A surge of optimism from financial behemoths has characterized recent activity around Danaher. Analyzing the historical options data for Danaher (DHR) has unearthed a total of 10 notable trades.

Diving into the specifics, it is revealed that 60% of traders exhibited bullish sentiments, while 10% veered towards a bearish outlook. Within these trades, 8 were puts valued at $1,950,976, contrasted by 2 calls totaling $75,645.

Foreseen Price Ranges

Scrutinizing the trading volumes and Open Interest, a prevailing focus has emerged on a price corridor between $260.0 and $280.0 for Danaher over the past quarter.

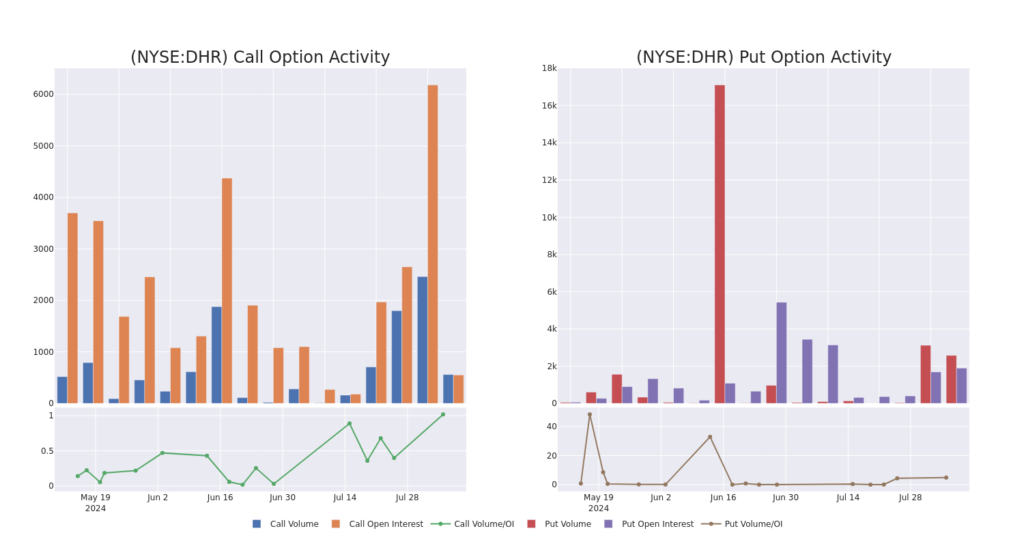

Evolution of Volume & Open Interest

Employing a nuanced strategy, assessing volume and open interest provides crucial insights for options trading. This dynamic analysis tracks the level of interest and liquidity in Danaher’s options, particularly within a strike price spectrum from $260.0 to $280.0 over the last 30 days.

An In-Depth Look at Danaher’s Recent Option Moves

Noteworthy Options Highlights

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | PUT | TRADE | BULLISH | 12/20/24 | $12.4 | $11.8 | $11.8 | $260.00 | $944.0K | 593 | 808 |

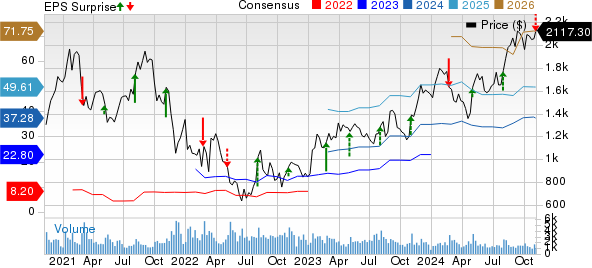

Insights into Danaher’s Background

Back in 1984, Danaher underwent a metamorphosis from a real estate entity to a manufacturing powerhouse with a focus on scientific instruments and consumables, following mergers and divestitures. After divesting its environmental and applied solutions group, Veralto, in late 2023, Danaher now predominantly caters to the life science and diagnostic industries.

Given the recent options activity around Danaher, it’s pertinent to turn our attention to the company itself and delve into its current performance.

Current Standing of Danaher

- With a trading volume of 810,223, DHR is currently priced at $268.26, experiencing a decrease of -3.07%.

- Indicators suggest that the stock might be on the verge of entering overbought territory.

- The next earnings report is anticipated in 78 days.

Expert Opinions on Danaher

A consensus of 5 market analysts has set a target price of $280.0 for Danaher.

- TD Cowen’s analyst has opted to uphold a Buy rating on Danaher, with a target price of $310.

- Leerink Partners supports an Outperform rating for Danaher, aligning with a target price of $280.

- B of A Securities maintains a Neutral stance on Danaher, aiming for a price of $275.

- Barclays holds an Equal-Weight rating, setting a target price of $285.

- Stifel continues with a Hold rating and targets a price of $250 for Danaher.

Trading options is a realm of heightened risk and potential rewards. Seasoned traders navigate these waters through continuous learning, tactical adjustments, leveraging diverse indicators, and staying finely attuned to market fluctuations. Stay updated on Danaher’s latest options plays without missing a beat with Benzinga Pro to receive real-time alerts.