Among the Zacks Rank #1 (Strong Buy) list, Brinker International and Texas Roadhouse are two stocks that stand out in terms of growth.

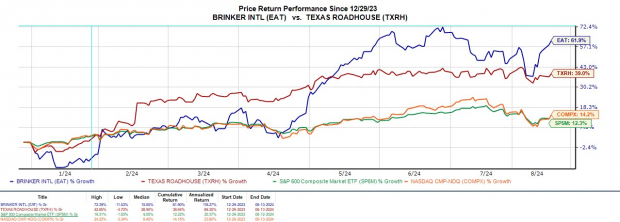

Seeing increased traffic, these retail restaurant stocks should fulfill investors’ appetites with their expansion. To that point, Brinker International’s stock has soared +62% this year with Texas Roadhouse shares up nearly +40%.

Image Source: Zacks Investment Research

Brinker International’s Success Through Chile’s

Brinker International’s momentum has been attributed to traffic-driving initiatives and improved operational performance at its Chile’s Bar and Grill locations with the company also operating Maggiano’s Little Italy.

Chile’s meals have appealed to consumers, with industry sales beating averages by 7% and traffic by 4% in the latest quarter.

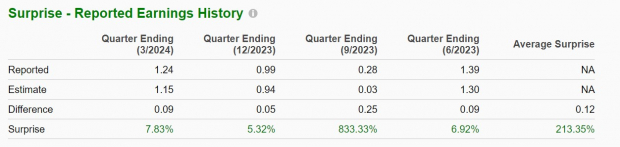

Brinker is set to announce Q4 results, with sales projected to rise 7% to $1.16 billion and earnings to spike 19% to $1.65 per share, showcasing consistent quarterly outperformance.

Image Source: Zacks Investment Research

The Zacks ESP predicts continued success for Brinker International, with Q2 EPS estimates surpassing the Zacks Consensus.

Texas Roadhouse’s Growth Engine: Bubba’s 33

Texas Roadhouse achieved growth with Bubba’s 33, its popular sports bar brand, driving Q2 results above expectations. Bubba’s 33 amassed impressive weekly sales of $123,000 during the quarter.

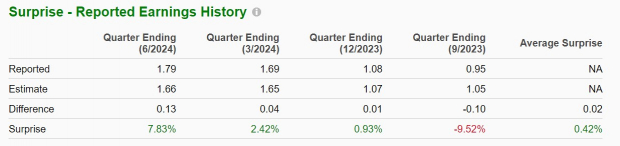

Texas Roadhouse posted Q2 sales of $1.34 billion, up 14% year-on-year, with earnings per share at $1.79, a striking 47% increase from the previous year, beating estimates by 8%.

Image Source: Zacks Investment Research

Positive Outlook on Earnings per Share (EPS)

Brinker International’s annual earnings are projected to surge 48% in fiscal 2024 to $4.18 per share, with further growth expected in FY25.

Texas Roadhouse anticipates 40% EPS growth this year, set at $6.34 per share, with a 9% increase expected for FY25. Earnings estimates for both companies have witnessed a recent uptrend, signaling positive investor sentiment.

Rising earnings estimates suggest continued price performance for Brinker International and Texas Roadhouse, making them strong candidates for investment in the retail restaurant sector.