Nvidia (NASDAQ: NVDA) has been one of the hottest stocks on the market since the beginning of 2023, clocking stunning gains of 799% and outpacing the S&P 500 index’s 45% jump by a massive margin. This was due to the impressive growth in the company’s revenue and earnings due to the healthy demand for its artificial intelligence (AI) chips.

This phenomenal surge is why Nvidia is now trading at a rich valuation. Its price-to-earnings (P/E) ratio of 77 is well above the Nasdaq 100 index’s multiple of 32. This is why some Wall Street analysts are now concerned about the company’s ability to sustain its red-hot rally.

The Road Ahead for Nvidia Stock

New Street Research recently downgraded Nvidia from buy to neutral, citing the stock’s valuation. Analysts are skeptical about Nvidia’s future performance beyond 2025. However, amidst concerns, the potential growth in the AI chip market, where Nvidia holds a dominant position, could drive sustained growth in the coming years.

Competitive Edge and Market Dynamics

Nvidia’s technological superiority with its Blackwell AI chips, ahead of competitors like AMD and Intel, gives it a significant edge. The company’s chips’ superior processing power and energy efficiency bode well for continued high demand. Additionally, the growth projections for Nvidia’s data center revenue further support a positive outlook.

Valuation and Investment Outlook

Analysts anticipate robust earnings growth for Nvidia in the next five years, highlighting its potential for a 60% stock price increase. Although Nvidia’s current P/E ratio may seem high, considering its exceptional revenue and earnings growth, the valuation appears justified. The company’s ability to consistently perform well indicates potential long-term benefits for investors.

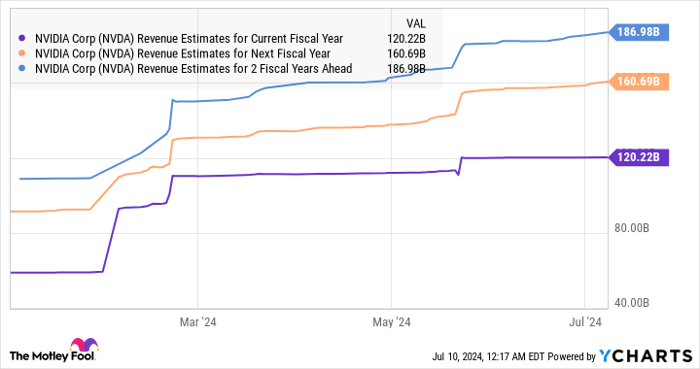

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

Despite concerns about Nvidia’s valuation, its recent earnings growth has supported its premium. The forward P/E ratio remains reasonable compared to industry peers, underscoring the company’s growth potential. Selling Nvidia stock solely based on valuation may not align with its future growth prospects.

Capitalizing on Opportunities

Evaluating Nvidia’s growth potential and current market dynamics points to a compelling case for holding onto the stock. The company’s strong position in the AI chip market, technological advancements, and revenue projections all support the notion that Nvidia stock continues to offer favorable prospects for investors.

Don’t miss out on potentially lucrative opportunities by prematurely selling Nvidia stock. Understanding the company’s strengths, market dominance, and growth outlook can provide insightful guidance for long-term investment strategies.

*Stock Advisor returns as of July 8, 2024