High-yield dividend stocks have often been viewed as lagging behind the broader market in the short run due to the challenges they may face. However, in the current financial landscape of 2024, two standout companies, Altria and AT&T, are defying this narrative and showing promising signs of keeping up with, or even surpassing, the red-hot S&P 500.

Image source: Getty Images.

So, how likely are these former underperformers to outshine the S&P 500 this year? Let’s peel back the layers to uncover the possibilities.

Altria: A Steadfast Value Creator

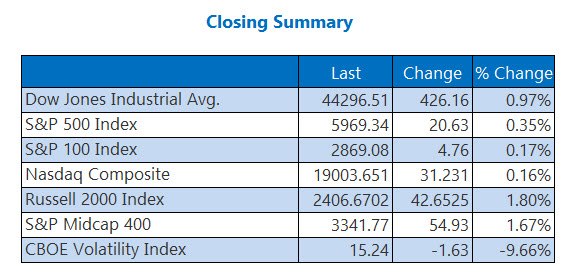

Altria, known for its Marlboro cigarettes, has been a standout performer despite a consistent decline in the tobacco industry. With a total return of 19.3% this year, surpassing the S&P 500’s 16% return, Altria is making a strong case for itself.

Despite concerns about its sector, Altria offers an enticing 8.51% annualized yield and trades at a modest 9 times forward earnings. In comparison, the S&P 500 is valued at 22.6 times forward earnings, underlining the value proposition of Altria’s stock.

While the company has an 81% payout ratio, its impressive 54-year streak of raising dividends suggests stability. Additionally, Altria’s foray into the e-cigarette market with NJOY is a promising avenue for growth amidst declining traditional tobacco sales.

Wall Street’s consensus on Altria hints at a potential upside of 3.3%, which although not exuberant, may be sufficient to outpace the S&P 500 in the remainder of 2024.

AT&T: Resurfacing as an Undervalued Player

AT&T is on the cusp of a new chapter, with its tumultuous media ventures in the past and a stabilizing telecom sector. The market has responded positively, with AT&T delivering a 15.8% total return in 2024, aligning closely with the S&P 500.

What sets AT&T apart is its generous 5.9% yield and a sustainable payout ratio of 59.6%, indicating sound coverage of dividends by earnings. Furthermore, the stock trades at an attractive 8.45 times forward earnings, presenting an appealing investment opportunity.

While not a growth powerhouse, AT&T boasts a nationwide 5G wireless network along with extensive fiber infrastructure. Analysts foresee a further 6.5% upside in AT&T’s stock over the next 12 months, driven by its strong market position and financial metrics.

The Verdict

With the S&P 500 trading at historically high valuations, and its current reliance on Nvidia, a potential correction could pave the way for Altria and AT&T to shine. These stalwart dividend stocks, with their attractive yields and compelling valuations, may indeed surpass the benchmark index in 2024.

Considering Altria Group Investment

Before diving into Altria Group stock, it’s crucial to weigh your options. The Motley Fool Stock Advisor team has highlighted 10 top stocks poised for significant growth, with Altria Group not making the list. The potential returns from these selected stocks could be substantial, echoing past successes like Nvidia’s remarkable growth back in 2005.

Stock Advisor’s investor-friendly platform offers a roadmap for success, featuring expert insights, portfolio building strategies, and regular stock recommendations. The service has significantly outperformed the S&P 500 since its inception in 2002, underscoring its value for investors seeking stellar returns.