Opening Bells and Rising Tides

Palantir Technologies and Arista Networks showcased strength during Monday’s premarket session, steering the technology ship back on course for investors. The prowess of these companies in harnessing artificial intelligence into tangible outcomes resonated with the market sentiment.

Analysts from UBS forecasted a colossal surge in the AI sector, potentially reaching a market value of $225 billion by 2027, a significant leap from $2.2 billion in 2022. The potential growth spurt bodes well for the AI industry, bringing efficiency and advancements across various sectors, such as the foreign exchange market.

However, skepticism looms over the uninterrupted ascent of AI-focused firms. Semiconductor behemoth NVIDIA Corp faced headwinds despite a positive premarket performance, hinting at a turbulent journey in the tech realm.

AI: A Tale of Two Sentiments

While some experts like New Street Research analyst Pierre Ferragu have neutralized their outlook on NVIDIA due to valuation concerns, others, like Goldman Sachs, have raised red flags on the bloated valuations of select AI stocks.

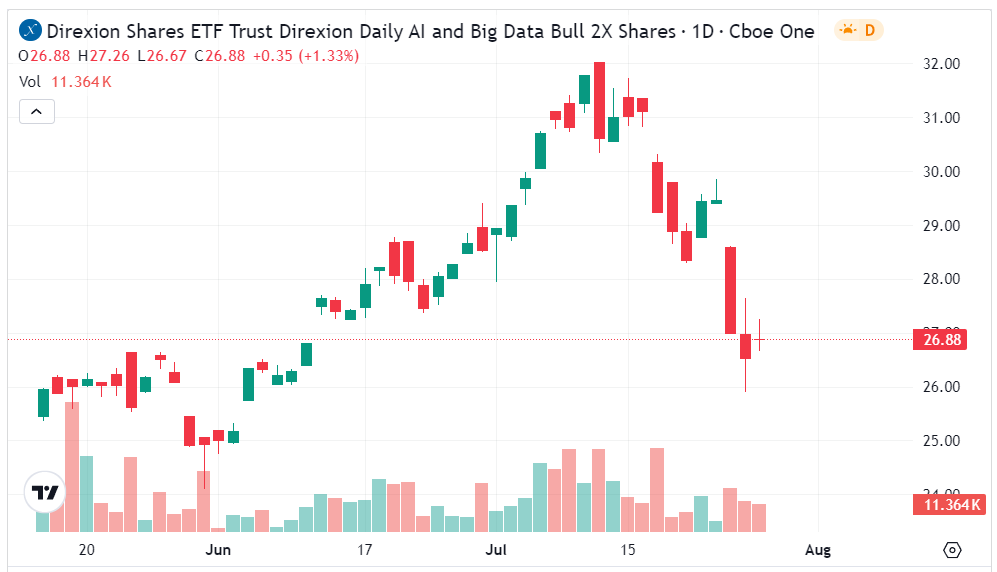

Amidst this dichotomy, Direxion’s leveraged ETFs present an intriguing avenue for retail traders seeking to navigate the choppy waters of the AI market. The Direxion Daily AI and Big Data Bull 2X Shares and Bear 2X Shares cater to divergent sentiments within the AI landscape.

Strategic Moves and Market Dynamics

The AIBU, a 2X leveraged ETF tracking the Solactive US AI & Big Data Index, offers an amplified exposure to the potential upside of the AI market. Conversely, the AIBD provides a leveraged inverse play on the same index, ideal for traders anticipating a downward trend in AI stocks.

It’s imperative for stakeholders to note that these ETFs are designed for short-term exposure, limiting risks associated with prolonged investments that may diminish returns over time due to daily compounding effects.

Charting the Course

The AIBU ETF reflected the tech sector’s struggles by closing below its 20-day moving average at $26.95, albeit showing signs of recovery from the previous session. The volatility in individual tech stocks like PLTR and ANET influenced the ETF’s performance trajectory.

- The AIBD ETF, responding inversely to its counterpart AIBU, gained over 6% amidst the tech turmoil of the past week. Closing at $22.86 above its 20-day EMA of $21.91, the ETF’s resilience was notable.

- With subdued trading volume compared to previous sessions, the AIBD fund might face challenges in the wake of strong premarket tech performances.

Both ETFs’ performance underscores the dynamism of the AI market, where sentiments oscillate between optimism and caution, compelling traders to tactically maneuver amidst the evolving landscape of deep learning and big data applications.

Investors await with bated breath for the next chapter in the AI saga, as Direxion’s ETFs stand ready to facilitate calculated market plays in a realm where probabilistic outcomes often outweigh certainties.