Nvidia, a powerhouse in the semiconductor and AI realm, is slated to unveil its earnings report after the closing bell on Wednesday, August 28, stirring anticipation among investors. The remarkable trajectory that Nvidia has traversed in the last couple of years seems almost surreal, with the company showing no signs of deceleration and poised to continue its upward trajectory for the foreseeable future.

Let’s delve into the journey that has brought Nvidia to its current zenith, what the upcoming earnings report might hold, and the tantalizing prospect of Nvidia achieving a staggering $10 trillion market capitalization.

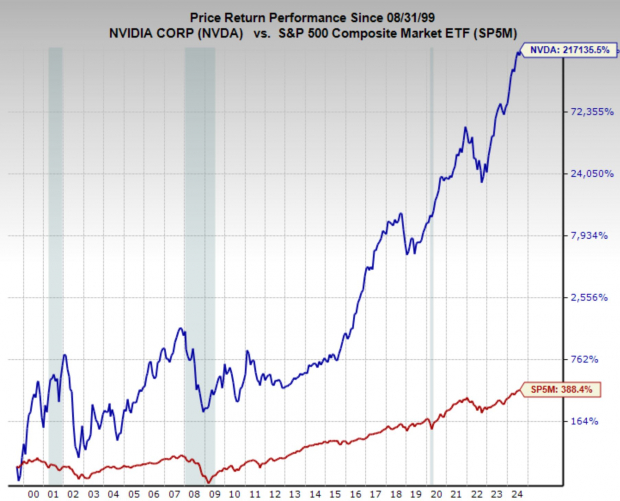

The Phenomenal Ascent of Nvidia Stock

In a span of 25 years, Nvidia has bestowed its shareholders with stellar returns that are nothing short of mind-boggling. With an annual compounded growth rate of 35.4%, the stock has delivered a stratospheric 217,000% return over this period. Zooming into the recent five-year window, Nvidia’s stock has surged at an annual rate of 98.5%, translating to a jaw-dropping 30-fold increase for investors.

Plummeting to a market cap of $250 billion during the 2022 bear market nadir, Nvidia presently stands tall at a formidable $3 trillion. This meteoric ascent can be predominantly attributed to Nvidia’s strategic thrust towards AI infrastructure through its range of data center products. Post this strategic pivot, annual sales have nearly quadrupled to $80 billion, with projections indicating a further twofold increase by 2026. The icing on the cake is Nvidia’s enviable 53% net margins on this revenue.

Fueled by the escalating demand for AI-driven solutions, Nvidia has cemented its position at the epicenter of the AI revolution. Strategic collaborations with tech behemoths such as Amazon, Microsoft, and Alphabet, coupled with relentless innovation in AI software like the CUDA platform, and a prescient anticipation of the vast potential of generative AI, have been instrumental in propelling Nvidia’s stock to stratospheric heights.

Heightened Expectations for Nvidia’s Earnings

The forecasts for the current quarter’s earnings paint a picture of Nvidia’s relentless growth on both the top and bottom lines. Projections indicate a staggering 110% year-over-year growth in sales, reaching $28.2 billion for the quarter, while earnings are poised to soar by 133% year-over-year to $0.63 per share. Looking further ahead, the expectations are equally impressive.

While Nvidia had occupied the zenith of the Zacks Rank for an extended period, reflecting a persistent pattern of analysts elevating earnings projections, it currently holds a Zacks Rank #3 (Hold) rating, which is by no means a bearish signal. A rank #3 is simply indicative of a status quo, where there haven’t been recent upgrades to earnings estimates.

The $10 Trillion Market Cap Dream for Nvidia

The tantalizing prospect of Nvidia attaining a market cap of $10 trillion in the next five years isn’t just a dream but a realistic probability based on prevailing forecasts. Currently commanding a one-year forward earnings multiple of 48.9x, significantly below its five-year median of 55x, Nvidia’s galloping growth has ensured that despite a 20-fold surge in stock price over five years, it still hovers around its most modest relative valuation levels due to its phenomenal profit expansion.

While postulating Nvidia’s worth reaching $10 trillion might seem audacious, a simple extrapolation underscores the plausibility of this scenario. Forecasts indicate a robust 37.6% annual earnings growth over the next three to five years, and if the stock continues this trajectory while upholding its current earnings multiple, it could conceivably achieve the $10 trillion milestone within five years.

Is Nvidia Stock a Buy for Investors?

For investors eyeing exposure to AI and high-growth tech sectors, Nvidia remains an alluring option. Despite the exponential surge in its stock price, Nvidia’s dominance in AI infrastructure, strategic partnerships, and unmatched growth rates suggest that the stock still holds substantial upside potential.

At its core, Nvidia is ingeniously positioned to retain its pivotal role in the AI revolution, with its GPUs spearheading the future of AI-driven industries. The company’s unwavering focus on continual innovation and its synergistic partnerships with major cloud players like Amazon, Microsoft, and Alphabet lay a robust groundwork for sustained growth and continued value creation.

The Long-term Path of Nvidia’s Growth Potential

High Valuation Backed by Extraordinary Earnings Growth

While Nvidia’s valuation may seem lofty, it is supported by exceptional earnings growth that is anticipated to persist at a rapid rate.

Nvidia’s Potential for a $10 Trillion Market Cap

The company’s ability to potentially achieve a $10 trillion market cap highlights its long-term growth path, presenting an enticing opportunity for investors with a higher risk tolerance seeking long-range rewards.

The Future of AI and Nvidia’s Stock

Investors looking to capitalize on the future of artificial intelligence may find Nvidia’s stock an intriguing prospect, despite potential short-term market fluctuations. With its strong position in the AI sector and robust earnings growth forecasts, Nvidia remains poised to deliver lasting value to investors as it advances towards new milestones.