US stock indexes have soared, reflecting a bullish breakout in the market. With a stable economy, strong employment numbers, and decreasing inflation, stocks are hitting record highs, painting a rosy picture for investors.

Image Source: TradingView

Stock Market Generals Flourish, Display Robust Momentum

The market giants continue to deliver impressive earnings growth and exhibit strong momentum. Q2 earnings projections for these top companies show a substantial increase, with the stock prices of many reaching year-to-date highs.

Key players such as Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL) lead the charge, with Nvidia (NVDA) also demonstrating notable potential as a top Zacks Rank stock.

These companies exhibit significant relative strength against the broader market, with Apple, in particular, showing impressive short-term momentum, boasting a 30% increase in the last three months.

Image Source: Zacks Investment Research

Surging Earnings Propel Stock Performance

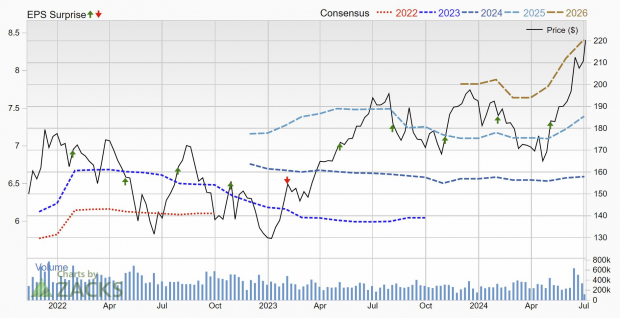

Apple, known for its consistent success, has been closely monitored for its earnings trends. Recent positive movements in earnings revisions are an encouraging sign, leading to an upgraded Zacks Rank #2 (Buy) rating.

Similarly, Amazon has witnessed an upward trend in earnings revisions, securing a Zacks Rank #2 (Buy) rating as well.

The trio of Apple, Amazon, and Alphabet benefits greatly from the AI boom, with each making significant strides in AI technology integration.

Amazon, in particular, leverages AI across various sectors such as web services and operational optimizations, hinting at future earnings growth.

Image Source: Zacks Investment Research

Reasonable Valuations, Especially for Alphabet

Alphabet, though currently rated Zacks Rank #3 (Hold) due to flat earnings revisions, stands out as the most reasonably priced stock among the trio.

With a forward earnings multiple just above the market average and growth prospects ahead, Alphabet presents an enticing opportunity for investors.

Amazon, trading at a significant discount compared to historical valuations, offers substantial growth potential with an EPS forecast to rise annually over the next few years.

Apple, trading at a premium relative to its historical median valuation, sets the standard for quality, justifying its higher valuation.

Image Source: Zacks Investment Research

Summary

The current bullish trend in the market is underpinned by solid economic fundamentals and robust earnings growth from industry leaders. The “Magnificent 7” companies shine bright, offering compelling opportunities for investors looking to ride the wave of top performers.

Furthermore, the increasing integration of AI technologies by these firms positions them for sustained success in emerging tech landscapes, particularly in automation and cloud computing.

The Wave Continues: Analyzing the Market Surge

With valuations remaining reasonable and fundamental strength unwavering, this market rally appears poised to extend its winning streak.

Avoiding Temptation

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Market Momentum

Stock Analysis

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report