Investors often rely on Wall Street analysts’ recommendations to make informed decisions on stock transactions. Analysts’ opinions play a crucial role in shaping market sentiments and influencing stock prices. But are these recommendations truly worth their weight in gold?

Before delving into the significance of brokerage recommendations and how investors can leverage them, let’s explore the sentiment among Wall Street giants towards TSMC (TSM).

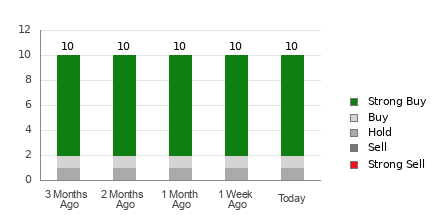

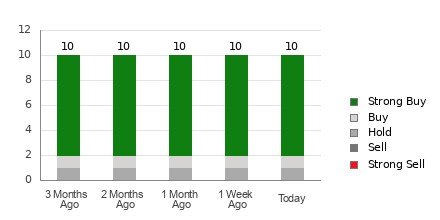

TSMC boasts an average brokerage recommendation (ABR) of 1.30, indicating a favorable stance towards the stock from 10 brokerage firms. Notably, eight of these recommendations are Strong Buy, reiterating the optimistic outlook on TSMC’s performance. This overwhelming positivity from analysts is further emphasized with a meager 10% of recommendations falling under the Buy category.

Decoding Brokerage Recommendation Trends for TSM

While the ABR signals a promising outlook for TSMC, wisdom dictates that investors should not solely base their investment decisions on this metric. Studies have shown a limited success rate in following brokerage recommendations for achieving optimal returns, given the inherent bias in analysts’ assessments influenced by their firms’ interests.

Brokerage firms often demonstrate a strong inclination towards positive ratings for stocks they cover, skewing their recommendations heavily towards ‘Strong Buy’ ratings. This discrepancy in perspectives between institutional entities and individual investors underlines the need for caution in relying solely on analyst recommendations for investment choices.

One proven tool that investors can utilize alongside ABR is the Zacks Rank, an extensively validated stock rating mechanism that encapsulates stocks within five distinct categories based on their potential for market performance. The efficacy of combining ABR with Zacks Rank to drive investment strategies cannot be overstated.

Distinguishing ABR from Zacks Rank

Despite both ABR and Zacks Rank sharing a 1 to 5 scale, they differ significantly in their operational scopes. ABR solely hinges on analyst recommendations, depicted with decimal values, while Zacks Rank functions as a quantitative model leveraging earnings estimate revisions, expressed in whole numbers.

While analysts’ recommendations tend to skew optimistically due to vested interests of brokerage firms, Zacks Rank thrives on factual data stemming from earnings estimate revisions. This contrast underscores the reliability of Zacks Rank in predicting stock price shifts based on its robust foundation of authentic assessments.

Moreover, unlike ABR, Zacks Rank ensures a balanced representation across all stocks analyzed by brokerage firms, thus maintaining fairness and objectivity in evaluating performance potential.

While ABR may lack real-time updates, Zacks Rank swiftly captures evolving market trends through revised earnings estimates, providing investors with timely insights into future stock movements.

Is TSM a Viable Investment?

Recent revisions in TSMC’s earnings estimates have propelled the Zacks Consensus Estimate for the current year to $6.45, reflecting a 0.2% growth over the past month. Analysts’ collective optimism in revising earnings per share (EPS) estimates upwards indicates a promising growth trajectory for the stock in the foreseeable future.

With an amalgamation of positive estimations and a Zacks Rank of #2 (Buy) for TSMC, all signs point towards a favorable investment prospect. The growing consensus among analysts on TSMC’s financial outlook underscores the stock’s potential for substantial gains in the coming period.

Therefore, the Buy-equivalent ABR for TSMC emerges as a valuable guiding compass for investors navigating the intricate landscape of stock investments.

Curating the 7 Best Stocks for the Next 30 Days

Delve into the expert-curated list of 7 premier stocks carefully handpicked from a pool of 220 Zacks Rank #1 Strong Buys. These elite stocks, projected to exhibit early price surges, have consistently outperformed the market since 1988, boasting an average yearly gain of +24.0%. Ensure to give these top-performing stocks your immediate attention for potential lucrative returns.

Explore the elite stocks now >>

Obtain the Free Stock Analysis Report for Taiwan Semiconductor Manufacturing Company Ltd. (TSM) here