Inflation Figures Show Promising Trends

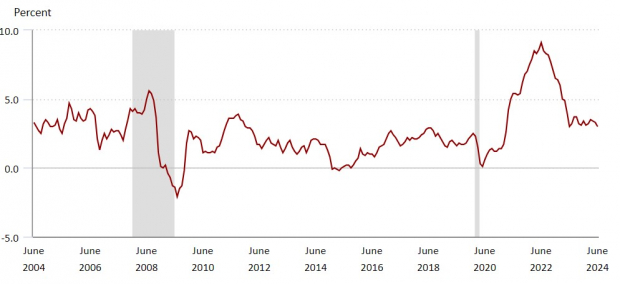

With a consecutive decline in the Consumer Price Index (CPI) over the past two months, June’s data releases on Thursday delivered encouraging news. The CPI rose by 3% compared to the same period last year, marking a decline from May’s 3.3%. Additionally, on a monthly basis, the CPI showed a decrease of 0.1% after remaining unchanged in May.

Furthermore, Core CPI, which excludes volatile food and energy prices, demonstrated a year-over-year increase of 3.3% compared to 3.4% in May. The monthly rise in Core CPI was also moderate, standing at 0.1% in June versus 0.2% in May. This shift in inflationary trends bodes well for various sectors of the economy, including the tech industry.

Impending Rate Cuts in a Cooling Inflation Scenario

The data supports a stronger argument for potential rate cuts as Federal Reserve officials gain evidence of inflation moderating at an optimal pace. This change suggests that it is no longer premature to consider such measures. The tech sector stands to gain significantly from this cooling inflationary environment.

RingCentral and Twilio: New Opportunities in Tech

Two tech stocks, RingCentral (RNG) and Twilio (TWLO), have garnered attention by securing spots on the Zacks Rank #1 (Strong Buy) list. RingCentral experienced a 6% surge in its stock price on Friday, reflecting potential for further growth as it remains undervalued at 7.9X forward earnings.

Despite RingCentral facing a challenging year with an 8% decline, the company is positioned for a strong recovery. Projections indicate significant growth in its top and bottom lines by fiscal 2024 and FY25, signaling optimistic prospects for investors.

Conversely, Twilio witnessed a 23% decline in its stock price year-to-date due to concerns surrounding its guidance and profitability in a high-interest rate environment. However, the company is likely to benefit from a more favorable operational landscape stemming from easing inflation. Twilio provides developers with services to facilitate real-time communications in software applications.

Arm Holdings: Rising from Adversity

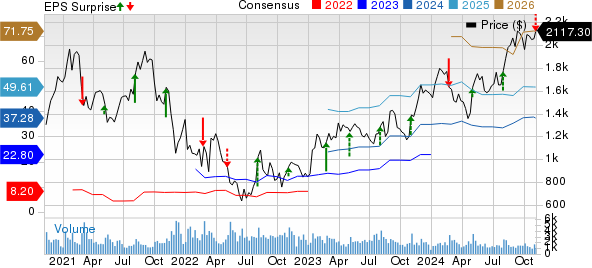

Following the pandemic, a surge in inflation had deterred the IPO market. However, Arm Holdings took a bold step by going public in 2023. The UK-based company, known for providing processor designs and software platforms, boasts prominent US clients like Amazon, Alphabet, and Nvidia.

Investors have been closely monitoring Arm Holdings amidst a global economic landscape, especially in the US. The company witnessed a 4% spike in its trading session and hit 52-week highs, reflecting positive market sentiment. Since its IPO last September, Arm Holdings has soared by over 150%, achieving a Zacks Rank #3 (Hold).

Looking Ahead

As RingCentral, Twilio, and Arm Holdings gear up for expansion, investors anticipate fruitful outcomes in a market characterized by cooling inflationary pressures.

The Rise and Resilience of Tech Stocks Amid Cooler Inflation

Stellar Performance Amid Economic Variability

As the temperature of inflation cools, three tech giants stand tall with their “A” Zacks Style Scores grade for Growth. This sterling mark of excellence correlates with a bullish projection as market sentiments soar post the release of June’s Consumer Price Index data.

Unlocking Potential: An Undervalued Gem?

Analysts might just be scratching the surface of these stocks’ true potential. With earnings on the horizon, the shares have the potential to surge by an impressive 10-20% in the aftermath of these announcements.

Foundation of Strength: Unwavering Growth Amidst Uncertainty

While the financial landscape continues to experience undulating waves of change, the unwavering performance of these tech stocks is reminiscent of historical resilience in the face of economic turmoil.

Strategic Analysis: Identifying Lucrative Opportunities

Investors seeking to capitalize on the upcoming market trends might find solace in exploring the comprehensive stock analysis reports available for the following tech powerhouses:

- ARM Holdings PLC Sponsored ADR (ARM) : Free Stock Analysis Report

- Ringcentral, Inc. (RNG) : Free Stock Analysis Report

- Twilio Inc. (TWLO) : Free Stock Analysis Report

- Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

- NVIDIA Corporation (NVDA) : Free Stock Analysis Report

- Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Seizing Opportunities: Riding the Wave of Success

For investors eager to dive deeper into the nuances of the market shifts surrounding tech stocks amidst cooling inflation, a detailed examination awaits. Click here to access the full article on Zacks.com.

Explore and exploit the potential of these tech behemoths, backed by comprehensive analysis and expert insights from Zacks Investment Research.