Resilience Amidst Disappointment

The recent June-quarter reports from six members of the prestigious ‘Magnificent 7’ club have left the market with mixed feelings. While Tesla, Alphabet, Microsoft, and Amazon elicited disappointment, Apple and Meta were greeted with approval.

Such divergence in reactions hints at potential challenges ahead for the group. Some speculate that the era of Mag 7 dominance might be waning. However, a closer look paints a different picture.

With impressive top- and bottom-line growth, most Mag 7 stocks represent pillars of stability in the market. Apart from companies like Apple, which may have outgrown its growth phase, and Tesla grappling with market pressures, the remainder exhibit robust performance sustained into the foreseeable future.

The Bright Side of Growth

Amazon, despite a slight miss on revenue estimates, boasted a remarkable 99.8% spike in Q2 earnings to $13.16 billion on a 10.1% revenue surge to nearly $148 billion. Alphabet and Microsoft also outpaced expectations, reporting significant jumps in both top and bottom lines.

However, despite stellar performance, investors seem perturbed by the companies’ massive investments in artificial intelligence (AI) infrastructure. These substantial commitments have raised concerns about monetization strategies, leaving stakeholders seeking clarity.

As Alphabet’s CEO hinted, underspending in the AI realm poses a greater risk than the converse. While the market frets over capital expenditure, these visionary companies are fortifying their positions for an AI-centric future, igniting optimism for their enduring leadership.

Riding the Wave of Expectations

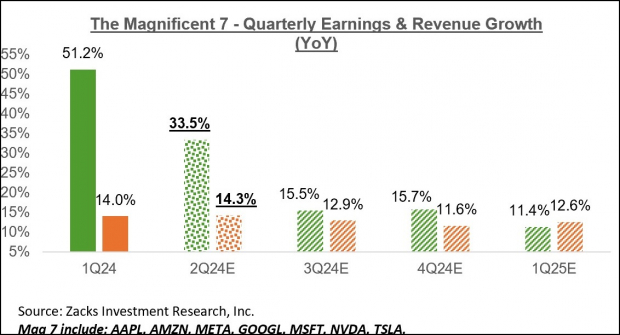

Projections for the ‘Mag 7′ group forecast a robust 33.5% earnings growth, driven by reported figures and estimates for Nvidia. This bullish outlook underscores investors’ confidence in the collective strength of these tech titans.

Amidst these stalwarts, the technology sector at large anticipates a 20.3% earnings surge and a 10.1% revenue uptick in Q2. The upward trajectory in growth, led by the Mag 7, paints a promising landscape for the sector’s future prosperity.

Beyond the Numbers

As we navigate through the current earnings season, the tech sector’s favorable revisions trend, spearheaded by the Mag 7 stocks, illuminates a path of optimism amid market fluctuations.

While the Q2 results for many S&P 500 members exhibit commendable performance, the low percentage of revenue beats raises eyebrows. However, the overall earnings growth of +10.5% marks a significant uptick from prior periods, heralding a season of prosperity.

Anticipating Tomorrow

With Q2 earnings ringing in a superior growth pace, the S&P 500 is poised for a remarkable +10.5% surge compared to last year. This accelerated momentum mirrors the tech sector’s resilience amidst market dynamics, dictating a narrative of growth and prosperity in the quarters to come.

Unveiling Earnings Growth Trends

Improvement in Expected Revenue Growth

When Finance is excluded from the aggregate data, the expected revenue growth pace jumps to +4.2%. This adjustment reveals a more robust outlook for revenue expansion, marking a positive shift in the financial landscape. Despite this refinement, the index level aggregate earnings growth for the year only experiences a slight decline to +8.1% on an ex-Finance basis.

Insights into Earnings Trends

Delving into the minutiae of the overall earnings picture unveils insightful revelations about the financial landscape. The projections for the forthcoming periods carry significant implications for market participants and investors seeking to grasp the directional momentum of the economy.

Optimistic Glimpse into Market Recommendations

Among thousands of stocks, a select group of Zacks experts have identified their top picks projected to surge by +100% or more in the coming months. The Director of Research, Sheraz Mian, singles out one company from this exclusive list, touting it as having the most explosive upside potential in the current market environment.

Notably, this company strategically caters to millennial and Gen Z demographics, raking in close to $1 billion in revenue during the previous quarter alone. With a recent market correction offering an opportune entry point, investors may find this juncture particularly favorable to embark on a financial journey with promising returns.

While no investment is devoid of risks, this pick stands out as a prospective frontrunner that could potentially outshine previous Zacks’ selections such as Nano-X Imaging, which witnessed a remarkable upsurge of +129.6% in slightly over 9 months.

Unlock Valuable Stock Insights

For investors seeking comprehensive stock analysis and valuable insights into market recommendations, Zacks Investment Research offers a plethora of resources. By leveraging these tools, individuals can stay abreast of the latest market trends and make well-informed decisions that align with their financial objectives.

Concluding Thoughts

In a dynamic financial landscape characterized by evolving trends and emerging opportunities, maintaining a keen focus on earnings growth trajectories is imperative for investors navigating the market terrain. By synthesizing data and trends, market participants can gain a competitive edge and position themselves strategically for long-term financial success.