Embracing a Semiconductor Surge

Semiconductor stocks have pulled back from soaring highs, unveiling an enticing buying opportunity amidst an industry flourishing under the artificial intelligence (AI) renaissance. The Semiconductor Industry Association (SIA) reports a robust 18.3% global surge in semiconductor sales year over year, indicating a vibrant market landscape for savvy investors.

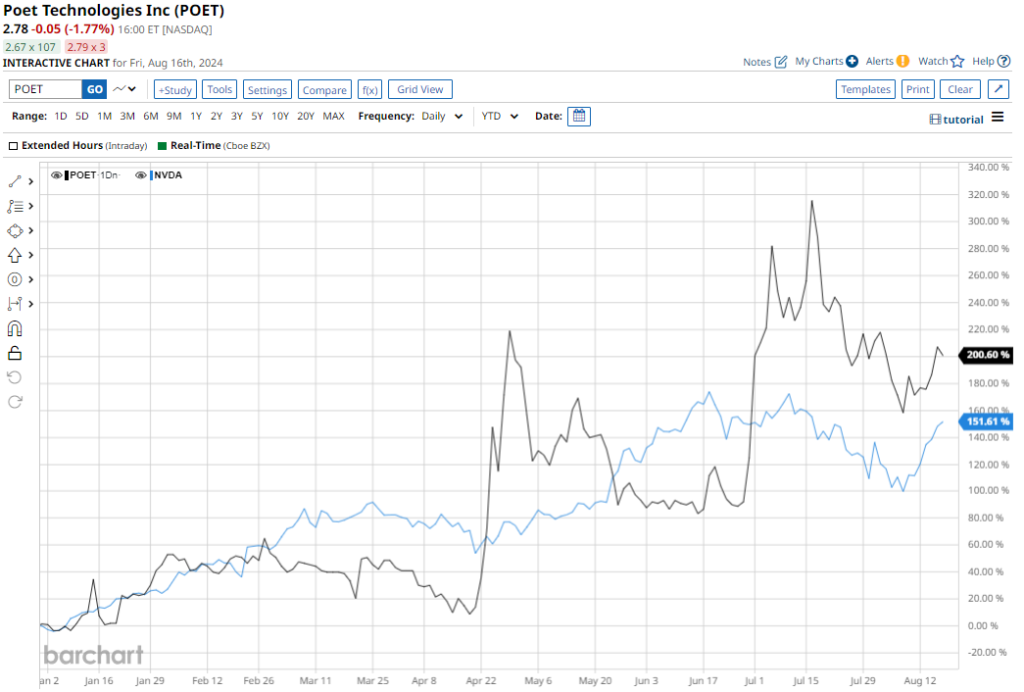

Nvidia (NVDA) may reign supreme in AI chip dominion, but a growing cohort of investors is now setting their sights beyond the colossal behemoth for more substantial growth windows. Enter POET Technologies (POET), a diminutive force in the semiconductor cosmos priced under $5 per share. In a dazzling display of prowess, POET has soared 195% in 2024, outpacing the remarkable 150% returns of NVDA.

Exploring POET’s Semiconductor Evolution

Based in Toronto, POET Technologies (POET) is a stealthy semiconductor maestro crafting discrete and integrated optoelectronic solutions tailored for data centers and AI markets. Their crown jewel, the POET Optical Interposer, is a pioneering platform fusing electronic and photonic devices into a cohesive multi-chip module through cutting-edge wafer-level semiconductor production.

At a market cap of $175 million, POET operates across China, Singapore, Canada, and the United States, illustrating its global footprint. Despite outshining NVDA, POET isn’t just surpassing the broader market performance in 2024; it’s also diligently chipping away at a 52-week decline, although it remains down by 81% over the past decade.

Fortifying Financial Foundations

On August 15, POET Technologies announced notable Q2 results, heralding advancements across various financial metrics. Bolstering its cash position, POET raised a substantial $15 million through private placements and an additional $10 million via a registered direct offering to fortify its financial standing. With a cash reserve of $28.7 million by end-July, POET stands on a solid financial foundation, poised for sustained growth and innovation in the cutthroat tech realm.

Furthering its liquidity, POET secured an additional $7.4 million through its ATM facility by issuing common shares. Despite reporting a Q2 net loss of $8 million, or $0.14 per share, POET showcased cutting-edge products such as an 800G transmit optical engine chipset and C-Band light sources at OFC, signaling strategic advancements amid a dynamically evolving marketplace.

Navigating the AI Terrain with Strategic Collaborations

In Q2, POET unveiled transformative design wins in partnerships with Foxconn Interconnect Technology and Luxshare Tech, cementing its pivotal role as a premier supplier in the burgeoning AI and high-speed data center segments. Through these strategic alliances, POET is forging ahead with a 3.2T optical engine program and pioneering 800G and 1.6T optical transceiver modules for data centers and AI markets, positioning itself as a beacon in the expanding AI equipment domain.

POET’s recent accolade as the “Best Optical AI Solution” at the 2024 AI Breakthrough Awards Program underscores its commitment to cutting-edge AI optical technology.

Analyst Perspectives on POET Stock

Despite its niche foothold in the semiconductor domain, POET Technologies garners coverage from a solitary Wall Street analyst who applauds the stock with a “Strong Buy” rating and an ambitious price target of $7.50, hinting at a tantalizing upside potential of 171.6% from its current valuation.