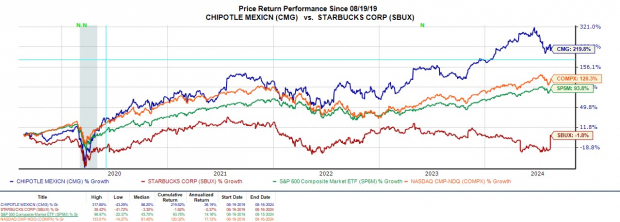

In an unexpected turn of events, Chipotle Mexican Grill’s CMG CEO Brian Niccol announced he will be departing to take over the reins at Starbucks (SBUX). Investors now face a conundrum as to which of these retail restaurant stocks presents a more enticing investment opportunity, especially with Niccol set to assume the position of CEO at Starbucks come September.

Chipotle has witnessed stellar performance under Niccol’s leadership, with its stock skyrocketing over +200% in the last five years, dwarfing Starbucks’ meager -2% growth. However, past success does not guarantee future triumph, leaving investors pondering over the superior choice between the two competitors at this juncture.

Image Source: Zacks Investment Research

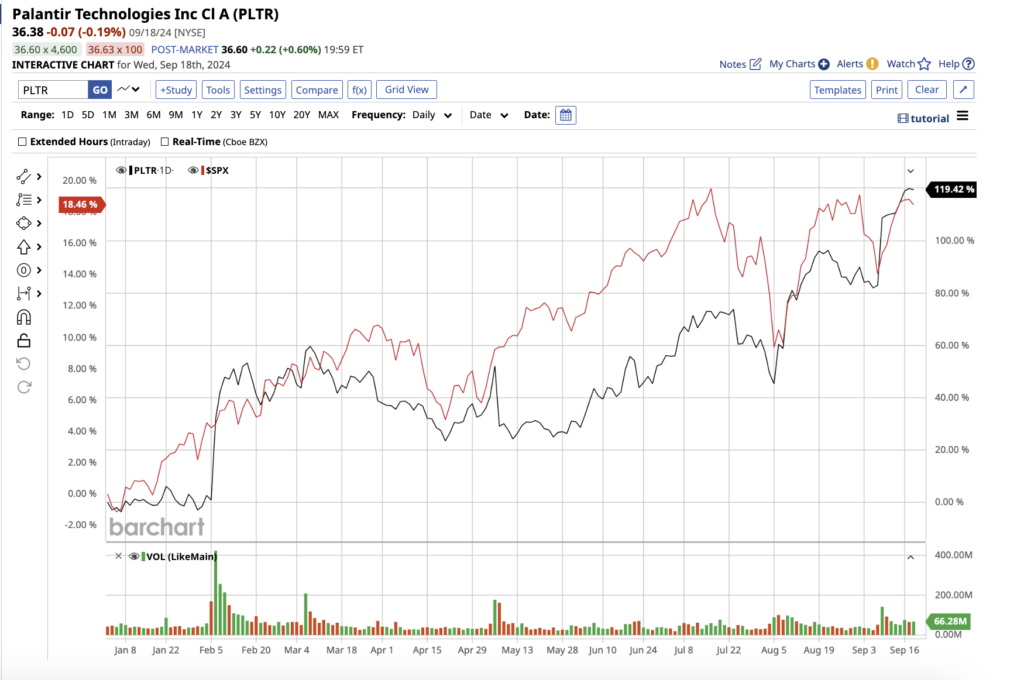

Growth Projections

Following a monumental 50-1 stock split in June, Chipotle’s annual earnings are forecasted to surge by 20% in fiscal 2024 to $1.08 per share, up from 0.90 in the previous year ($45 per share/50). Additionally, an 18% growth in earnings per share is anticipated in FY25.

On the revenue front, Chipotle’s total sales are expected to climb by 15% this year and are projected to leap by another 13% in FY25 to $12.79 billion.

