Netflix Quarterly Results

As the 2024 Q2 earnings season unfolds, all eyes are on the upcoming quarterly report from streaming giant Netflix. Despite a recent plunge post-earnings, the stock has made a robust recovery, currently hovering near record highs.

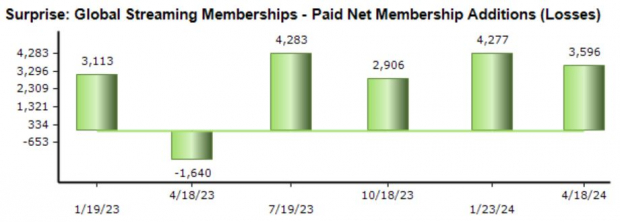

Subscriber metrics continue to be a focal point, with the upcoming report being the last to include quarterly membership numbers, a change to take effect from the 2025 Q1 report. The previous data indicated a 16% increase in total subscribers year-over-year, surpassing expectations for the fourth consecutive quarter.

Analysts predict a 43% growth in EPS on a 17% revenue increase, showcasing enhanced profitability driven by operational efficiencies.

Taiwan Semiconductor Outlook

Taiwan Semiconductor (TSM) has enjoyed considerable gains amid the semiconductor sector’s boom, fueled by the AI frenzy. Expectations for the quarter include a 20% rise in earnings per share and a 5% increase in sales, hinting at a substantial growth trajectory.

Valuation multiples have expanded as investors anticipate further growth, with a forward earnings multiple of 26.5X, above the five-year median. However, the current PEG ratio remains at a moderate 1.1X, reflecting a balanced growth outlook.

Johnson & Johnson Performance

Despite sluggish stock performance in recent years, consumer staple giant Johnson & Johnson has maintained a stellar track record in earnings delivery, exceeding EPS estimates in the last ten quarters. The upcoming report shows a slight downturn in EPS estimates but consistent revenue expectations.

Key Takeaway

With the earnings season heating up, investors should closely monitor reports from Netflix, Taiwan Semiconductor, and Johnson & Johnson. These insights provide a glimpse into the financial health and future outlook of these market-leading companies.