The Search Frenzy

Netflix (NFLX) has been causing quite a stir on Zacks.com, attracting investors like ants to a picnic. But is there more to the buzz than meets the eye?

Over the past month, Netflix’s shares have outpaced the Zacks S&P 500 composite, signaling potential prosperity ahead.

Unmasking the Earnings Outlook

Forget the fluff – the heart of the matter lies in earnings prospects. At Zacks, we swear by the impact of earnings estimate revisions on stock valuation. A surge in earnings predictions often translates to a surge in stock value, a theory proven by market trends.

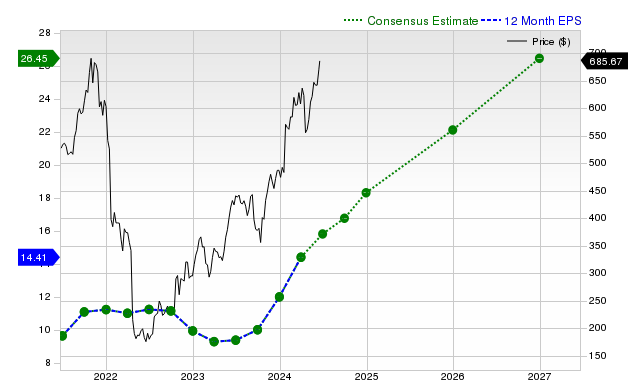

Netflix is gearing up to report an impressive +42.9% change in earnings per share for the current quarter. And the consensus is +52.2% for the entire fiscal year.

Revenue Growth Projection

In the game of financial health, revenue growth is the golden ticket. Netflix seems to have struck gold with estimated increases of +16.4%, +14.8%, and +12% for the current quarter and the upcoming fiscal years, respectively.

Revisiting Past Glory and Surprise Moments

Netflix’s track record showcases a commendable year-over-year revenue rise of +14.8%, with EPS soaring to delightful heights. The recent revenue and EPS surprises of +1.18% and +17.07% indicate stability and room for growth.

Valuation Musings

Cut the chase – valuation is key. Here, Netflix raises eyebrows with a Zacks Value Style Score of D, implying a premium position relative to peers. Is it overvalued? That’s for you to dig deeper.

Final Thoughts

Analyze, scrutinize, then hypothesize. The data surfacing on Zacks.com offers a springboard for judgment. With a Zacks Rank #3 singling it out among a sea of stocks, Netflix may just play the market melody in harmony with the broader sphere.