You’ve heard the age-old question, Reader.

What’s your edge?

An edge serves as your compass in the tumultuous seas of trading. It’s your guiding star towards consistency in profitability.

For a trader, having an edge means possessing a method, insight, or strategy that heightens your odds of successful trades.

Lack an edge, and you’re gambling away your funds, counting on luck to sway your trades in the right direction.

Yet relying on sheer chance is a swift road to financial ruin. You might snag some fleeting triumphs, but ultimately, you stare down the abyss of losses.

My edge as a trader springs from innovative software tools I’ve cultivated (with the wizardry of actual NASA rocket scientists) to unearth concealed patterns within the market.

One such tool even pinpoints the opportune moments to buy or sell cryptocurrencies like Bitcoin and Ethereum, enabling my subscribers to double their investments a remarkable 114 times.

However, the tool that steals the limelight today is the simplest and yet the most potent one in my arsenal.

I’ve christened it the Money Calendar for its knack of identifying specific “windows” each month when stocks tend to soar or plummet.

Soon, I’ll unveil its accuracy and versatility. Yet, the Money Calendar plays a dual role…

It has prophetically alerted me to an impending seismic shift in the realm of AI stocks, the very darlings of today’s market.

Let’s delve into its mechanics and what it foresees, a vision that every market player should heed closely.

Embracing Seasonal Cycles

My foray into unmasking clandestine market patterns birthed the Money Calendar, an exalted tool in my armory.

During my trading tutelage, I espied the predictable movements of select stocks adhering to seasonal cycles.

These patterns recurred incessantly, year after year, with eerie precision.

Thus, I crafted a software paladin to unveil these phenomena daily when the market unfurls its canvas.

Leveraging a decade’s worth of historical data, the Money Calendar spots fleeting junctures – usually lasting 35 days or fewer – when a stock is poised to ascend or descend.

My quest is to unearth repetitive patterns unfolding across these windows a staggering 90% of the time (9 out of the last 10 years).

Granted, the Money Calendar isn’t infallible – no trading edge is.

Still, in recent years, it has kindled hopes of doubling investments 182 times for my flock of subscribers.

Illustratively, let’s zoom into Elon Musk’s automotive wonder, Tesla Inc. (TSLA).

Behold a golden epoch – May 12 to June 20 – when Tesla traditionally embarks on an upward trajectory.

The verdant and crimson bars depict the yearly returns within this epoch.

A gazes upon these annals evinces Tesla’s upward march between these dates in 9 out of the last 10 years.

Can such insights furnish you with an edge?

Unquestionably so.

A prudent maneuver guided by the Money Calendar this year could have yielded a 60% profit over 40 days.

Against an average annual S&P 500 return of roughly 10% over the past two decades, this spells a windfall nearly fivefold what the index typically offers in a year.

The Money Calendar unfurls myriad such patterns, nay, a bounty of these treasures daily during market hours.

Moreover, it not only bequeaths an edge for individual stock trades but also extends a prescient hand foreseeing profound transitions in the broader market.

Espying Market Paradigm Shifts

The maxim “Sell in May and go away” likely reverberates in your ears.

A time-honored tradition where brokers and Wall Street denizens unloaded their holdings ere savoring the summer air in the Hamptons, triggering a bearish market spell.

