Tesla Inc. TSLA has experienced a tumultuous 2024. Despite being down more than 19% year-to-date, recent gains of about 3% in the last month have provided some relief.

The company’s second-quarter earnings report on July 23 brought a glimmer of hope. With revenue around $25.5 billion — a modest 2% increase year-over-year — Tesla surpassed Wall Street’s expectations of $24.73 billion.

However, Tesla’s earnings per share (EPS) painted a different picture, dropping 43% year-over-year to 52 cents, missing the Street’s consensus estimate of 62 cents. Despite the earnings miss, the stock managed to form a Golden Cross on July 29.

A Golden Cross occurs when the 50-day moving average crosses above the 200-day moving average, indicating a potentially bullish trend. This pattern has stirred optimism among investors, suggesting a looming rebound for Tesla.

While Tesla revels in the glory of its Golden Cross, the broader clean energy sector is facing challenges.

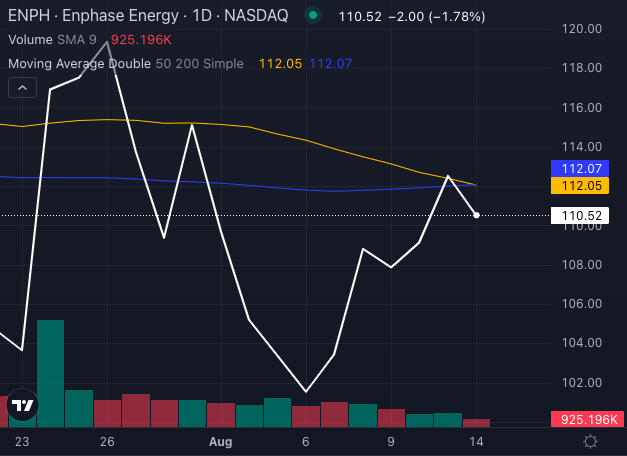

Enphase Energy Inc. ENPH, a frontrunner in energy management technology, has seen a 15.69% decline year-to-date and is on the verge of a Death Cross.

This bearish signal, where the 50-day moving average falls below the 200-day moving average, hints at potential further declines.

Blink Charging Co. BLNK, another significant player in the EV market, is also grappling with challenges.

With its stock down 35.49% year-to-date, Blink is rapidly approaching a Death Cross, clouding its short-term outlook.

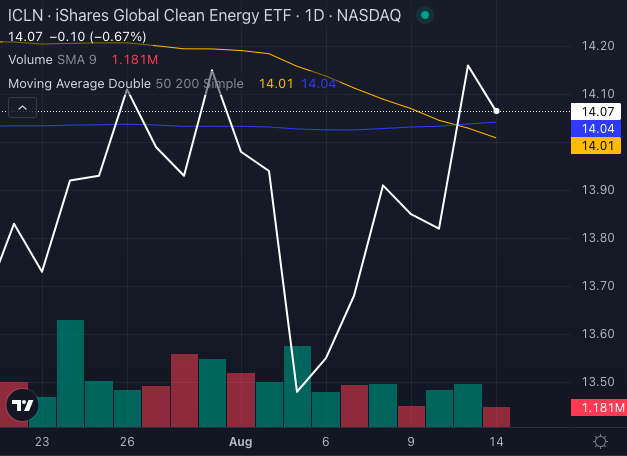

The iShares Global Clean Energy ETF ICLN, which monitors the performance of clean energy companies worldwide, has already succumbed to a Death Cross, echoing the sector’s broader challenges.

The ETF shows an 8.54% decline year-to-date, underlining the uphill battle faced by clean energy stocks despite Tesla’s technical resurgence.

As Tesla revs up with its Golden Cross, clean energy stocks remain mired in a Death Cross rut, illustrating the divergent paths within the sector’s performance.

Read Next: