The Dynamics of Option Volatility Ahead of Earnings Reports

A crucial week unfolds as a myriad of companies, including tech giants, gear up to report their earnings. Before these pivotal moments, the realm of implied volatility reigns supreme. The uncertainty that shrouds these reports sends the options market into a frenzy. Expectations run high, propelling option prices into the stratosphere.

Unveiling Expected Ranges for Key Stocks

Implied volatility tends to normalize post-earnings, highlighting the ebb and flow of market sentiment. To gauge the potential impact, traders often look at the expected ranges for various stocks. By assessing the at-the-money put and call options post-earnings, a rough estimate of the expected move emerges.

Monday

MCD – 4.7%

…

Tuesday

AMD – 9.0%

…

Wednesday

ADP – 4.4%

…

Thursday

AAPL – 4.5%

…

Friday

CVX – 3.0%

…

Crafting Trading Strategies Around Expected Moves

Traders can leverage these expected ranges to orchestrate their moves. Bearish traders may consider bear call spreads, while bullish counterparts can explore bull put spreads or engage in naked puts for the daring. Neutral traders can find solace in iron condors, with an emphasis on keeping the short strikes beyond the expected range for earnings plays.

Prudence reigns supreme when dabbling in options during this volatile period. Employing risk-defined strategies and limiting position sizes are cornerstones of a prudent approach. In the event of an unexpected market upheaval, limiting losses to 1-3% of the portfolio shields traders from significant harm.

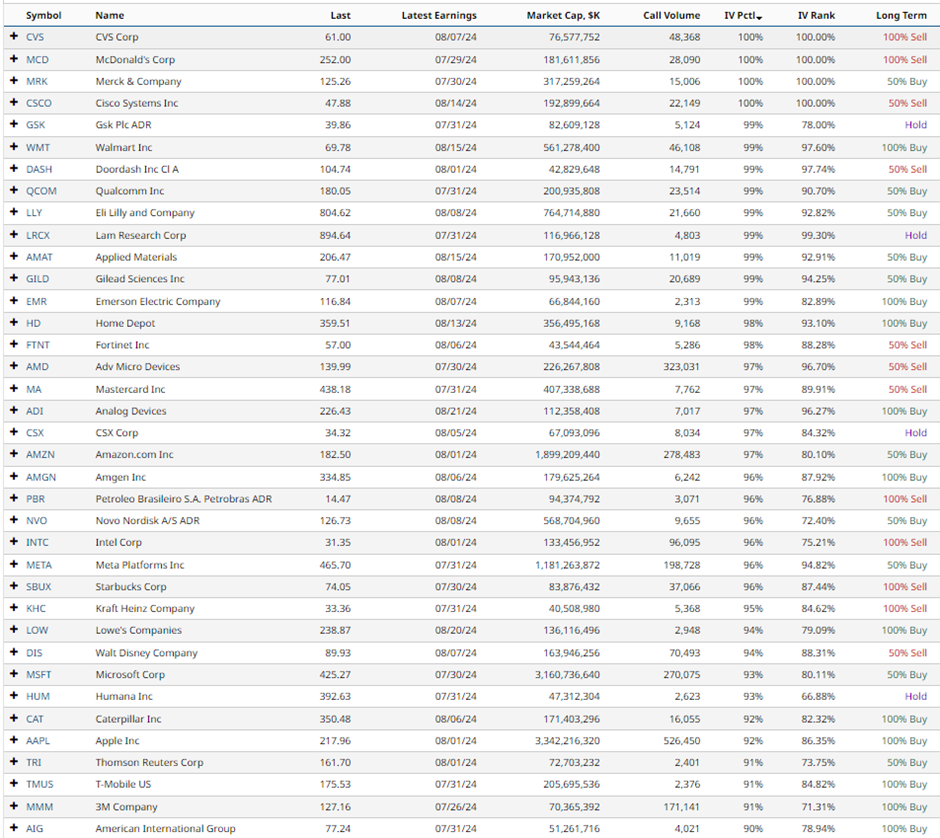

Spotting High Implied Volatility Stocks

Barchart’s Stock Screener unveils a trove of volatile stocks with elevated implied volatility. By setting criteria such as call volume, market capitalization, and IV percentile, traders venture into a realm brimming with opportunities.

For a detailed guide on uncovering option trades during earnings season, a comprehensive article awaits exploration.

Reflecting on Last Week’s Earnings Movement

Comparing actual versus expected moves from the previous week provides a lens into market dynamics. A plethora of stocks either adhered to or deviated from anticipated ranges, illuminating the challenges and rewards of navigating earnings season.

Unusual Options Activity

Companies like TEVA, MMM, GILD, GOOG, COIN, PFE, BMY, and RCL raised eyebrows with unusual options activity. This distinctive behavior sets the stage for potential intrigue and speculation in the days ahead.

While the allure of options beckons, the risks are palpable. Vigilance and due diligence remain imperative, with prudent counsel from financial advisors acting as a guiding beacon amidst the tempestuous seas of investment decisions.