New nicotine products have taken the United States by storm in the last decade. These include e-vapor devices (vapes) and nicotine pouches. Traditional tobacco companies have invested and acquired start-ups in the space with mixed success. In recent years, the vaping sector has been disrupted by disposable devices, mainly from foreign countries. Even though these products are not approved by the U.S. government and are technically illegal, they have been taking a ton of market share, presenting a headwind for owners of other vaping brands.

Now, the U.S. government and law enforcement agencies claim they will finally crack down on stores selling these illegal disposable vapes. What does that mean for the nicotine giant British American Tobacco (NYSE: BTI) and its ultra-high dividend yielding close to 10%? Let’s take a closer look and find out.

A Brighter Future for British American Tobacco

On Monday, June 10, the Federal Drug Administration (FDA) and Department of Justice said that they would be working with multiple law enforcement agencies in the United States to get illegal vaping devices off retail shelves. There have been announcements from the government telling convenience stores to stop selling these devices, but given how profitable they are, there has been minimal change so far. Now, with potential enforcement actions about to take place, you’ll likely see stores start taking these devices off the shelves.

This crackdown should benefit British American Tobacco, which is one of the only owners of approved vaping devices in the United States with the Vuse brand. Despite these headwinds, British American Tobacco’s vapor segment grew revenue by 27% in 2023 (it also sells these products internationally). Add in the fact that its biggest competitor to nicotine pouches — Zyn — is facing product shortages right now, and British American Tobacco’s new nicotine brands are set up to do well this year.

Last year, these new categories combined to generate $4.22 billion in revenue, using today’s conversion from British pounds to U.S. dollars. Nicotine pouch revenue grew 39% last year, which shows how promising this product category is. Since 2019, the entire new nicotine products segment has grown revenue at a 28% annual clip for the company.

Now, the segment is finally generating a profit. Last year, the segment hit about break-even as its operations scaled around the globe. In the coming years, if revenue keeps growing and profit margins continue to expand, the segment could be doing close to $10 billion in annual revenue and multiple billions in operating earnings. These are earnings that are not in British American Tobacco’s trailing operating earnings and price-to-earnings ratio (P/E).

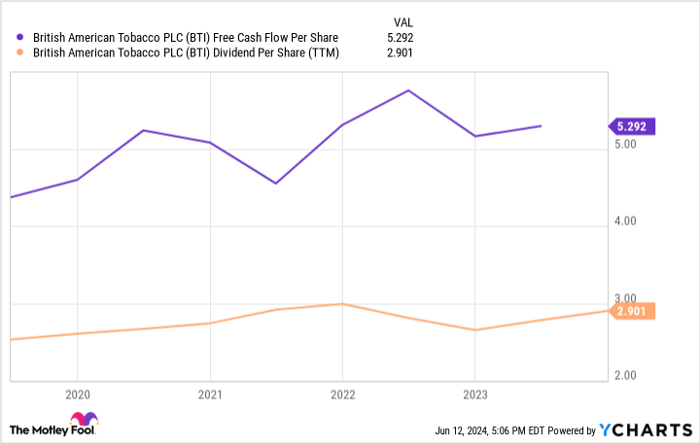

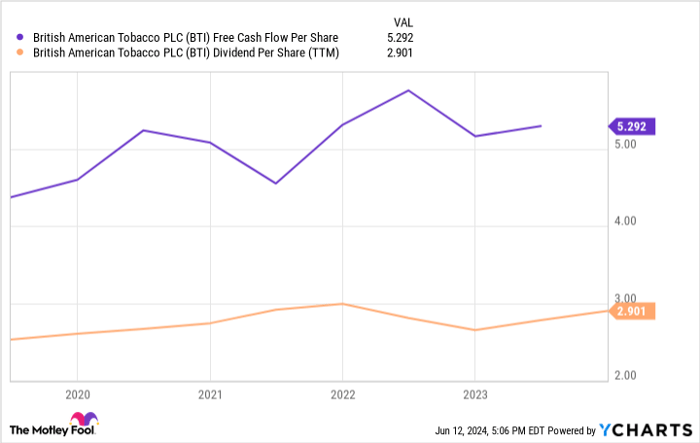

BTI Free Cash Flow Per Share data by YCharts

Future Growth and Sustainability

Clearly, the crackdown on illegal vapes and current Zyn shortage can help British American Tobacco in 2024. But what about its legacy tobacco operations?

Volumes are declining quickly, but that is getting made up for with price increases on its cigarette brands like Newport and Camel. Free cash flow per share is actually up 20% over the last five years, even with no profit contributions from new nicotine categories. Over the last 12 months, British American Tobacco has generated $5.30 in free cash flow per share. This is significantly above its dividend per share of $2.90, alleviating any concerns that its 9.5% dividend yield will get cut anytime soon.

Over the next five to 10 years, free cash flow per share should grow even if the tobacco business struggles as the new nicotine categories finally start contributing to free cash flow. In fact, I think it is likely that British American Tobacco will grow its dividend per share significantly over the next 10 years. For that reason, the stock looks like a great buy for income-focused investors at these prices.

Investing in British American Tobacco

Before you buy stock in British American Tobacco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.