Lisata Therapeutics, Inc.‘s groundbreaking lead pipeline candidate, certepetide, formerly known as LSTA1, has sparked a wave of optimism among investors as it charts a course towards potential breakthroughs in cancer treatment.

The recent revelation of positive preclinical study results on the efficacy of certepetide in combating intrahepatic cholangiocarcinoma, a challenging cancer variant, has further fueled the company’s momentum. The combination of certepetide with standard-of-care chemotherapy and immunotherapy exhibited promising outcomes by enhancing survival rates in mice afflicted with this aggressive cancer.

Certepetide’s innovative mechanism of action, which facilitates the better penetration of anti-cancer drugs into solid tumors, has drawn attention for its potential to reshape the treatment landscape for various cancer types, notably enhancing tumor responsiveness to immunotherapy.

The ongoing phase IIa BOLSTER study, exploring certepetide’s potential as a first-line treatment for cholangiocarcinoma in conjunction with standard chemotherapy, underlines Lisata’s commitment to advancing the boundaries of cancer care.

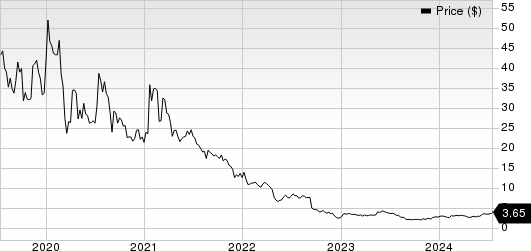

The impressive stock rally of 33.7% year-to-date for LSTA stands in stark contrast to the industry’s downtrend, reflecting the market’s growing confidence in the company’s innovative approach and the potential of its lead candidate.

Certepetide’s versatility extends beyond cholangiocarcinoma, with ongoing evaluations in various cancer settings, including metastatic pancreatic ductal adenocarcinoma. Its recent Orphan Drug designations for treating osteosarcoma underscore its potential impact across a spectrum of rare and challenging cancers.

With numerous clinical data readouts anticipated in the near future, the investment community eagerly awaits potential milestones that could propel Lisata’s growth trajectory further. Success in ongoing studies and the continued evolution of certepetide are poised to sustain Lisata’s upward trajectory throughout the rest of 2024 and beyond.

Zacks Rank & Stocks to Consider

Onto company rankings, Lisata currently holds a Zacks Rank #3 (Hold). Here are a few other standout performers in the biotech sector that investors may want to keep an eye on:

Among them, ANI Pharmaceuticals, Inc. (ANIP), Adaptive Biotechnologies Corporation (ADPT), and RAPT Therapeutics, Inc. (RAPT) currently boast a Zacks Rank #2 (Buy), signaling potential opportunities for growth.

ANIP’s consistent earnings beat and positive revised estimates contribute to a strong YTD performance, reflecting the company’s resilience and growth potential in the biopharma domain.

On the other hand, ADPT and RAPT showcase varying performances, with ADPT demonstrating a positive earnings trend despite a recent decline in share value, while RAPT grapples with a challenging market year-to-date, emphasizing the sector’s dynamic nature.

The volatility and innovation inherent in the biotech landscape make it an enticing yet demanding arena for investors, offering both risks and rewards as companies strive to navigate the complexities of drug development and market dynamics.