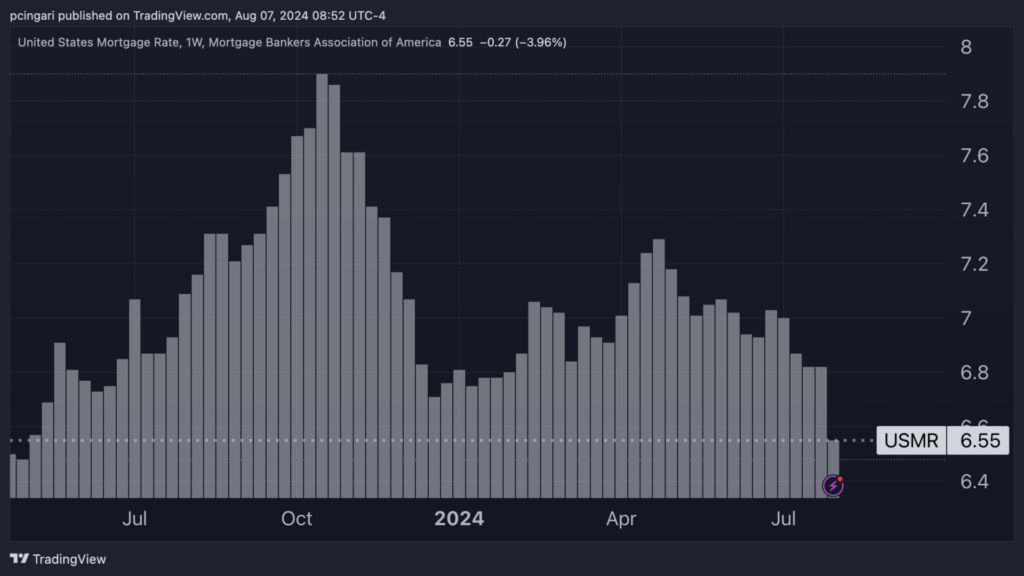

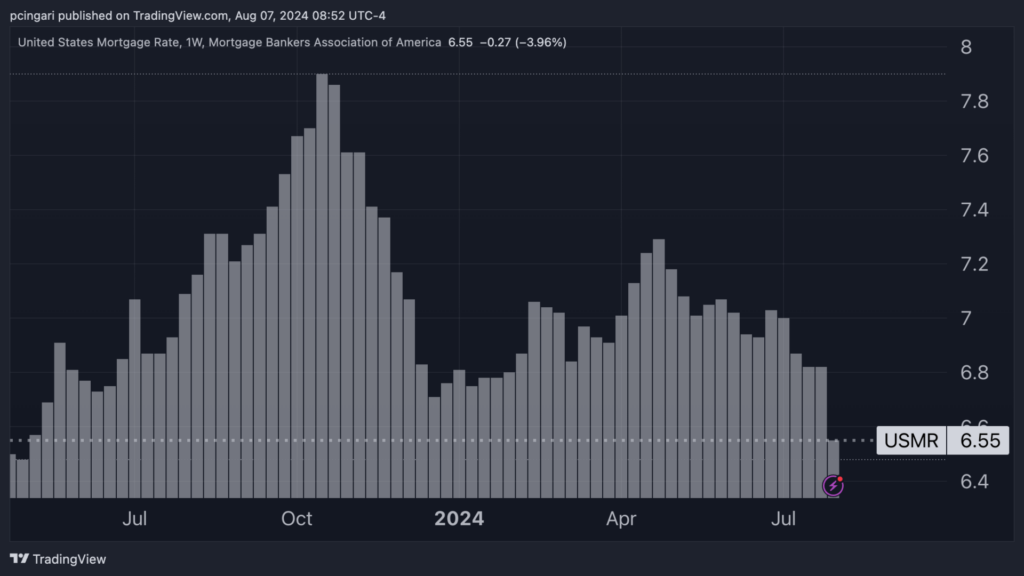

As expectations mount for a Federal Reserve interest rate cut, mortgage rates have plummeted to their lowest levels in over a year, revitalizing homebuyer activity and driving a surge in both new mortgage applications and refinancing of existing loans.

During the week ending Aug. 2, the average contract interest rate for 30-year fixed-rate mortgages, with conforming loan balances of $766,550 or less, dropped by a substantial 27 basis points to 6.55%, marking the lowest rate since early May 2023.

This substantial 27 basis point decline from the previous 6.82% rate recorded on July 26 constitutes the most significant weekly drop since July 2022, coinciding with notable decreases in Treasury yields.

Key among these figures is the 30-year Treasury yield, a crucial benchmark for mortgage costs, which plunged by 34 basis points during the week ending Aug. 2, reaching around 4.2%.

Highlighting these trends, Joel Kan, the Mortgage Bankers Association’s vice president and deputy chief economist, mentioned, “Mortgage rates decreased across the board last week…following dovish communication from the Federal Reserve and a weak jobs report, which added to increased concerns of an economy slowing more rapidly than expected.”

30-Year Mortgage Rates Plunge To Levels Unseen Since May 2023

Increase in Mortgage Demand Driven By Reduced Interest Rates

Mortgage applications experienced a substantial 6.9% surge during the week ending Aug. 2, marking the most significant increase in nearly two months and completely reversing the cumulative application declines from the preceding weeks.

Of particular note was the spike in applications for mortgage refinancing, which are particularly susceptible to weekly interest rate fluctuations, soaring by close to 16%. This surge led the MBA Mortgage Refinance index to achieve its highest level in two years.

Although the Federal Reserve maintained the federal funds target rate at its July meeting, it hinted at a potential rate cut in September. The market’s speculation around a Fed rate reduction rose sharply following a weaker-than-expected July jobs report.

Reflecting on recent data, MBA chief economist Mike Fratantoni expressed, “The weaknesses in this report, including the deceleration in wage growth and uptick in the unemployment rate, certainly bolster the case for such a cut, though confirmation of slowing price growth is needed from the upcoming inflation report.”

He added, “The market is anticipating the Fed’s move, driving down long-term rates, including those for mortgages, which should result in increased home purchases and a resurgence in refinance activity.”

Market Response

Premarket trading on Wednesday saw a surge in shares of real estate companies, with the Vanguard Real Estate ETF (VNQ) rising by 0.8%, following a 2% gain the previous day and edging towards levels last reached in January 2023.

Among the top premarket gainers were Howard Hughes Holding (HHH), up 14.5%, Peakstone Realty Trust (PKST), up 5.4%, Opendoor Technologies Inc. (OPEN), up 4.6%, and Hudson Pacific Properties Inc (HPP), up 4.4%.

Stocks linked to the mortgage industry, as tracked by the iShares Residential and Multisector Real Estate ETF (REZ), surged by over 2.5% in premarket trading, building on a 2.7% rally the previous day. American Healthcare REIT, Inc. (AHR) and Community Healthcare Trust Incorporated (CHCT) led the gains, rising by 9.4% and 2.9%, respectively.

Read now:

Photo via Shutterstock.