Tesla (NASDAQ: TSLA) shares are on the rise in today’s trading session. At 3:45 p.m. ET, the electric vehicle (EV) pioneer’s stock price had climbed by 3%, per data from S&P Global Market Intelligence.

The driving force behind this uptick stems from the highly-anticipated approval of CEO Elon Musk’s substantial compensation package. Following Musk’s announcement after the market close yesterday, revealing shareholders’ favorable sentiment for a contentious pay deal valued at around $56 billion, optimism has spread through Wall Street like wildfire. Notably, shareholders also showed support for relocating the company’s incorporation to Texas from Delaware.

Awaiting Approval: Musk’s Lucrative Compensation Package

In 2018, Tesla’s board greenlit a performance-based compensation scheme that could potentially bestow Musk with up to $56 billion in company shares. However, this January, a Delaware judge invalidated the package, citing the board’s failure to demonstrate fair compensation or engage in meaningful discussions regarding Musk’s pay. Shareholders have been casting their votes to reauthorize the deal.

While the majority of votes were tallied yesterday, a small fraction remains outstanding for submission today. Although it appears likely that the pay package will pass scrutiny, some legal experts anticipate further court challenges to Musk’s compensation post-approval.

Implications for Musk and Tesla Stock

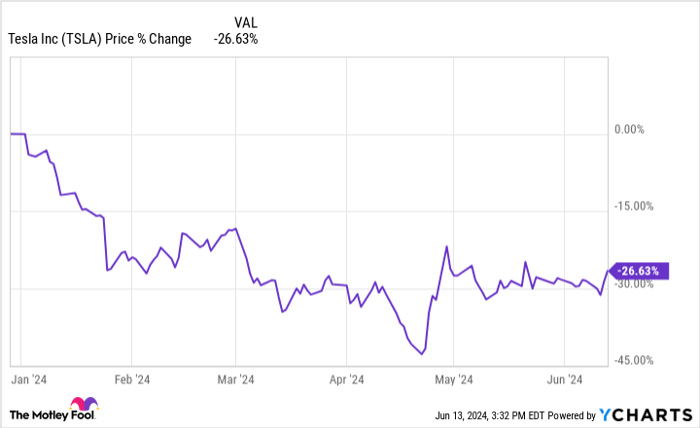

Musk’s influence on Tesla’s meteoric rise and stock performance is undeniable. Nevertheless, the EV company has encountered formidable hurdles recently. Complicating matters further, Tesla’s stock has weathered significant sell-offs this year despite a generally bullish climate propelling explosive tech stock gains.

Traded at approximately 72 times this year’s projected earnings, Tesla maintains sky-high valuations heavily reliant on growth, juxtaposed against the company’s somewhat lackluster business performance. Amidst rising competition from Chinese EV manufacturers and other industry players, defending Tesla’s valuation as a traditional automaker has become increasingly challenging. Nonetheless, Musk persists in pouring resources into innovative ventures, leading some investors to generously attribute a premium to the stock based on his visionary leadership and the company’s history of groundbreaking disruptions.

Should You Place Your Bets on Tesla?

Before diving into Tesla stock, it’s wise to heed this advice:

The Motley Fool Stock Advisor team recently pinpointed the 10 best stocks poised to provide substantial returns, and Tesla missed the mark. The selected stocks offer the potential for significant growth in the forthcoming years.

Reflecting on past successes, consider when Nvidia landed on this list on April 15, 2005. Had you invested $1,000 at the recommendation time, you’d currently be sitting on $767,173!

The Stock Advisor service not only furnishes investors with a clear roadmap for success, including portfolio-building guidance and monthly stock picks from analysts but also boasts returns surpassing the S&P 500’s performance fourfold since 2002.

Explore the 10 recommended stocks»

*Stock Advisor returns as of June 10, 2024

Keith Noonan holds no positions in the mentioned stocks. The Motley Fool holds positions in and endorses Tesla. For further details, refer to The Motley Fool’s disclosure policy.