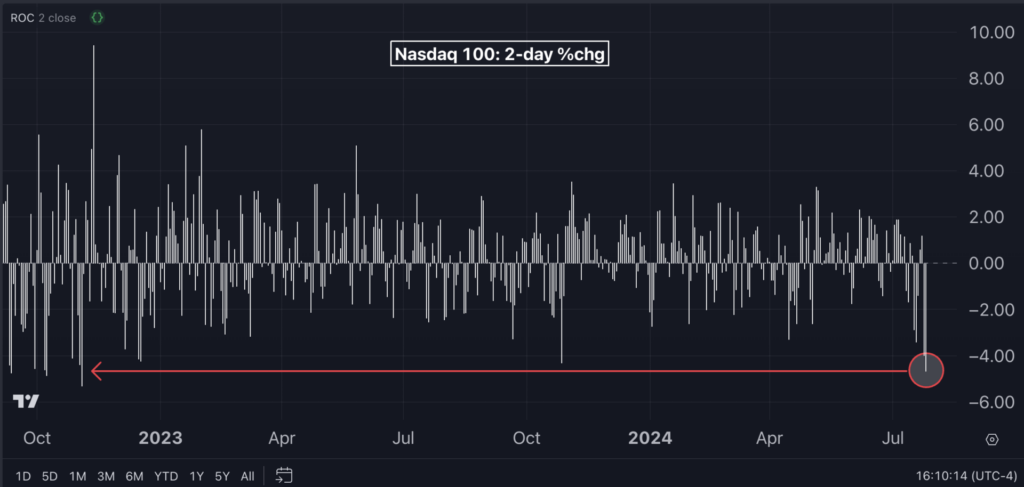

Amidst a turbulent climate, the Nasdaq 100 index stumbled to its lowest point in seven weeks, struck by severe blows that haven’t been witnessed in nearly two years. The latest downward spiral on Thursday marked a dismal chapter, closing at levels not seen since the early days of June, following a rollercoaster session. Just a day before, the Nasdaq 100 plunged by a staggering 3.7%, recording its most abysmal performance since the haunting days of October 2022.

Despite a flicker of hope ignited by a second-quarter GDP figure that surpassed expectations and reassuring signs of diminishing price pressures, tossing a lifeline momentarily to equities and high-risk assets, the Nasdaq 100 managed to shimmy up by 0.9% during midday trading in New York. However, the tide turned in the later hours of the trading day, as traders cautiously recalibrated their bets on a potential rate cut by the Federal Reserve.

Alphabet Inc. was among the notable casualties, grappling with a stumble after OpenAI teased new search functionalities to a restricted pool of users. Subsequently, the tech giant and its counterparts faced a double session ordeal, with the Nasdaq 100 tracking measure, the Invesco QQQ Trust, absorbing a bruising 4.7% decline over the past two days. This grim statistic etches a distressing record as the index’s worst bender since the bleak days of September 2022.

Nasdaq 100’s Grim Downturn Echoes a Bygone Era

A Closer Look at Nasdaq 100’s Top and Bottom Performers on Thursday

| Name | 1-Day % |

| Lululemon Athletica Inc. | -9.03% |

| Warner Bros. Discovery, Inc. | -5.73% |

| Arm Holdings plc | -5.45% |

| Honeywell International Inc. | -5.26% |

| Advanced Micro Devices, Inc. | -4.36% |

| Booking Holdings Inc. | -3.86% |

| Intuitive Surgical, Inc. | -3.79% |

| ON Semiconductor Corporation | -3.67% |

| DexCom, Inc. | -3.57% |

| QUALCOMM Incorporated | -3.15% |

| Alphabet Inc. | -3.07% |

Thursday’s Stellar Performers Among Nasdaq 100 Stocks

| Name | 1-Day % |

| Atlassian Corporation | 6.34% |

| Old Dominion Freight Line, Inc. | 5.74% |

| MongoDB, Inc. | 4.83% |

| Gilead Sciences, Inc. | 4.12% |

| O’Reilly Automotive, Inc. | 4.09% |

Ruminations for the Future:

Photo via Shutterstock.