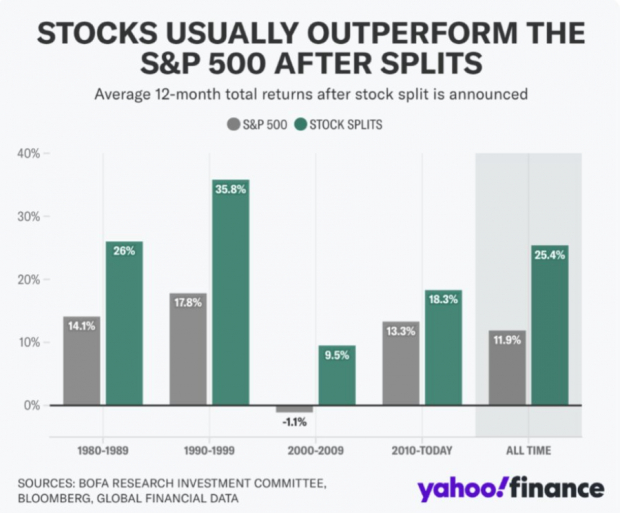

Like many Wall Street phenomena, the implications of stock splits necessitate nuanced evaluation tailored to each context. Broadly, historical data suggests that post-split, stocks often outshine the S&P 500 Index in the ensuing year.

Overindulgence in Splits: A Note of Caution

However, excessive stock splits, exemplified by two or more splits within a year, warrant investor vigilance. Multiple splits within a short span might signal underlying flaws in fundamentals or corporate avarice. Qualcomm (QCOM), a standout performer in the late 1990s, endured a double split in 1999, culminating in a protracted stagnation post the subsequent split, with the stock failing to reclaim prior highs for two decades.

Stock Split Strategems: Key Considerations

While a stock split marks a pivotal event, investors should evaluate a panoply of factors. Pre-split stock performance, prudent positioning rather than speculative pursuits, and diligent scrutiny of fundamentals and future earning expectations constitute essential facets in gauging a stock’s trajectory. Additionally, a stock split can infuse vigor into an options market grappling with burgeoning option prices.

Parting Thoughts

Recent headlines reverberate with Nvidia’s stock split, prompting investors to deliberate upon various post-split dynamics and ramifications.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential

Market Insights Amidst the Election Year Buzz

Steady Growth Amidst Political Turbulence

Ever noticed how the stock market seems impervious to the political rollercoaster that comes with each election year? It’s a bit like a resilient oak tree – swaying with the wind but never uprooted. Investors have weathered the storm throughout various administrations, staying the course regardless of the party in power.

Historical Triumphs and Future Projections

A glance back at history reveals remarkable success stories in the market. Remember how the Medical manufacturer sector surged an astounding +11,000% over the last 15 years? A feat that stands as a testament to the enduring potential of certain industries, regardless of political landscapes.

Now, consider the Rental company that’s been dominating its sector. It’s like watching a prizefighter deliver knockout blows with every move. The Energy powerhouse isn’t far behind, with plans to boost its already substantial dividend by 25%, signaling a bright future ahead.

Meanwhile, the Aerospace and defense standout just secured a potentially lucrative $80 billion contract, showcasing the market’s ability to soar to new heights even amidst uncertainty. And the Giant Chipmaker? It’s setting roots deep in the American soil, like a giant redwood promising to stand tall for years to come.

Looking Beyond Partisan Politics

Political affiliations fade into the background when it comes to investing in these booming sectors. The market dances to its own tune, moving to the rhythm of innovation, growth, and opportunity. No matter what happens in the ballot box, savvy investors find a way to capitalize on the shifting winds of change.