Shares in Advanced Micro Devices (NASDAQ: AMD) have taken a plunge by 11% over the past three months. The company, riding the high wave of the artificial intelligence (AI) revolution, witnessed a staggering rise of 147% since the onset of 2023. Positioned as a key player in the chip-making realm, with the second-largest market share in graphics processing units (GPUs), AMD seemed poised to follow the triumphant path of its competitor, Nvidia (NASDAQ: NVDA), which dominated the AI chip market.

However, a lukewarm earnings report juxtaposed against Nvidia’s stellar growth hints at potential hurdles for AMD. In the face of these circumstances, the critical question emerges: Is it a strategic move to consider a long-term position in AMD amidst its dip, or opt for alternative avenues to tap into the unfolding markets?

AMD’s Q1 2024 Earnings Snapshot

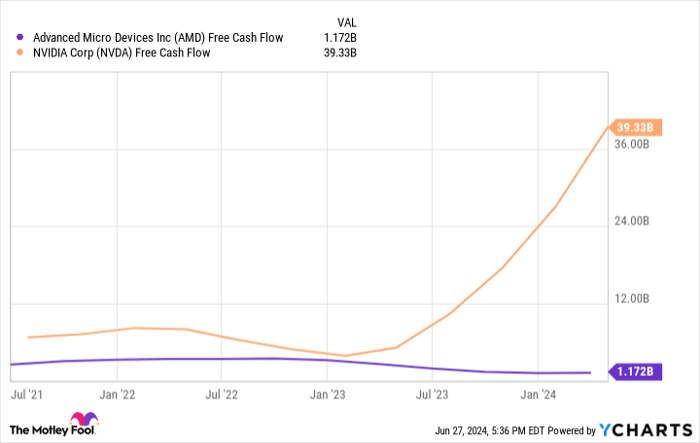

AMD unveiled its first-quarter 2024 financial results on April 30, revealing a 2% year-over-year revenue uptick to $5 billion, surpassing analysts’ expectations by $20 million. The company experienced substantial upswings in its data center and client facets, with revenue climbing by 80% and 85% compared to the previous year. Nevertheless, the gaming and embedded divisions encountered a harsh setback with more than a 40% decline in revenue. While AMD managed to surpass revenue and earnings-per-share forecasts, the massive 262% surge in Nvidia’s revenue during the same period overshadowed AMD’s performance significantly. The divergence in growth trajectories is stark, as illustrated by the plunge of AMD’s free cash flow by 52% since 2021, juxtaposed against Nvidia’s meteoric 490% surge, showcasing a wide chasm in financial prowess.

AMD’s role as a pivotal chipmaker across various tech domains, from PC gaming to consoles, data centers, personal computing devices, such as laptops, signals its entrenched presence in the tech landscape. However, the looming shadow of Nvidia necessitates that AMD embarks on a journey to carve a distinct identity in the industry and offer compelling reasons for customers to select its products.

Battling Barriers in the AI Arena

Nvidia currently exerts dominant control over AI GPUs, capturing an estimated 70% to 95% share of this burgeoning industry. Although the sector is witnessing swift expansion, creating opportunities for both market retention and potential entrants like AMD, historical trends in the chip market portend a daunting challenge for AMD to outshine its primary competitor.

Over the last decade, Nvidia has steadily amplified its majority hold on discrete GPUs from 65% to 88%. In stark contrast, AMD’s market position has dwindled from 35% to a meager 12% in Q1 2024. Similar challenges confront AMD in the central processing unit (CPU) domain against Intel. Notable success was achieved with the introduction of AMD’s Ryzen processors in 2017, catapulting its CPU market share from 18% to 33% since inception. Nonetheless, Intel’s resilient grip on the sector, boasting a commanding 64% share in CPUs presently, underscores the arduous nature of relinquishing dominance in the chip industry once it is established. This scenario suggests formidable odds for AMD to etch out significant growth in the competitive landscape.

Furthermore, AMD faces an arduous differentiation task in a fiercely competitive environment. While Nvidia commands the GPU sphere, chip adversary Intel is actively delving into AI chip innovation and production expansion. Intel’s strategic move to establish fabrication plants across the U.S., aiming to become the country’s premier AI chip fab, positions it favorably to capitalize on the escalating demand for AI chips in the backdrop of companies like Nvidia and AMD subcontracting their manufacturing processes. Conversely, AMD is yet to identify a niche for domination in the AI realm as it persists in developing chips to contend with Nvidia and Intel’s offerings.

In light of these circumstances, the two primary competitors of AMD emerge as potentially more attractive investment prospects amid the burgeoning AI market.

Considering Investment Strategies for AMD Stock

The visual representation of AMD’s stock performance relative to its peers underscores its comparative lack of value. Notably, AMD registers the highest Price-to-Earnings (P/E) ratio alongside Nvidia and Intel, portraying their stocks as exorbitantly priced when juxtaposed against competitor offerings.

Hence, despite the recent downturn, prudence suggests holding off on acquiring AMD stock presently and exploring avenues presented by better-valued alternatives.

Should You Allocate $1,000 in Advanced Micro Devices Now?

Before contemplating an investment in Advanced Micro Devices, ponder on the insights provided:

The analysts at Motley Fool Stock Advisor recently unveiled their handpicked selection of what they believe constitute the 10 best stocks for current investors to consider. Surprisingly, Advanced Micro Devices did not make the cut. The highlighted ten stocks harbor the potential for substantial returns in the imminent horizon.

Reflect on the groundbreaking journey trodden by Nvidia, which secured its place on this exclusive list on April 15, 2005. The adage that hindsight is 20/20 crystallizes when considering that an investment of $1,000 at the time of endorsement could potentially burgeon into a staggering $757,001 in capital!* This remarkable trajectory underscores the transformative potential within the stock market.

Stock Advisor furnishes investors with a straightforward blueprint for success, offering invaluable insights into portfolio construction, regular analyst updates, and two fresh stock recommendations each month. The service’s track record surpasses S&P 500 returns by an astounding margin of over fourfold since the inception of the service in 2002*.

Delve into the details to explore the 10 recommended stocks and unlock the pathway to potentially lucrative investment avenues.

*Stock Advisor returns as of June 24, 2024.