Brokerage Recommendations: A Murky Path?

Investors often listen to the symphony of analyst recommendations to decide their financial dance steps. The tune they play impacts stock prices, but does it really hold the key to the market’s beat?

Stepping into the arena of Wall Street heavyweights, we find ourselves in the glittering world of Newmont Corporation (NEM). With an average brokerage recommendation (ABR) of 1.88 on a scale from Strong Buy to Strong Sell, the melody suggests harmony between the two extremes.

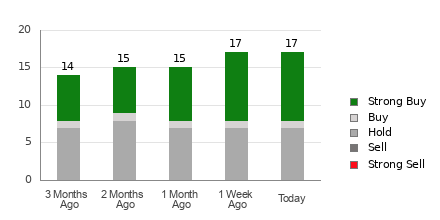

Among the 17 curtain calls that composed this score, nine were thunderous Strong Buys and one a sweet Buy, echoing notes that resonate with 52.9% and 5.9% of all recommendations, respectively.

The Tides of Brokerage Recommendations for NEM

While the ABR chorus sings in favor of Newmont, caution should be heeded. History tells us that following the pied-piper of brokerage recommendations may not always lead to a pot of gold at the end of the stock rainbow.

Why the cautionary tale? Analysts, bedecked in their firm’s colors, often paint stocks with a rosier hue than reality might suggest. For every “Strong Sell,” five “Strong Buys” are proffered, creating a symphony that may lull rather than enlighten.

Verifying the harmony with your own financial melody could be the key to unlocking the treasure chest or, better yet, leveraging a proven guide in navigating the swirling seas of the markets.

The Zacks Rank: A Clarion Call Amidst the Decibels

Enter the Zacks Rank, a maestro in its own right, conducting a symphony of earnings estimates. From a #1 (Strong Buy) to a #5 (Strong Sell), this score holds the baton to a stock’s future performance, with an impressive track record to dazzle even the skeptics.

Unlike its ABR companion, the Zacks Rank dances to the tune of earnings, letting the numbers speak where analysts might sing a sweet but misleading melody. And the dance between earnings estimates and stock prices is a ballet that has weathered the test of time.

The Zacks Rank, with its swift tempo, updates its rhythm in tandem with changing business landscapes, providing a timely waltz through the market’s ever-shifting fortunes.

A Glittering Golden Path?

Peering into the crystal ball of earnings estimates for Newmont, the Zacks Consensus Estimate gleams brightly, marking an 8.1% uptick over the past month to $2.64.

Analysts, united in their crescendo of optimism, revise their forecasts skyward, painting a portrait of potential prosperity for the company. With a Zacks Rank #2 (Buy) leading the symphony, Newmont seems poised for a standing ovation in the market arena.

Could the ABR guide investors toward fortune’s door? The answer may lie in harmonizing the notes of brokerage recommendations with the Zacks Rank’s melody, creating a symphony that sings of golden opportunities.