Interpreting the Pre-Open Market Sentiment

- The market seems to be losing momentum after surpassing the significant 5,400 mark, hinting at a possible shift towards a trading range.

- Bears are observing closely, hoping for a reversal from the 5,400 level to reassert control.

- The downward target for bears is the May 31st low, aiming to test the latest higher low for a bearish play.

- Conversely, bulls are keen on defending the May 31st higher low to maintain the upward trajectory.

- Anticipate a retracement in the coming weeks as bears attempt to mount selling pressure to validate a potential buy climax.

- Traders will monitor the market for signs of increasing bearish sentiment in the days ahead.

Anticipated Market Behavior Today

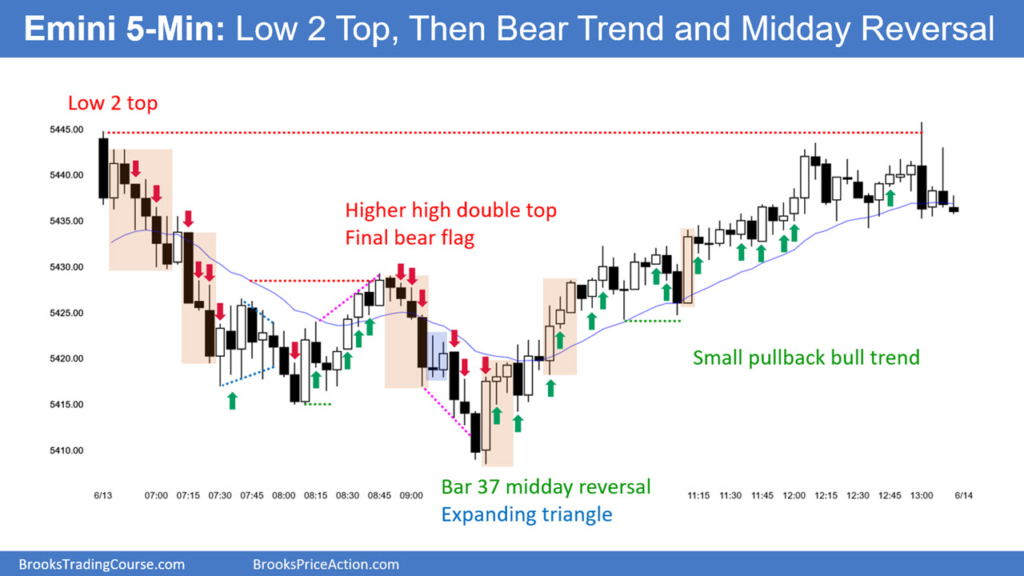

- The Emini recorded a 24-point drop in the overnight Globex session.

- Support was found around the 5,400 mark after a selling spree in the global market.

- Expect a volatile opening phase with high chances of a trading range rather than a clear trend.

- Probabilities favor the formation of double tops/bottoms or wedge patterns at the commencement of trading.

- Exercise caution in the initial trading hours as breakouts often stumble at the market open.

- Focus on capturing the opening swing, usually occurring within the first two hours of the session.

- Friday’s session gains importance as traders gauge weekly performance; bulls eye above 5,400 for a robust close.

- Stay alert for any unexpected breakouts towards the close, influenced by weekly chart dynamics.

- Keep an eye on the 5,400 level as it is likely to act as a pivotal point throughout the trading day.

Review of Previous Day’s Emini Setups

Notable stop-entry setups from the prior session are detailed, focusing on potential swing opportunities.

Emphasizing an ‘Always In’ perspective, these setups offer logical entry points for traders seeking consistent market presence.

It’s crucial to acknowledge that most swing setups do not materialize into trades, prompting quick exits by disappointed traders.

For cautious risk management, wait for lower-risk trades or consider alternative markets like the Micro Emini.