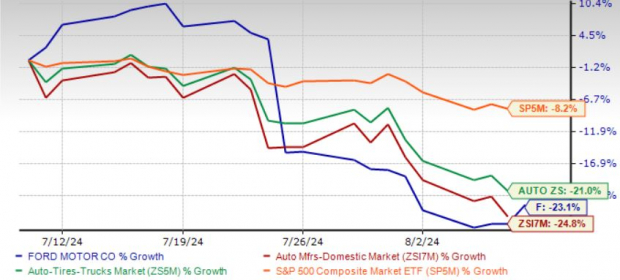

Downward Spiral: Ford’s Recent Stock Decline

In the wake of a lackluster second-quarter performance, Ford (F) has seen its stock price plummet by nearly 23% in just one month. Disappointing earnings results, with earnings per share missing expectations and net income shrinking by over 5% year over year, have rattled investors. The significant rise in warranty and vehicle recall expenses, amounting to $2.3 billion in the second quarter alone, has dealt a severe blow to the automaker’s profitability.

Comparative Analysis: Ford vs. General Motors

While Ford struggles, its competitor, General Motors (GM), reported stronger second-quarter earnings, surpassed sales expectations, and revised its full-year guidance upwards for both EPS and free cash flow. Ford, on the other hand, maintained its profit outlook, which left some investors dissatisfied with the lack of a more positive forecast.

Exploring Ford’s Strengths: The Ford Pro Division

Despite the overall challenges, Ford’s commercial vehicle sector, Ford Pro, emerged as a standout performer in the second quarter. With a commanding operating margin of 15.1%, driven by strong demand for Super Duty trucks and Transit commercial vans, this division showcases promise for future growth. Additionally, Ford’s focus on software technology and services through Ford Pro is expected to be a significant revenue driver in the coming years.

Electric Woes: The Ford Model e Setback

On the flip side, Ford’s electric vehicle division, Ford Model e, has been a drag on the company’s profits. With a second-quarter loss of $1.1 billion due to various challenges like lower sales volumes and high manufacturing costs, the Model e segment represents a notable obstacle to Ford’s bottom line. This underperformance in the EV sector has raised concerns about Ford’s overall profitability.

Strategic Outlook: Mapping Ford’s Future

Looking ahead, Ford faces a mix of opportunities and hurdles. While Ford Pro’s resilience may offset some setbacks, challenges in the EV sector and ongoing quality issues in the traditional segment pose significant obstacles. Although the company closed the second quarter with improved liquidity and adjusted free cash flow projections, efforts to reduce warranty costs and revamp the EV business are critical for long-term success.

Valuation Assessment: Ford’s Investment Appeal

Despite its recent struggles, Ford’s valuation presents an attractive proposition for investors. Trading at a lower forward sales multiple than the industry average and its historical averages, Ford earns a favorable Value Score of A. This suggests the stock may be undervalued, making it a potentially intriguing investment opportunity.

Parting Thoughts: The Road Ahead for Ford

As investors deliberate on Ford’s future prospects, it’s evident that the company is at a crossroads. Balancing its strengths in the commercial vehicle sector with challenges in the EV division will be crucial for Ford’s recovery. While uncertainties loom, Ford’s resilience and strategic initiatives may pave the way for a turnaround in the long haul.

The Rise of Hydrogen Stocks: A Steady Climb in Turbulent Markets

Exploring the Hydrogen Energy Landscape

The quest for clean hydrogen energy is not just a futuristic dream but a tangible reality. Projections indicate that the demand for this eco-friendly energy source is set to soar, potentially hitting the $500 billion mark by 2030 and experiencing a monumental five-fold growth by 2050. As the world intensifies its focus on sustainability, hydrogen stocks have emerged as prime contenders for investment opportunities that offer both environmental and financial rewards.

Unveiling Zacks’ Top 3 Hydrogen Stocks

Zacks, a renowned name in financial analysis, has identified three prominent players within the hydrogen energy sector that are poised to lead the charge towards becoming dominant forces in the industry.

Among these contenders is a company that has not just outperformed the market but has done so remarkably, boasting an impressive surge ranging from +2,400% to +380% over the past 25 years. Another standout pick has already secured capital commitments amounting to $15 billion, dedicated solely to low carbon hydrogen products within the timeframe of 2027. Lastly, the third pick witnessed a significant upswing, reaching 52-week highs in the final quarter of 2023, while consistently increasing its dividend payout annually for more than ten years.

The current economic landscape, characterized by turbulence and uncertainty, further showcases the resilience of these hydrogen stocks. Despite facing headwinds, these companies continue their upward trajectory, standing as beacons of stability in a volatile market environment.

The historical context of market fluctuations and industry transformations underscores the significance of these solid performances. The ability of these hydrogen stocks to weather storms, adapt to changing conditions, and demonstrate robust growth prospects attests to their enduring value as key players in the evolving energy landscape.