The 2024 Q2 earnings season reaches a crescendo this week as a flurry of companies prepares to disclose their financial status. Among these, industry giants such as Microsoft and Amazon, both pivotal players in the cloud computing domain, are set to share their performance in the market.

A Glimpse into Alphabet’s Success

Alphabet, in their recent quarterly announcement, showcased impressive numbers. With a remarkable 31% growth in EPS and nearly a 14% surge in sales, the company outperformed market expectations, aligning with their ongoing trend of positive quarterly results.

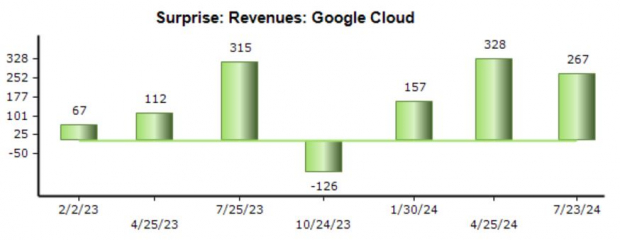

Cloud revenue also witnessed a substantial upswing, with a record-breaking $10.3 billion in earnings, marking a 30% year-over-year expansion. Moreover, Google Cloud’s operational income soared to $900 million from $191 million in the previous year.

While the overall outcome was promising, Alphabet’s shares faced minor setbacks post-release due to uncertainties surrounding AI CapEx. Nonetheless, the company has consistently surpassed cloud revenue estimates in recent times.

Microsoft Set to Maintain Cloud Momentum

In its latest report, Microsoft astonished investors with a 23% growth in cloud revenue year-over-year, indicating a stabilizing trend following a series of slowed growth rates. Despite steady expectations in earnings and revenue over the past months, the company is poised for an 8% rise in EPS and a 14% surge in sales.

The company’s historical cloud performance has consistently outstripped consensus forecasts, with the upcoming $28.7 billion estimate signaling a substantial 20% increase from the previous year.

Anticipating Amazon’s Performance Leap

Amazon Web Services (AWS) exhibited strong results in the preceding period, manifesting a notable 17% year-over-year growth with net sales touching $25 billion, marking a halt to the recent string of disappointing metrics in this sector. The forthcoming financial release estimates a 17.2% year-over-year spike in cloud revenue, standing at $25.9 billion.

Projections for earnings and revenue remain restrained, although a significant uptick is predicted, with a projected 63% increase in EPS on a 10% surge in sales. Improved cost management and operational efficiencies have significantly bolstered profitability, paving the way for substantial margin expansion.

It is crucial to note that the presented data is on a trailing twelve-month basis.

The Final Verdict

The upcoming week witnesses several major cloud providers divulging their financial health, including Amazon and Microsoft. Alphabet’s recent astounding cloud performance sets the stage for high expectations across the industry.

Investors eagerly await the year-over-year growth figures from these key players, with any signs of deceleration anticipated to trigger market jitters. Conversely, surpassing growth estimates could drive a wave of optimism post-earnings, with a keen eye on various other performance metrics.