Finding diamonds in the rough can be akin to discovering hidden treasure. In the realm of stocks, the consumer sector is ablaze with undervalued companies beckoning savvy investors.

One key indicator, the RSI, serves as a sentinel in these tumultuous waters. This metric keenly discerns a stock’s strength on bullish versus bearish days. Hovering below 30, it heralds potential opportunities in oversold assets, as per the esteemed Benzinga Pro.

Tickling investors’ fancies are the following top contenders in the consumer discretionary domain, flaunting RSIs close to or below the coveted 30 mark.

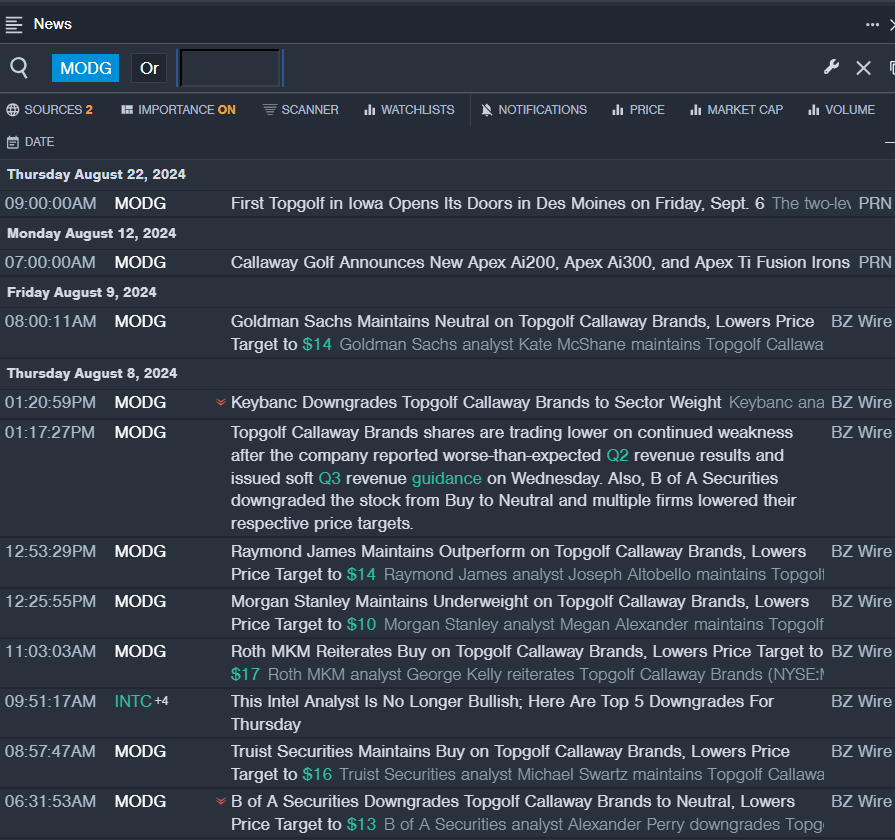

Driving Missed Opportunities: Topgolf Callaway Brands Corp (MODG)

- Regrettably, on August 7, Topgolf Callaway Brands announced lackluster second-quarter revenue figures, coupled with a dreary outlook for the third quarter. Despite cosmic headwinds like pesky FX trends and unabating inflation pain, Chip Brewer, the President, and CEO, remains resolute. The company’s stock has plummeted roughly 27% in the past month, languishing at a 52-week low of $9.84.

- RSI Value: 29.11

- MODG Price Action: Topgolf Callaway Brands shares took a 2.5% dip, closing at $11.38 on the somber Thursday.

Craving Better Results: Red Robin Gourmet Burgers Inc (RRGB)

- Alas, on August 22, Red Robin served up a plate of discouraging tidings with its second-quarter earnings missing the mark. To add salt to the wound, the FY24 revenue forecast took a nosedive. G.J. Hart, the venerable President and CEO, lamented the industry-wide slowdown camouflaging their internal strides. The stock has tumbled approximately 22% in the past lunar cycle, grasping onto a 52-week low of $4.50.

- RSI Value: 26.81

- RRGB Price Action: Red Robin’s stocks saw a 6.3% decline, concluding at $4.73 on the valiant Thursday.

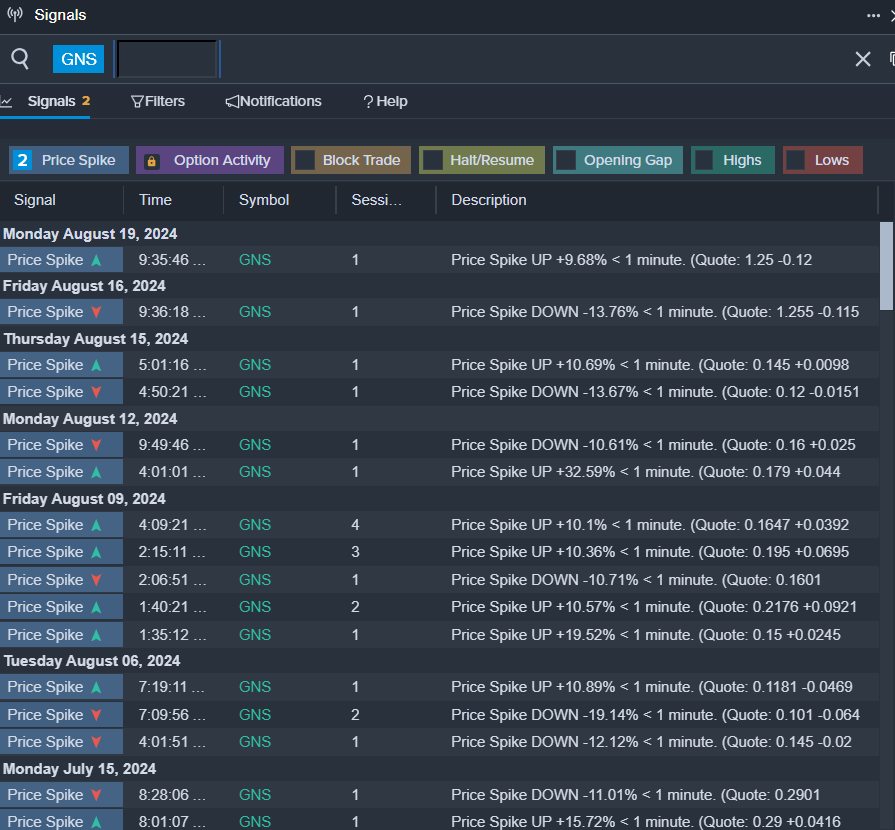

Rising from the Ashes: Genius Group Ltd (GNS)

- Marking a symbolic turnaround, Genius Group orchestrated a reverse stock split effectively starting August 16. Nonetheless, the stock swerved downwards by nearly 32% in the previous quintet of trading days, clutching onto a 52-week low of $1.03.

- RSI Value: 25.58

- GNS Price Action: Genius Group stocks plunged by 12.3%, wrapping up the fateful Thursday at $1.07.

Read More: