With the AI bonanza showing no signs of slowing down, Nvidia’s fiscal year 2026 sales estimates have yet again skyrocketed, hitting a staggering $204 billion according to a UBS analyst. This dwarfs the $26 billion annual sales mark in 2022 and the $80 billion figure for the trailing twelve months.

Nvidia Stock Riding the Momentum Wave

Investors keen on artificial intelligence exposure find Nvidia stock as the premier vehicle for this journey. As the technology is in its infancy, investments in infrastructure dominate the sector. With its cutting-edge GPUs, Nvidia stands as the go-to choice for tech firms seeking increased computing power. This advantage, akin to possessing the proverbial “picks and shovels,” has been a game-changer for Nvidia, attracting a flurry of investors.

Positive Earnings Revisions Bolster Investor Confidence

For nearly two years, Nvidia has maintained a Zacks Rank #1 (Strong Buy) rating, a feat rarely witnessed in the stock market world. The incessant revisions to earnings and sales estimates present a truly remarkable spectacle. The past month alone saw further upgrades to earnings estimates, solidifying investor optimism.

Valuation Considerations for Investors

Presently, Nvidia trades at a forward earnings multiple of 50.7x for the upcoming year, a relatively high valuation. However, historically, Nvidia has commanded a premium valuation, slightly surpassing its 10-year median of 42.5x. Forecasts indicate a spectacular 37.5% annual profit growth over the next 3-5 years, lending credence to the current valuation.

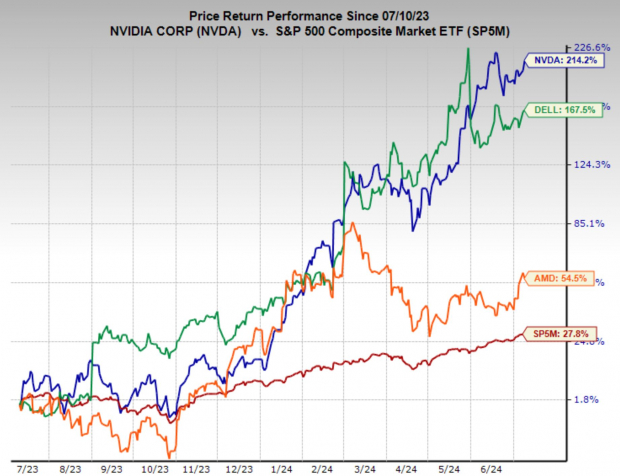

Exploring Other AI Beneficiaries

Investors hesitant to plunge into Nvidia might find solace in diversifying across multiple AI-centric stocks. Dell Technologies, boasting a Zacks Rank #1 (Strong Buy), is poised for a significant technical breakout, having recently cleared a key resistance level. Despite AMD’s Zacks Rank #3 (Hold) status, signaling stable earnings revisions, impressive growth estimates shine through. Projected sales growth of 25% next year and a 33% annual EPS growth over the next few years indicate a solid foundation for the future.

The Promising Horizon: Nvidia and the Future of AI

Emerging Opportunities in Artificial Intelligence

The dawn of a new era shines brightly for artificial intelligence, and in this landscape, Nvidia emerges as a formidable contender. With its robust Graphics Processing Units (GPUs) and a lion’s share of the market, Nvidia paves a captivating path to tap into the flourishing AI industry.

A Glimpse into Alternatives

Yet, for investors wary of Nvidia’s lofty price, Dell Technologies and Advanced Micro Devices present themselves as compelling alternatives. Positioned strategically to harness the AI upsurge, both entities flaunt promising growth prospects and an upward trajectory.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report