There’s no doubt that Nvidia (NASDAQ: NVDA) reigns supreme in the tech investment realm at present, and the numbers back it up. Even with a recent stumble, the stock has surged a whopping 145% in 2024. The company has solidified its dominance as the leading provider of chips for artificial intelligence (AI), boasting an impressive 80% market share. It’s no surprise that competitors are eyeing the crown, hoping to unseat the king.

The Rivalry Heats Up: AMD Challenges Nvidia’s Throne

Among those vying for Nvidia’s crown is long-time rival Advanced Micro Devices (AMD). AMD has been investing heavily in developing a chip that can match the latest offerings from its arch-nemesis. At a recent product launch event, AMD CEO Lisa Su underscored the company’s commitment to AI, labeling it as their top priority.

Morgan Stanley’s analyst Joseph Moore recently expressed skepticism about AMD’s prospects, downgrading the company citing “limited upward revision potential for AI from here.” Moore’s caution suggests that AMD may face an uphill battle in outpacing Nvidia’s AI dominance.

Analyst Sentiments and Market Realities

Moore’s concerns do not dismiss AMD’s potential entirely. He believes the company will continue to thrive in the realm of video game cards and AI. However, the market seems to have set its sights too high, pricing AMD with a significant premium. With a trailing price-to-earnings ratio of around 230, the market is counting on AMD to make substantial strides in its AI chip business. Comparatively, Nvidia sits at around 47 using forward P/E estimates.

Despite analyst opinions, it’s important for investors to remember that forecasts are not infallible. Analysts often vary widely in their predictions, and it’s crucial for individual investors to evaluate the arguments themselves and determine their stance.

Challenges Ahead: AMD vs. Nvidia

The uphill battle goes beyond mere projections—AMD faces formidable challenges in replicating Nvidia’s success. Nvidia, with its $34 billion in AI chip sales last year compared to AMD’s anticipated $4 billion in 2024, showcases the vast disparity between the two companies. Nvidia significantly outspends AMD in research and development, with Nvidia allocating $2.7 billion to AMD’s $1.5 billion in the previous quarter.

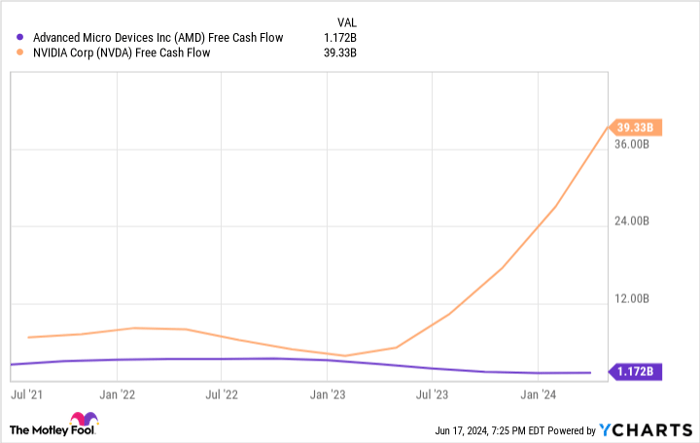

Considering financial metrics like free cash flow further emphasizes Nvidia’s dominance. The stark contrast in resources leaves AMD trailing by almost 2-to-1, significantly limiting its capacity to bolster R&D expenditures compared to Nvidia. This suggests an uneven playing field in terms of innovation and technological advancement.

While AMD remains a promising investment, the odds of unseating Nvidia seem slim. Nvidia’s robust resources position the company to not only defend its prime status in AI but also to forge ahead into new and unforeseen areas of growth.

Investor Insights: Making Informed Decisions

For potential investors eyeing Advanced Micro Devices, it’s critical to assess the current landscape. While Moore’s caution highlights the challenges faced by AMD in surpassing Nvidia, market dynamics may evolve differently than expected. This underscores the importance of thorough evaluation before making investment decisions.

Ultimately, while AMD and Nvidia are competitors in the race for tech supremacy, the expansive AI sector offers opportunities for both companies to thrive. Nvidia’s strategic position and visionary leadership indicate a strong potential for sustained growth and innovation, setting the company apart as a leading player in the evolving tech landscape.

Before diving into Advanced Micro Devices or Nvidia stock, consider the diverse range of perspectives and evaluations offered by market analysts. By staying informed and discerning, investors can navigate the intricate tech industry terrain with greater clarity and confidence.