When Warren Buffett makes a move in the stock market, the world takes notice. The Oracle of Omaha and his team at Berkshire Hathaway (BRK.A) have a reputation for strategic value investing, guiding their ship through the turbulent waters of Wall Street. Their recent decision to divest the conglomerate’s entire stake worth almost $1 billion in Snowflake (SNOW) has sent shockwaves through the investment community.

Buffett, legendary for his knack for outperforming the S&P 500 Index over the long term, is closely watched by investors of all calibers. Berkshire’s quarterly filings are scrutinized for insights, almost like reading tea leaves, as market players endeavor to emulate Buffett’s storied success.

While much of the attention surrounding Berkshire’s recent moves has centered on the additional selling in Apple (AAPL) and the acquisition of a new stake in Ulta (ULTA), the dump of their Snowflake holdings paints a grim picture for the cloud-based data warehousing company.

Decoding Snowflake Stock

Established in 2012, Snowflake (SNOW) is an enterprise software firm specializing in cloud-based data warehousing. Berkshire initially invested in Snowflake during its IPO in September 2020, showing Buffett’s first foray into IPO waters in decades.

Currently valued at $44.1 billion by market cap, Snowflake shares have plummeted over 68% from their December 2020 highs and sit below the IPO price.

Snowflake’s heavy investment in artificial intelligence (AI) aims to bolster its cloud data storage capabilities. Nonetheless, the company faces an uphill battle against industry giants like Microsoft (MSFT) and Amazon (AMZN) that dominate the cloud and enterprise software landscape, hindering Snowflake’s competitive edge.

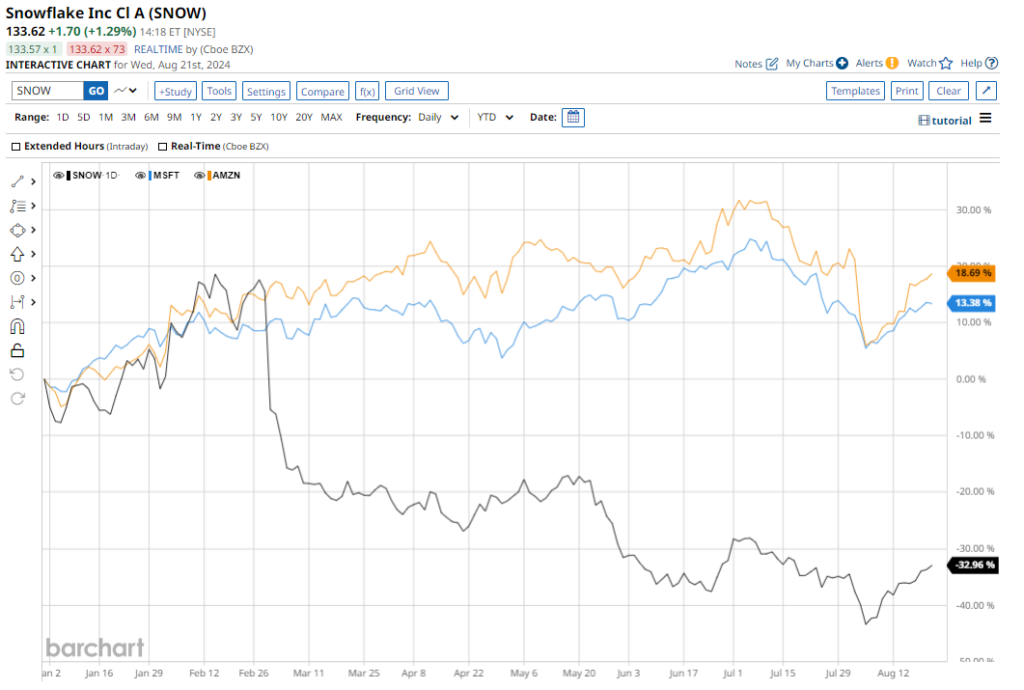

The company’s stocks have lagged this year, dropping 33%, in stark contrast to the 12.6% rise for Microsoft and the 18.7% gain for Amazon.

Snowflake’s troubles began with the unexpected exit of founder Frank Slootman as CEO in the first quarter, causing a sharp decline in stock price. Coupled with disappointing revenue forecasts, the stock lost 18% in a single day in February.

Despite its poor performance, Snowflake shares trade at a hefty 211.6 times forward earnings and 12.7 times sales, significantly above sector averages. This suggests that Snowflake is overvalued compared to its tech peers.

Snowflake’s Q2 Earnings Report

Snowflake is poised to announce earnings after today’s market close, with consensus estimates pointing to a loss of $0.56 per share on revenue of $850.15 million. Adjusted EPS is anticipated to reach $0.16, down from $0.22 the previous year.

Following a lackluster fiscal Q1 report in May, which fell short of estimates, Snowflake shares tumbled over 5% in a single trading session.

AT&T Attack and Snowflake’s Reputation

Adding insult to injury, Snowflake faced negative publicity this summer when AT&T (T) linked its software to a cyberattack affecting millions of U.S. customers. Although the breach exploited stolen logins rather than a vulnerability in Snowflake’s systems, the incident dented the company’s reputation, casting doubt on its data security practices.

Analysts downgraded Snowflake recently due to the data breach, rising competition, and other concerns, altering the stock’s price target and outlook unfavorably. The prevailing sentiment on Wall Street remains cautiously optimistic, with a modest “Moderate Buy” consensus and varied opinions among analysts.

The Verdict on SNOW Stock

Snowflake finds itself in stormy seas with its profitability in question. Escalating expenses for AI development and widening losses underscore the company’s struggle to rein in costs in a fiercely competitive market. With a new CEO at the helm, Snowflake’s path to recovery is riddled with challenges, leaving little room for missteps if it hopes to regain momentum in the coming quarters.