Market Sentiment vs. Short Interest

As the US equity gauge teeters on the edge, predictions swirl about a potential 23% plummet by year-end. However, historical data is a mixed bag, with only three negative equity markets during election years since 1950. Bold bets make waves, but will they hold true in this tumultuous sea?

Riding Waves of Volatility

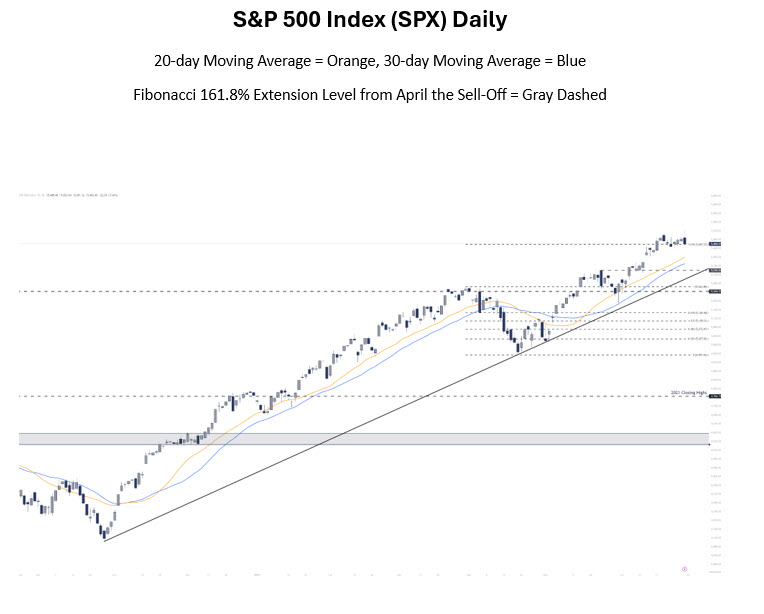

The SPX charted a volatile course last week, closing lower amid month and quarter-end turbulence. While the candle signals a potential turnaround, the index teeters at a critical Fibonacci extension level. Market walls may crumble, but resilience is key in the face of uncertainty.

Historical Highs and Technical Analysis

June marked a triumphant high for the equity markets, breaking barriers and inching towards a potential technical target. The 30-day moving average stands as a beacon of hope, guiding trends and echoing past bullish rallies.

July: An Equities Odyssey

July emerges as the hero of equities, boasting a historical track record of positivity. Amidst the political turmoil of election years, the month shines, albeit with some dark clouds post-options expiration. Can July be the shining armor that the market needs?

Rotations and Resurgences

The recent trading sessions unveiled a tale of rotations and resurgences, with different sectors taking the stage. From software to banks, market players juggle various narratives, waiting for the spark that will set stocks ablaze.

The Short Interest Saga

The rise of short interest paints a bleak picture for some, as the market battles with overbought conditions and limited breadth expansion. Hedge funds take a stance as cumulative short interest reaches staggering percentiles, setting the stage for a potential showdown.

The Future Outlook

As hedge funds navigate crowded positions and long exposures, the market sits on a precipice. July beckons with promises of bullish cycles, but the specter of a rotation trade looms. The tides of the market are ever-shifting, leaving investors poised at the edge of anticipation.