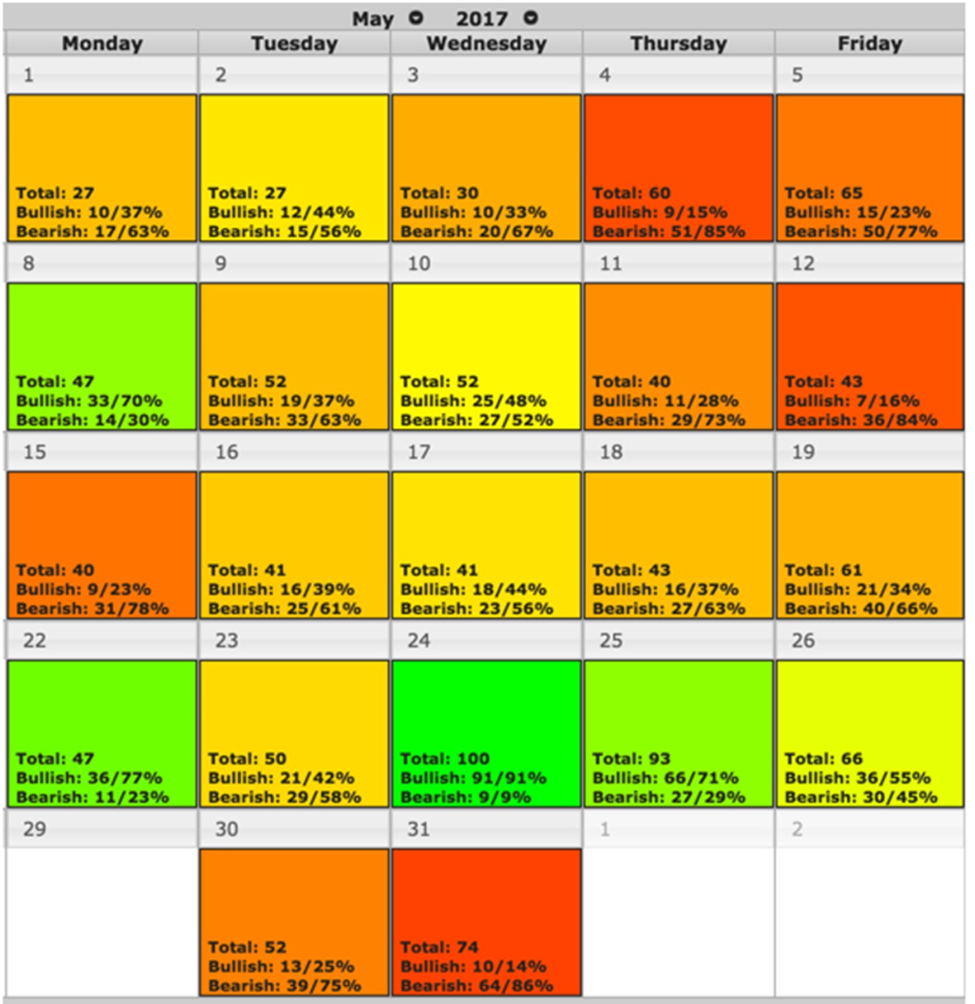

Merely seven years hence, this norm held sway. Behold the Money Calendar from May 2017…

The Money Calendar’s Insightful Market Predictions

Market trends are like shifting sands, unpredictable yet occasionally susceptible to patterns. The Money Calendar, a tool renowned for its foresight, recently signaled a significant shift. Despite the bearish undertones in recent times, seasoned investors understand that change is the only constant in the financial world.

Unveiling Market Dynamics Through Patterns

Analyzing the past is akin to peering through a foggy window into the future. Observing the transition from bearish to bullish patterns signals a kaleidoscope of opportunities. While media outlets debated the age-old adage of ‘Sell in May and Go Away,’ the Money Calendar provided a clear direction.

May 2024 emerged as a beacon of optimism with every day painted in shades of green, embodying bullish sentiments. Contrary to the naysayers, the S&P 500 surged by 4.8%, surpassing the long-term average return multiple times over. The Money Calendar’s predictions once again proved invaluable in navigating the turbulent tides of the market landscape.

Insightful Glimpse into AI Evolution

Reflecting on historical patterns offers a roadmap to unlocking future trends. In early 2019, the Money Calendar identified a cluster of stocks with burgeoning bullish patterns, all intertwined with the realm of artificial intelligence (AI). This foresight led to staggering gains for those who heeded its advice.

From Meta Platforms to Microsoft and Nvidia, investors reaped substantial profits by embracing the AI wave. Yet, as with all booms, the crescendo inevitably heralds a decline. The Money Calendar now foresees the Final Phase of the AI boom, cautioning against a probable crash in the biggest AI players.

As the stock market gears up for this seismic shift, individuals are urged to sharpen their strategies and brace for impact. Avoiding pitfalls requires a keen eye for patterns and a proactive stance towards safeguarding investments. The imminent Final Phase demands astute navigation to prevent an abrupt erosion of gains, reminiscent of bygone internet stock collapses.

Navigating the Future with the Money Calendar

With the upcoming revelation scheduled for July 9, stakeholders are invited to explore the intricacies of the Final Phase through the lens of the Money Calendar. An opportunity to delve into market intricacies, secure long-term financial stability, and capitalize on short-term gains awaits.

The journey towards financial resilience is illuminated by the insights and predictive prowess of tools like the Money Calendar. Tuesday’s briefing promises an in-depth look at deciphering patterns, protecting investments, and leveraging proprietary tools for sustainable profits.

Embark on this journey towards financial acumen and prosperity, anchored by the wisdom encapsulated in the Money Calendar’s predictions. The future beckons, ripe with possibilities and opportunities for those willing to embrace the evolving landscape of the stock market.