Wix.com‘s WIX shares have been on a tear this year, with an impressive surge of 32.5% year to date, outpacing the S&P 500 and its own sub-industry’s growth by a significant margin.

Following a robust performance in the second quarter of 2024, WIX stock has gained 4.2%, albeit still trading below its 52-week high. This dip might present a compelling opportunity for discerning investors.

Established in 2006 and based in Tel Aviv, Israel, WIX thrives as a cloud-based web development platform, facilitating personalized website and application development to enhance online visibility for businesses, professionals, and individuals alike.

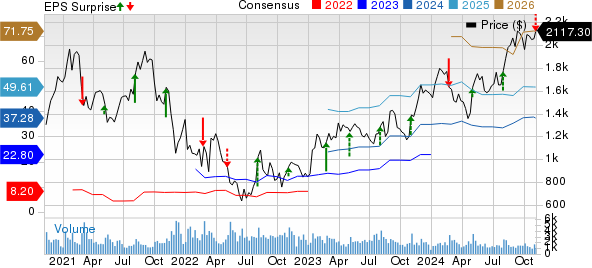

The company has continually surpassed earnings expectations, with an average surprise of 29.8% in the past four quarters.

WIX Studio & AI Strategy Propelling Growth

WIX’s growth trajectory is fueled by the growing popularity of its product portfolio, notably its AI offerings and WIX Studio. The continuous improvement and innovation within WIX Studio have resulted in increased adoption rates, reflecting positively on the company’s performance.

Moreover, WIX has made significant strides in integrating AI capabilities across its platform, boasting 17 AI business assistants to date. The recent introduction of advanced AI features for its mobile app builder marks a pivotal moment in redefining app design.

An important move made by WIX was to expand the availability of its AI Website Builder in various languages, catering to a global audience and enhancing user experience by allowing customers to create websites in their preferred language.

In the second quarter of 2024, WIX reported a 12% year-over-year revenue increase, exceeding the Zacks Consensus Estimate. Noteworthy increases were observed in Creative Subscriptions’ and Business Solutions’ bookings, pointing to a healthy demand for the company’s services.

Outlook Revised

Building on its first-half performance, WIX has raised its guidance for bookings, revenues, and free cash flow for the year. This upward revision underscores the company’s confidence in sustaining its growth momentum.

Key projections now include total bookings ranging between $1,802 million and $1,822 million, with total revenues anticipated to fall within the bracket of $1,747-$1,761 million. Improved free cash flow expectations further enhance WIX’s financial outlook for 2024.

Estimates Moving North

Analysts’ optimism is reflected in the upward revision of earnings estimates for 2024 and 2025, with a projected rise in EPS and revenues signaling a positive trend for WIX. The company’s long-term earnings growth rate of 22.4% reinforces its potential for sustained profitability.

Headwinds Persist

Despite its promising performance, WIX faces challenges stemming from unfavorable foreign currency movements and global macroeconomic conditions. Moreover, increased investments in product development and heightened competition in the e-commerce sector pose risks to the company’s growth trajectory.

Stocks to Consider

For investors seeking alternative options in the technology sector, potential considerations include stocks like Badger Meter (BMI), Manhattan Associates (MANH), and ANSYS (ANSS). These companies, with their impressive track records and favorable Zacks Ranks, present compelling investment opportunities in the tech space.

Each of these companies exhibits unique strengths, such as sustained earnings growth, beating consensus estimates, and a strong market performance, making them attractive prospects for discerning investors.