Meta Platforms (NASDAQ: META) stock has outperformed the S&P500, with a notable 28% gain year-to-date compared to the S&P500’s 14% rise. Meta’s peer, Alphabet (Google) (NASDAQ: GOOG), is up 20% YTD. As Meta Platforms prepares to release its fiscal Q2 2024 results on Wednesday, July 31, 2024, expectations are high. Analysts anticipate the company to surpass consensus estimates for revenues and earnings, building on its impressive performance in the last quarter. Revenues surged by 27% year-over-year to $36.5 billion, with key metrics like family daily active people (DAP), ad impressions, and average price per ad showing improvement. This positive trend is likely to continue in the upcoming quarter.

Despite seeing substantial gains of 65% since early January 2021, climbing from $275 to around $455, Meta Platforms stock has been on a roller-coaster ride. Returns for the stock varied significantly, with a 23% increase in 2021, a steep decline of -64% in 2022, followed by an impressive 194% rise in 2023. Comparatively, the S&P 500 experienced a 27% increase in 2021, a -19% drop in 2022, and a 24% growth in 2023. This erratic pattern indicates Meta’s struggle to consistently outperform the S&P 500, a challenge faced by many stocks in recent years, including heavyweights in the Communication Services sector and other megacap companies.

Analysts are curious about Meta Platforms’ performance in the current macroeconomic landscape, characterized by high oil prices and elevated interest rates. Will Meta face a situation similar to 2021 and 2022, underperforming the S&P, or will it see a remarkable upsurge in the coming months? The answer lies in the company’s ability to adapt and navigate these challenging conditions, leveraging its strengths to drive growth and shareholder value.

Looking ahead, our forecast indicates that Meta Platforms may be undervalued, with a valuation of $509 per share, representing a 12% upside from the current market price of around $453.

(1) Revenues expected to top the expectations

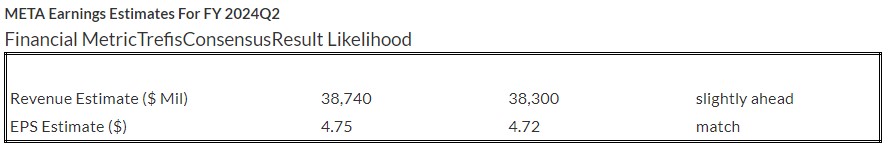

Meta Platforms witnessed a 16% year-over-year revenue growth to $134.9 billion in FY 2023, driven by higher family daily active people (DAP) and ad impressions. While the average price per ad saw a decline, all three metrics showed improvement in Q1. The company is estimated to achieve revenues of around $159.6 billion in FY 2024, with fiscal Q2 2024 net revenues projected to be approximately $38.74 billion, slightly above the consensus estimate of $38.30 billion.

(2) EPS to edge past (match) the consensus

Meta Platforms’ Q2 2024 adjusted earnings per share (EPS) are expected to reach $4.75 according to Trefis analysis, slightly exceeding the consensus estimate of $4.72. The company’s strong financial performance in FY 2023, marked by a 69% year-over-year growth in net income to $39.1 billion, is likely to continue into the second quarter. This momentum is fueled by revenue growth and operational efficiency improvements, leading to a robust operating margin of 38% compared to 25% previously. An annual GAAP EPS of around $20.05 is anticipated for FY 2024.

(3) Stock price estimate is 12% above the current market price

Based on a GAAP EPS estimate of approximately $20.05 and a P/E multiple slightly above 25x in fiscal 2024, Meta Platforms’ valuation points to a price of $509, representing a 12% premium over the current market price.

| Returns | Jul 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| META Return | -10% | 28% | 295% |

| S&P 500 Return | -1% | 14% | 142% |

| Trefis Reinforced Value Portfolio | -1% | 6% | 684% |

[1] Returns as of 7/26/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios. See all Trefis Price Estimates.