Image Source: Zacks Investment Research

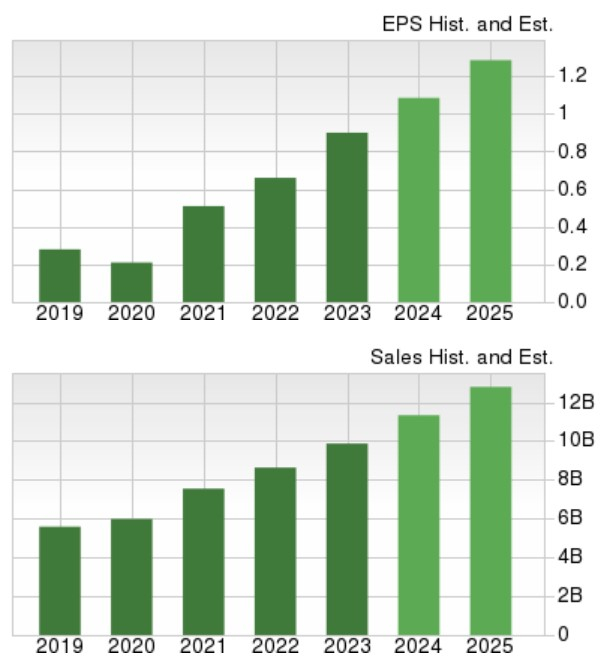

In stark contrast, Starbucks’ annual earnings are anticipated to remain relatively stagnant in FY24 but are predicted to see an 11% upsurge in FY25 to $3.94 per share. Meanwhile, the coffee giant’s total sales are slated to experience a modest 1% growth in FY24 and are prognosticated to expand by 6% the following year, reaching $38.84 billion.

Image Source: Zacks Investment Research

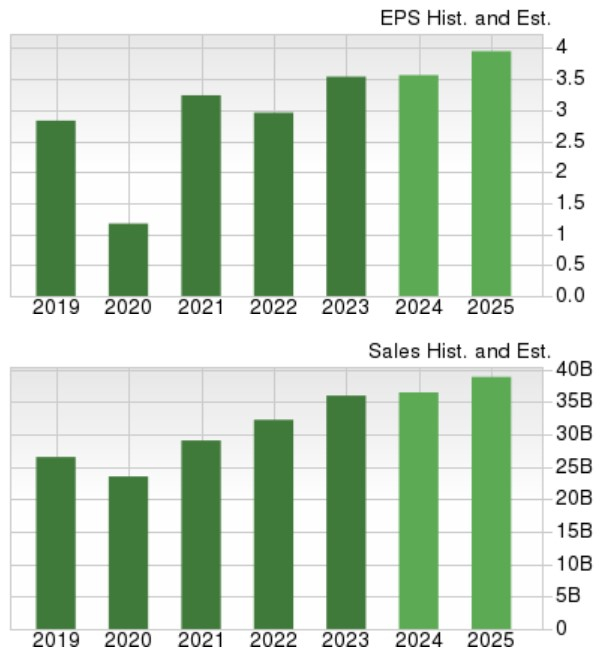

Valuation Analysis

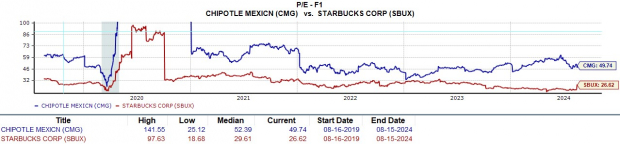

While Chipotle seems to hold the edge in growth prospects, Starbucks boasts a more appealing valuation. With SBUX trading at 26.6X forward earnings, the figure is in close proximity to the S&P 500’s 23.3X. On the contrary, CMG trades at a noticeable premium to the broader market at 49.7X.

Image Source: Zacks Investment Research

Financial Health Assessment

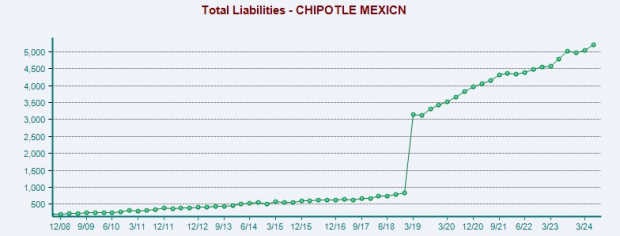

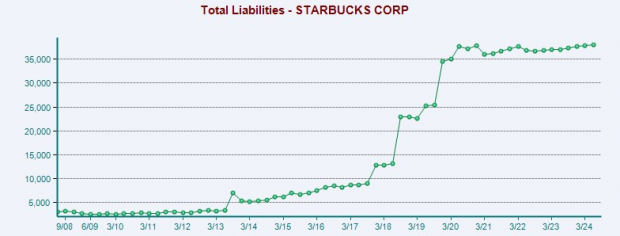

Financial well-being can be a critical determinant when selecting between stocks, and although Starbucks holds more cash, Chipotle exhibits a stronger balance sheet.

To illustrate, Chipotle currently possesses $1.49 billion in cash & equivalents alongside $8.92 billion in total assets, overshadowing its $5.2 billion in total liabilities.

Image Source: Zacks Investment Research

In comparison, Starbucks holds $3.39 billion in cash & equivalents but bears $38.04 billion in total liabilities, contrasted with $30.11 billion in total assets.

Image Source: Zacks Investment Research

Final Considerations

While a turnaround is imperative for Starbucks following their operational challenges, notably reflected in their balance sheet, Brian Niccol’s leadership brings hope that he can elevate Starbucks to the same successful heights witnessed at Chipotle. Presently, both Starbucks and Chipotle are rated a Zacks Rank #3 (Hold), indicating they are both promising long-term investments considering their favorable prospects, although opportunities for better entry points may arise in the future.