Bitcoin, the trailblazer of cryptocurrencies, has taken investors on a wild ride through its price history.

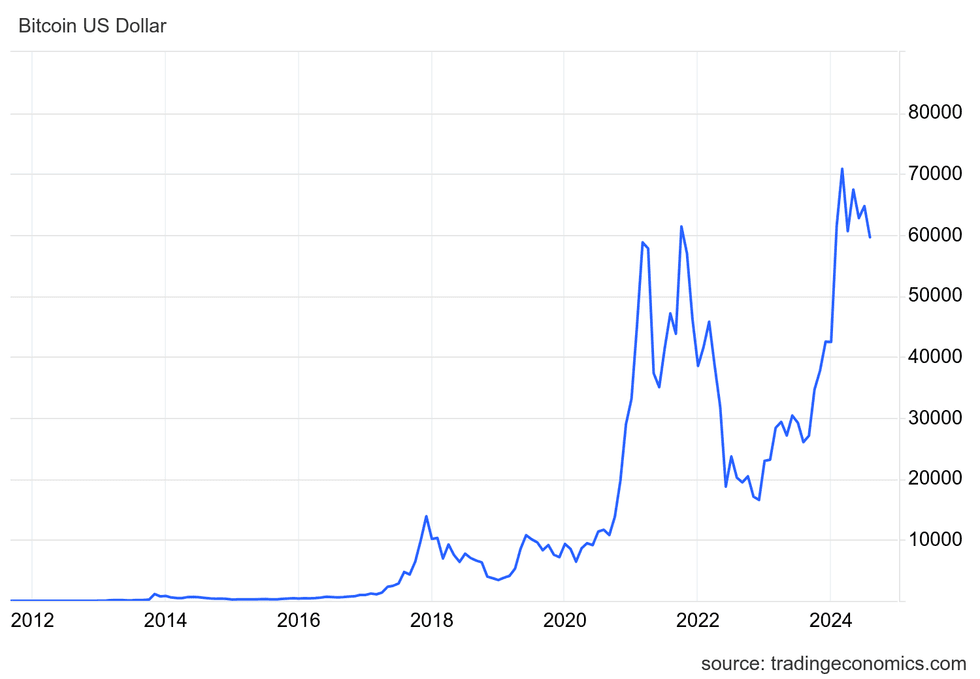

Rising over 1,200 percent from March 2020 to peak at US$69,044 on November 10, 2021, Bitcoin’s ascent defied traditional market norms.

The Origins of Bitcoin

Emerging in 2009 with a humble starting price of US$0.0009, Bitcoin was the brainchild of a mysterious figure or group under the pseudonym Satoshi Nakamoto. Born out of the aftermath of the 2008 financial crisis, Bitcoin aimed to disrupt the financial landscape with its decentralized, transparent, and censorship-resistant structure.

The creation of the Genesis Block on January 3, 2009, containing a symbolic message criticizing government bailouts, marked the inception of Bitcoin. As the first cryptocurrency transaction took place and the first recorded exchange valued Bitcoin at US$5.02, the stage was set for Bitcoin to revolutionize digital currencies.

The Great Bitcoin Pizza Purchase

The first-ever Bitcoin transaction for a tangible good occurred on May 22, 2010, when Laszlo Hanyecz famously traded 10,000 Bitcoins for two Papa John’s pizzas, setting Bitcoin’s price at approximately US$0.0025.

Bitcoin’s valuation witnessed its inaugural surge in 2013, transcending both the US$100 and US$1,000 thresholds before culminating in a peak price of US$1,242 by year-end.

Bitcoin’s Meteoric Rise

January 1, 2016, ignited Bitcoin’s remarkable bullish trajectory, commencing the year at US$433 and concluding at US$989, a staggering 128 percent increase. As global events like the Brexit referendum and Donald Trump’s election unfolded, Bitcoin emerged as a sanctuary asset amid market turmoil.

With 2016 bringing heightened blockchain interest from tech and financial sectors, Bitcoin fetched increasing attention. Noteworthy investments like IBM and Goldman Sachs’ US$60 million funding in blockchain-tech firm Digital Asset Holdings buoyed Bitcoin’s value to US$418 by April from US$368 in February.

The Ongoing Bitcoin Thriller

Economic uncertainties and geopolitical shifts have consistently swung Bitcoin’s price pendulum, exemplifying its volatile nature. As Bitcoin reached a new peak of US$73,115 on March 11, 2024, the cryptocurrency continues to intrigue, perplex, and delight investors around the globe.

The Rollercoaster Ride of Bitcoin: A Look at its Turbulent Journey

Bitcoin’s Historical Price Fluctuations

Bitcoin, the bellwether of cryptocurrencies, has been no stranger to volatility. In 2016, its value oscillated wildly, peaking in June before dipping drastically to rise again in a rollercoaster pattern that left investors breathless. Partnerships with giants like Microsoft and Bank of America Merrill Lynch in September did little to stabilize its price.

Meteoric Rise and Legitimization

Entering 2017 with a modest value, Bitcoin skyrocketed to close the year near $19,000. Its legitimization as an investment option was further solidified with the introduction of futures contracts on the Chicago Mercantile Exchange, prompting a surge of interest and a frenetic rush of investments.

The Year of 2020: A Turning Point

Bitcoin price chart via TradingEconomics.com.

