The latest chapter in the tech earnings saga delivered disappointment to investors, with the Magnificent Seven companies witnessing a decline in their shares throughout the trading week.

Tech Titans Stumble

Alphabet Inc. demonstrated robust earnings and revenue figures, but underwhelming performance in YouTube advertising revenue caused a dip in its stock value, earning it the title of the Google parent company’s worst week of the year.

In a similar vein, Tesla Inc. missed quarterly earnings estimates due to reduced profit margins from lower vehicle prices and restructuring costs. Additionally, the electric-vehicle giant pushed back the unveiling of the Robotaxi to October, resulting in a 12.3% plummet in its shares on Wednesday, the steepest one-day decline since September 2020.

The tech-laden Nasdaq 100 index closed its second consecutive week in the red, a trend not seen since April.

Mega-Cap Rollercoaster

Amongst the mega-cap stocks, Ford Motor Company and United Parcel Service Inc. faced substantial declines following disappointing earnings reports. Conversely, 3M Company and Bristol-Myers Squibb Company emerged as the top performers, bolstered by unexpectedly positive outcomes.

Small Caps Shine

On a brighter note, small-cap stocks continued their winning streak, with the Russell 2000 Index celebrating its third consecutive week of gains, riding high on anticipated interest rate cuts.

Robust US Growth

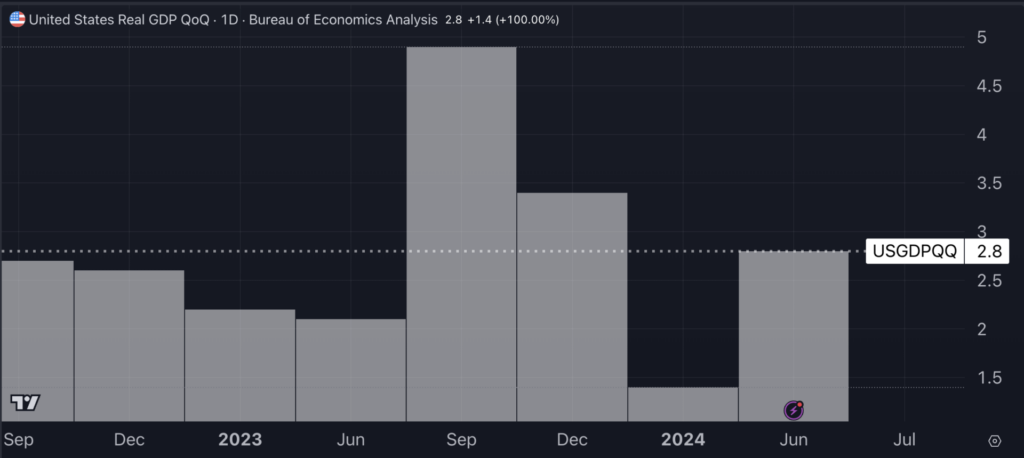

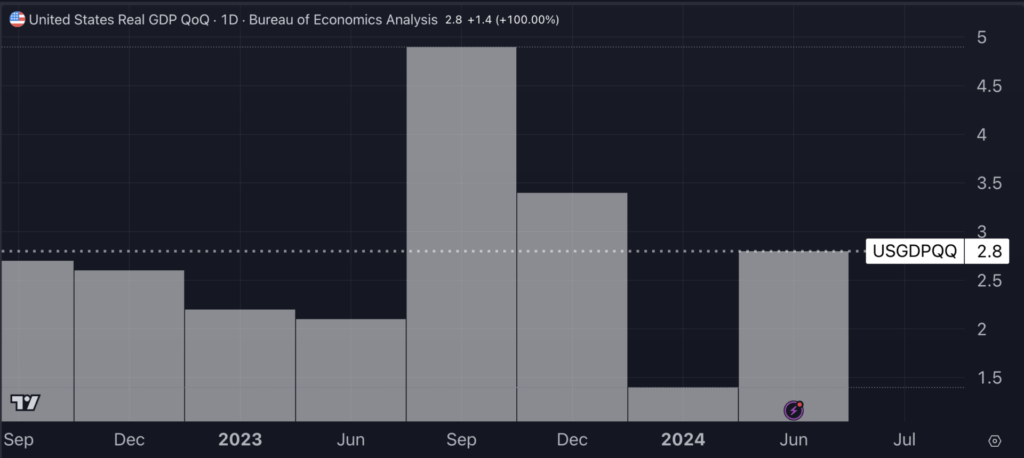

The US economy flexed its muscles, showcasing a 2.8% annualized growth rate in the second quarter, a significant acceleration from the previous quarter and exceeding the projected 2% growth mark.

Historical Context

Comparing the current economic data against historical trends reveals a promising outlook, with the US economy demonstrating resilience and adaptability in the face of varying market conditions.

Chart Of The Week: US GDP Growth Doubled From Q1 To Q2 2024

Market Insights and Trends

In a contrasting light, an array of market indicators and trends shed additional light on the dynamic nature of the current financial landscape, offering investors valuable insights and strategic cues.

Reflecting on Market Dynamics

With this week’s events serving as a poignant reminder of the volatility and unpredictability inherent in financial markets, investors are urged to maintain a prudent approach and a diversified portfolio to navigate through potential challenges.

Strategic Considerations

Strategically positioning assets and investment holdings based on a well-informed assessment of market conditions and economic projections is crucial in capitalizing on emerging opportunities and mitigating risks.

Industry Innovations and Competition

Exciting developments and competitive dynamics within various industries continue to shape market landscapes, introducing new challenges and opportunities for companies striving for growth and sustainability.

Technological Advancements

The relentless pace of technological advancements underscores the importance of adaptability and innovation within businesses, propelling progress and reshaping traditional paradigms within the corporate realm.

Conclusion: Navigating a Complex Market Terrain

As investors navigate the intricate and ever-evolving terrain of the financial markets, staying attuned to market trends, economic indicators, and industry shifts is paramount in making informed decisions and capitalizing on opportunities in a dynamic and competitive landscape.

Market Trends and Outlook

Looking ahead, a careful examination of market trends and economic projections can provide valuable insights into potential future developments and emerging opportunities, guiding investors towards prudent investment strategies and risk management practices.