- Nike stock remains entrenched in a downward spiral.

- The global sportswear titan recently unveiled a restructuring roadmap.

- Can the stock finally break free from its shackles post-earnings?

Despite maintaining its position as a leading sportswear producer worldwide and dominating nearly half of the sneaker market, Nike (NYSE:) has encountered substantial headwinds in recent quarters.

A lack of groundbreaking innovations, intensifying competition, and macroeconomic obstacles have impeded profits, compelling the Oregon-based conglomerate to embark on an extensive restructuring initiative.

Today’s earnings release is paramount in assessing the efficacy of these measures, potentially heralding a significant shift for the stock after a protracted period of stagnation.

Let’s delve into the key factors that investors should closely monitor.

Nike’s Blueprint for Redemption

A pivotal component of Nike’s strategy involves rekindling relationships with retailers. Following a period of reducing retail alliances in favor of direct sales, Nike plans to revert to its earlier model, discarding unprofitable channels to slash costs by a projected $2 billion annually.

The company forecasts that the benefits of these alterations will materialize by the latter half of fiscal 2025. Therefore, the forthcoming revenue, profit, and sales projections hold immense significance for stakeholders. While long-term recovery strategies dominate discussions, Nike’s imminent quarterly earnings will dictate short-term stock price movements.

The management also intends to leverage prominent events like the forthcoming Olympic Games to amplify marketing endeavors and introduce innovative products. Nike’s participation in basketball leagues such as the NBA and supplying jerseys for teams in events like the European Championships further bolsters promotional activities, albeit to a lesser extent.

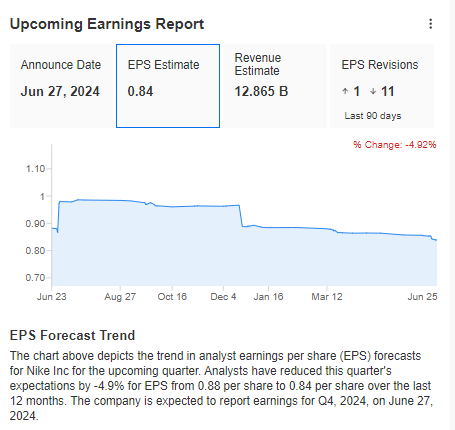

As the market anticipates the results, close attention will be paid to the consensus to gauge Nike’s immediate financial standing and the potential triumph of its restructuring endeavors.

Source: InvestingPro

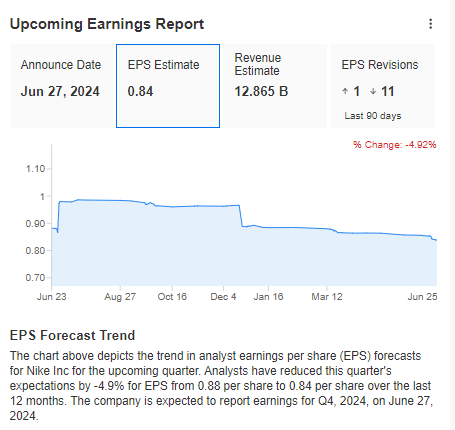

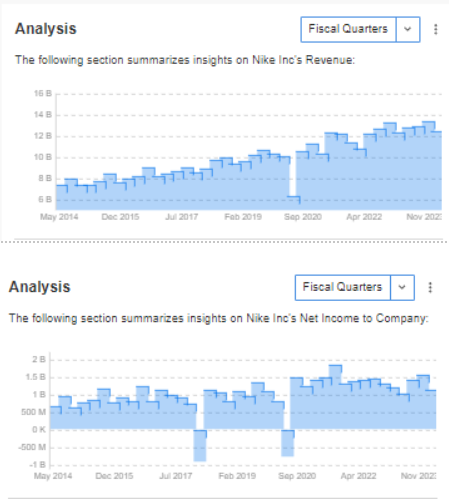

Following Nike’s recent release last quarter, a more thorough analysis is imperative to decipher the market’s response. Despite surpassing analysts’ net profit and revenue expectations, the stock price witnessed a decline, underscoring the necessity of comprehensively evaluating earnings reports while considering future forecasts.

Despite the momentary setback in share price, Nike’s financial robustness remains intact. The company consistently registers revenue growth and sustains a steady increase in net income, evidencing a sturdy financial foundation.

Source: InvestingPro

Analyzing Nike’s Technical Landscape

Nike’s stock has languished in a consolidation phase since March, oscillating between $89 and $98 per share following an earlier downtrend. Investors now pin their hopes on Nike’s upcoming earnings announcement to potentially trigger a breakout.

Presently, evident buying pressure is propelling the stock price towards the upper limit of the consolidation range. Improved-than-anticipated quarterly results could serve as the impetus for an upward breakout.

If the optimistic scenario materializes, the next target for buyers is the vicinity around $105 per share, where a local resistance level resides. Conversely, a dip below $90 per share could pave the way for a retest of last year’s lows.

***

Exclamations on Exclusive Discounts for Subscriptions!

Feeling left out as the big players amass profits while you remain on the sidelines?

Employ InvestingPro’s groundbreaking AI tool, ProPicks, to harness the might of AI-driven stock selection – straight to your fingertips!

Don’t forgo this limited-time offer.

Subscribe to InvestingPro today and elevate your investing prowess to unprecedented heights!

Disclaimer: This article is penned for informational purposes solely; it does not constitute a solicitation, offer, counsel, advice, or recommendation to invest as such, it is not intended to incentivize asset purchases in any manner. Remember that each type of asset is evaluated from numerous standpoints and is inherently risky, thus any investment decision and the associated risks are the investor’s responsibility.