Investors witnessed a notable market shift in July as small-cap stocks gained favor, anticipating lower borrowing costs for smaller companies due to expected Federal Reserve interest rate cuts.

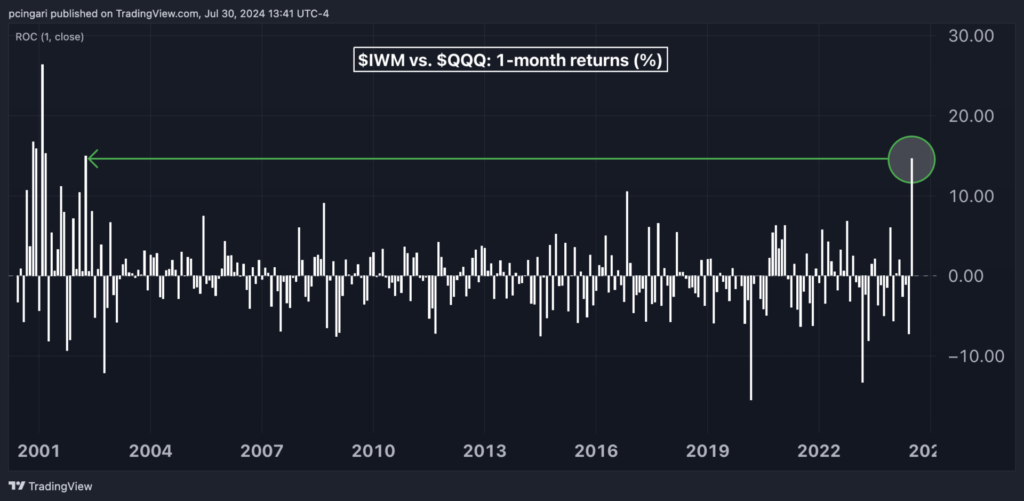

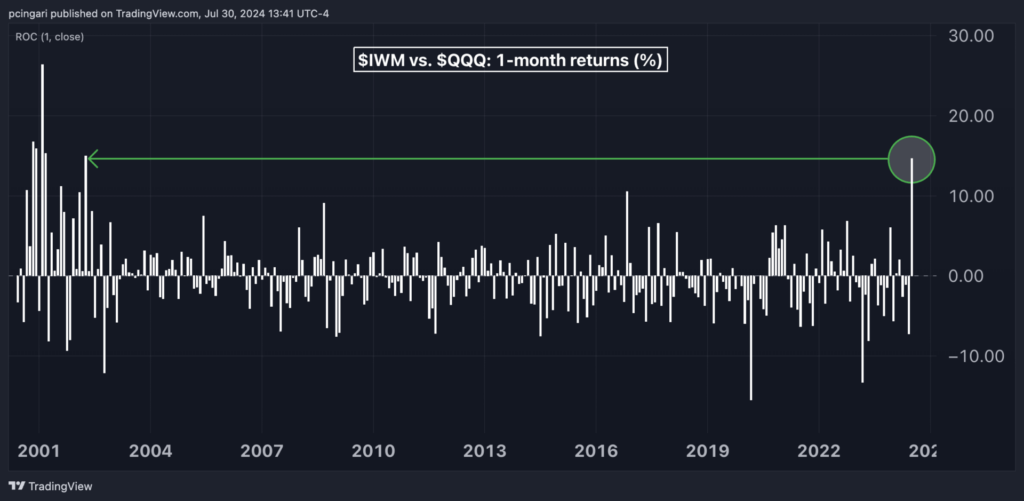

This strategic move propelled the iShares Russell 2000 ETF (IWM) to its strongest monthly performance against the Nasdaq 100, represented by the Invesco QQQ Trust (QQQ), in 22 years since April 2002.

During July, the Russell 2000 surged by 9.2%, while the Nasdaq 100 declined by 5%, showcasing a remarkable 14% outperformance of small caps over tech stocks by July 30.

Year-to-date, small caps are nearly on par with tech stocks after narrowing a significant performance gap. Historically, the Russell 2000 has outperformed the Nasdaq 100 only in three calendar years over the past 12: 2013 (+1.3%), 2016 (+13%), and 2022 (+17%).

This rotation towards small caps could strengthen further if the anticipated interest rate cuts by the Federal Reserve materialize. A positive outlook for small caps hinges on robust economic growth, evidenced by the recent 2.8% second-quarter growth in 2024 for the U.S. economy, coupled with easing inflation pressures that may lead to rate cuts independent of a slowdown.

Quincy Krosby, chief global strategist for LPL Financial, emphasizes that the anticipation of interest rate cuts has fueled a surge in small-cap stocks, known for their sensitivity to interest rate fluctuations compared to mega-tech stocks.

This trend signifies investor confidence in a solid economic landscape and expected lower interest rates.

Analysts predict a September rate cut, with a 90% likelihood of a 25-basis-point reduction and a 10% chance of a 50-basis-point cut, as per the CME Group FedWatch Tool. Further reductions are expected in November and December, potentially wrapping up the year with rates between 4.5% and 4.75%, with additional cuts projected for the first half of 2025.

If the Federal Reserve maintains a rapid pace of rate cuts, small caps could sustain their rally due to their sensitivity to overall borrowing costs in the economy.

Bank of America analyst Stephen Suttmeier, CFA, CMT, notes that the Russell 2000 hit all-time highs in four of the last five presidential elections, with bullish setups during these election periods, including the ongoing 2024 cycle, indicating the potential for new record highs. These post-election rallies, despite overbought conditions, have historically been robust.

Chicago is set to host Benzinga’s eagerly awaited SmallCap Conference 2024 on October 9-10, expected to be the largest event yet, drawing a live-stream audience of 10 million. Attendees can engage with emerging small-cap companies, join engaging presentations, take part in interactive Q&A sessions, and build valuable networks.

Seize the chance to be part of this exceptional event!

Photo: Shutterstock