Understanding the Financial Landscape

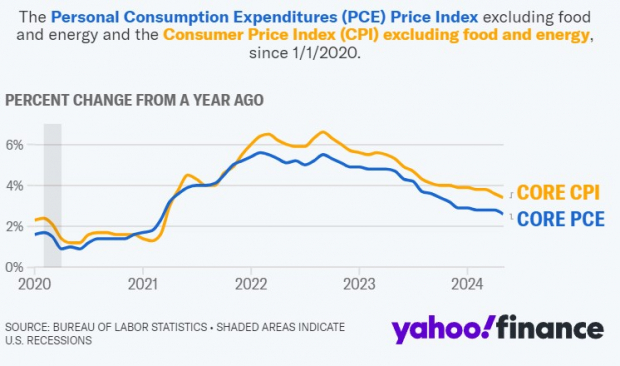

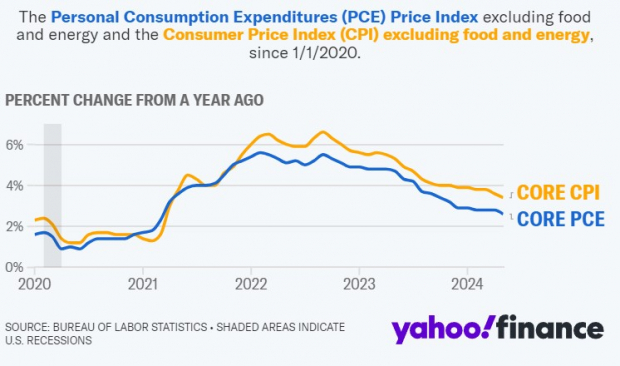

The Personal Consumption Expenditures (PCE) Price Index serves as a vital barometer, tracking consumer spending on goods and services in the United States. It provides businesses with a lens through which to view economic trends.

Key Economic Indicators

Core PCE, a primary gauge of inflation utilized by the Federal Reserve, excludes volatile items such as food and energy to assess changes in consumer goods prices. The recent report showing a modest 0.1% increase in May, down from 0.3% in April, marks a positive development. Year over year, the 2.6% rise in Core PCE – the slowest rate in three years according to Yahoo Finance – bodes well for economic stability.

Implications for Investors

Against the backdrop of cooling inflation as evidenced by the recent Core PCE figures, investors are turning their attention to stocks that could thrive in a favorable operating environment. With the Consumer Price Index also indicating a downward trend, three key stocks are under the spotlight.

Image Source: Yahoo Finance

The Tech Titan: Nvidia (NVDA)

Nvidia, a leader in AI chip production, stands to benefit from reduced inflationary pressures. Post a recent stock split, NVDA has seen a marginal climb, with analysts projecting further growth. The chip giant’s Zacks Rank #1 (Strong Buy) signals promising advances in both revenue and profit margins.

Image Source: Zacks Investment Research

E-commerce Powerhouse: Amazon (AMZN)

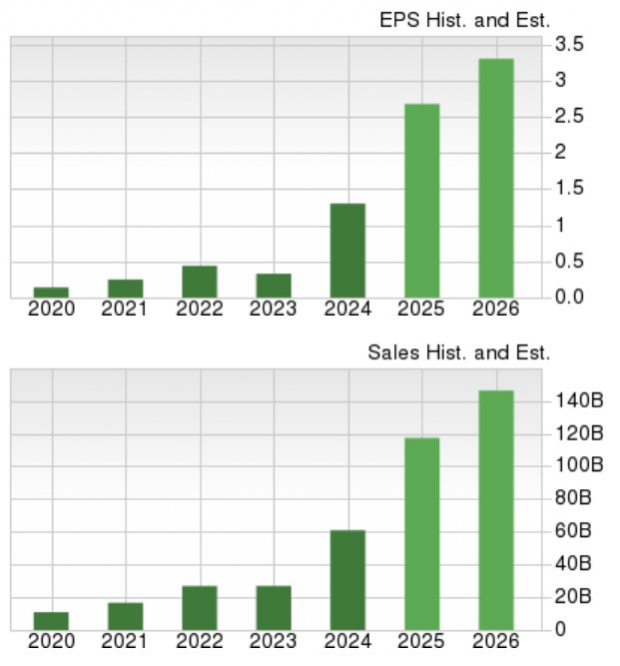

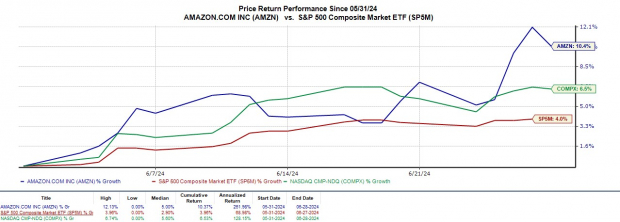

Amazon, a prominent player in consumer retail, is poised to capitalize on a stable inflationary environment. The stock has surged by 10% this month, reflecting market optimism. With a Zacks Rank #3 (Hold) and year-to-date gains of 27%, Amazon is a stock to watch.

Image Source: Zacks Investment Research

Banking Sector Champion: Bank of America (BAC)

Bank of America, well-positioned to leverage lower technology costs in a subdued inflationary environment, has garnered attention. With a Zacks Rank #2 (Buy), BAC offers an appealing investment opportunity. Its modest stock price and forward P/E ratio make it an attractive choice for investors.

Image Source: Zacks Investment Research

BAC also boasts a 2.45% annual dividend yield, second only to Citigroup (C) in the big four domestic banks.

Final Perspectives

As the second quarter draws to a close, the positive Core PCE data signals economic stability ahead, prompting investors to monitor Nvidia, Amazon, and Bank of America closely in the coming months.