Bitcoin price chart in US dollars from 2011 until August 8, 2024.

2020 tested Bitcoin’s resilience, kicking off the year on a high note before a pandemic-induced market crash knocked it down by 30%. Swift recovery followed, culminating in a soaring value of $29,402.64 by year-end, marking a remarkable 323% surge from the lows of March.

2021: A Year of Unprecedented Growth

The year 2021 witnessed Bitcoin’s meteoric rise to an all-time high of $68,649.05 in November, fueled by a confluence of investor risk-taking and increased money supply due to the pandemic. The cryptocurrency landscape also witnessed burgeoning interest in NFTs, signaling a broader shift towards digital assets.

Tumultuous Turns: 2022’s Crypto Downturn

The tides turned in 2022 as Bitcoin’s value plummeted below $20,000 amidst market uncertainties. Events like Terra Luna’s destabilization and Celsius Network’s bankruptcy shook investor confidence, triggering widespread panic selling and widespread disillusionment with the crypto market.

The Surge of Bitcoin Price and the Impact of the 2024 Halving

Bitcoin Reaches New Highs Despite Sector Turmoil

After the tumultuous events surrounding FTX and Bankman-Fried’s legal troubles, Bitcoin managed to rise above the chaos, reaching new pinnacles in terms of value. The resilience shown by the cryptocurrency market, particularly Bitcoin, was a testament to its robustness and enduring appeal.

Bitcoin’s Resilient Climb Back Up

Following the crisis of confidence triggered by the FTX scandal, Bitcoin slowly embarked on a journey of recovery from its lows in 2022. Despite the adversities faced by the entire sector, the digital currency managed to break through various price barriers, showing substantial growth and demonstrating its attraction to investors.

The Institutional Stamp of Approval

The latter half of 2023 and 2024 witnessed significant endorsements for Bitcoin from institutional investors. The backing from institutions like BlackRock and the anticipation of SEC approval for Bitcoin exchange-traded funds propelled the price of the cryptocurrency to new heights, cementing its status as a legitimate asset class in the eyes of traditional financial players.

The Impact of the 2024 Bitcoin Halving

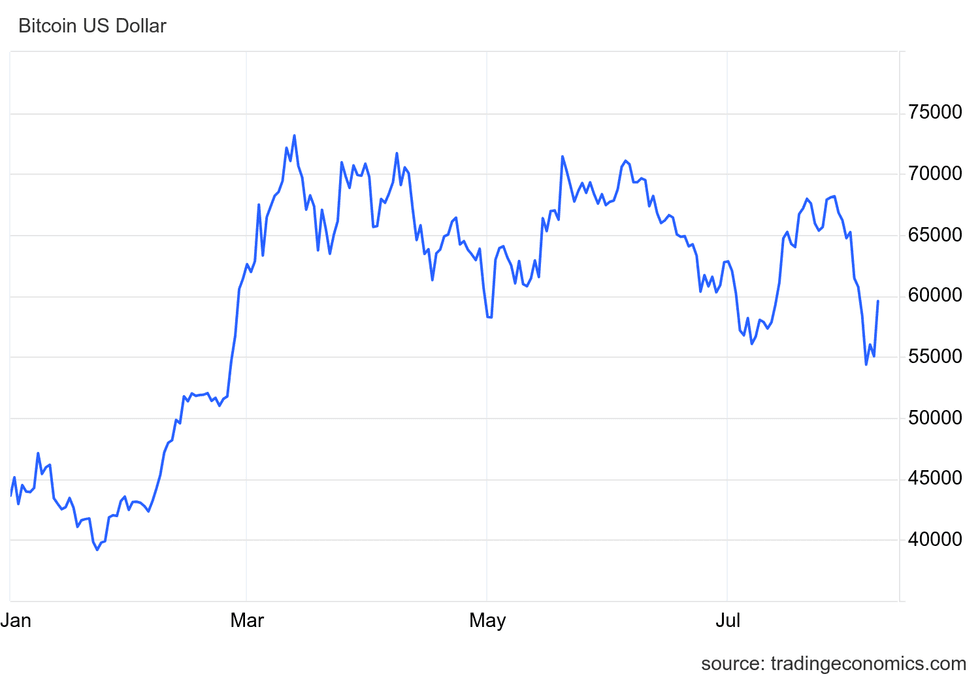

Bitcoin’s price dynamics leading up to and following the 2024 halving event underscored the significance of this milestone within the cryptocurrency ecosystem. While the immediate effects of the halving on Bitcoin’s value were not immediately discernible, the event undoubtedly contributed to the heightened volatility and market activity surrounding the cryptocurrency.

Bitcoin’s Price Swings Post-Halving

The period following the 2024 halving saw Bitcoin’s price oscillating within a range, influenced by various market factors and external events. Fluctuations in trading volume and price drops following key announcements highlighted the sensitivity of Bitcoin to regulatory developments and changing investor sentiments.

Bitcoin’s Evolution as an Investment Class

The evolving perception of Bitcoin from a speculative investment to a “risk-on” asset emphasized the changing landscape of digital currencies in the broader financial domain. With increased institutional involvement and mainstream acceptance, Bitcoin’s market behavior began to mirror that of traditional assets, responding to market conditions and investor confidence.

Bitcoin price chart via TradingEconomics.com.

Bitcoin price chart in US dollars from January 1, 2024, until August 8, 2024.