Medical Properties Trust, Inc. MPW — also known as MPT — recently finalized the sale of 11 healthcare facilities in Colorado to University of Colorado Health (“UCHealth”) for $86 million, aligning with its capital-recycling strategy.

Positive Market Response

On August 15, MPW shares surged by 5.34% during the NYSE regular trading session, reflecting investor positivity towards the transaction.

Strategic Utilization of Proceeds

The company intends to utilize the proceeds from this sale to reduce debt and for general corporate purposes, underlining its commitment to financial stability.

Disciplined Capital-Recycling Strategy

MPT’s strategic approach involves divesting non-core assets like freestanding emergency department (FSED) facilities and redirecting the generated funds towards acquiring high-value assets and developmental projects that contribute positively to growth.

Historical Context

In a similar vein, in July 2024, MPT sold several healthcare facilities in Arizona to Dignity Health for $160 million. Furthermore, earlier in April 2024, the company successfully closed multiple lucrative deals, including the sale of its interest in Utah hospitals and five facilities to Prime Healthcare for a substantial sum of $1.1 billion and $350 million, respectively.

Striving for Operational Efficiency

MPT’s commitment to enhancing portfolio diversification, reducing exposure to underperforming operators, and ensuring stable cash flow underscores its dedication to operational efficiency in the healthcare real estate sector. The company’s robust liquidity position following transactions exceeding $2.5 billion in the current year until August 8, 2024, signifies a strong financial footing.

Financial Performance and Market Recognition

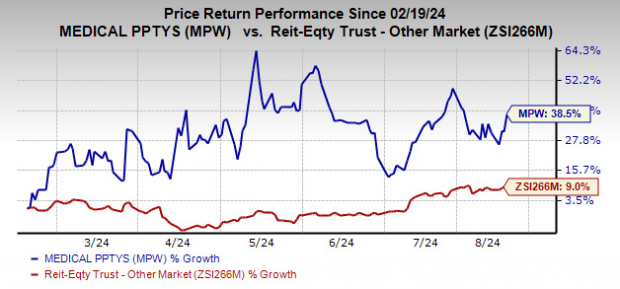

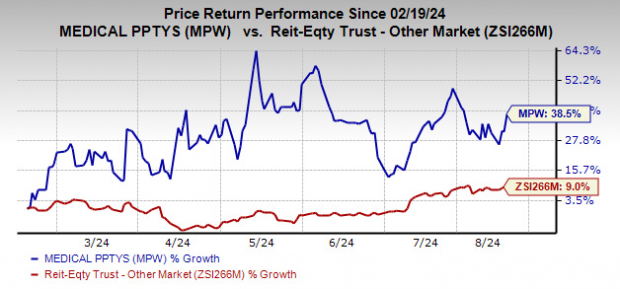

Recently, the REIT reported impressive second-quarter 2024 results, with Normalized Funds from Operations exceeding market expectations at 23 cents per share. This performance, combined with a Zacks Rank #1 (Strong Buy) designation, contributed to a noteworthy 38.5% increase in the company’s shares over the past six months, outpacing industry growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Investors keen on the healthcare REIT sector may also consider top-ranked stocks like CareTrust REIT CTRE and Sabra Healthcare REIT SBRA. CareTrust REIT carries a Zacks Rank #1, with a projected 2024 FFO per share growth of 4.3%. Sabra Healthcare REIT, currently ranked #2 (Buy), is expected to see a 6% increase in FFO per share for 2024.

Note: FFO represents funds from operations, a key metric used to evaluate the performance of REITs.