Home Depot in Focus

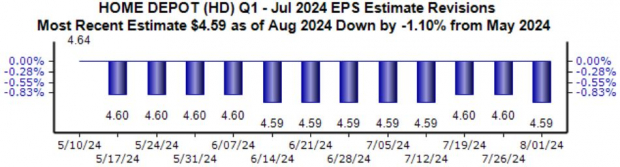

Home Depot’s shares have displayed erratic behavior in 2024, rising by a modest 2% and failing to keep pace with the S&P 500’s performance. Expectations for the upcoming quarter have dwindled over recent months, with predictions of a 1.3% decrease in earnings per share from the previous year.

The company’s comparable sales witnessed a 2.8% downturn, resulting in a lackluster post-earnings response. Despite this, Home Depot remains confident in its annual guidance, emphasizing the strength of its product range.

One ongoing trend to note is the consumer reluctance towards big-ticket discretionary products. This behavior, prevailing for multiple quarters, is a residual effect of pandemic-induced demand spikes.

Revenue forecasts have remained steady, predicting a minor 0.8% drop in sales. Additionally, the current forward 12-month earnings multiple of 22.8X, sits above the five-year median.

Walmart Performance

Walmart’s shares have exhibited solid growth in 2024, bolstered by robust quarterly outcomes, showcasing enhanced profitability. The company observed a 22% surge in earnings and a 6% increase in sales year-over-year in its most recent period.

Analysts maintain a positive outlook for the upcoming quarter, with a Zacks Consensus EPS estimate of $0.65, marking a 6.5% growth projection compared to the previous year. Revenue expectations align, pointing towards $168.4 billion in sales.

Walmart’s eCommerce segment remains a highlight, with a noteworthy 21% increase in global eCommerce sales in the last period. This steady growth trajectory suggests that the upcoming results will be closely monitored to affirm the company’s eCommerce prowess.

Deere & Co’s Perspective

Deere & Co has faced a challenging year in 2024, with shares plunging by approximately 11%, significantly underperforming against the S&P 500. Back-to-back disappointing releases resulted in stock pressure, exacerbated by a 12% decline in sales globally, influenced by weakened agricultural and turf demand.

Analysts hold a pessimistic view for the upcoming report, with a predicted earnings per share of $5.85 – a decline exceeding 15% since mid-May.

The company’s CEO, however, retains confidence in Deere’s resilience, citing, “Thanks to the dedication and hard work of our team, we continue to demonstrate structurally higher performance levels across business cycles and are benefitting from stability in construction end markets amid declining agricultural and turf demand.”

Deere & Co is currently labeled a Zacks Rank #4 (Sell) before its earnings presentation.

Concluding Thoughts

The ongoing Q2 earnings season unveils a mix of highs and lows, with positive trends dominating the landscape.

Looking ahead, investors await insights from prominent companies like Home Depot, Walmart, and Deere & Co, each poised to offer crucial updates on their financial performances.