In the realm of financial markets, revelations are abound this week in over 140 companies as they prepare to unveil their Q2 earnings reports, with 15 illustrious S&P 500 members poised to take center stage. Among the notable contenders waiting in the wings to showcase their performance spectacles are luminaries like Salesforce, Lululemon, Best Buy, Dollar General, and many more.

Putting Earnings and Revenue in Perspective

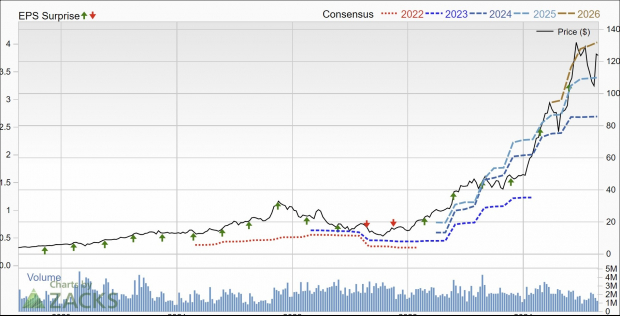

Behold the striking visuals that adorn the comparison charts below. These detailed portrayals encapsulate the earnings and revenue beat percentages for the upcoming stars against a historical backdrop, painting a vivid picture of their prior performances.

Image Source: Zacks Investment Research

One striking feature that leaps off the canvas in these charts is the remarkably low Q2 revenue beat percentage. At a paltry 60.3%, this quarter marks a nadir for this cohort of index members over the past 20 quarters, spanning a decadent half-decade.

Revenue beats have languished in the doldrums since the commencement of the reporting cycle, prophesying a trend that is poised to echo through the halls till the curtain falls on this earnings season.

Charting the Earnings Odyssey

As we shift focus to the earnings realm, the comparison charts below shepherd us through the Q2 earnings and revenue growth rates of our contenders across the annals of history, offering a compass to navigate their financial odyssey.

Image Source: Zacks Investment Research

Embracing the Earnings Landscape

Zooming out to capture the entirety of Q2, amalgamating the realm of actuals with the lingering few awaiting their turn in the limelight, S&P 500 earnings are poised to leap up by a commendable +9.6% from the bygone year, dancing to a melody of +5.4% higher revenues.

Such robust performance heralds the swiftest earnings growth pace in the bygone eight quarters, pirouetting close to the remarkable +10% crescendo witnessed back in the Q1 of 2022. The Q2 earnings tapestry unfurls, poised to etch a new all-time quarterly pinnacle as illuminated in the interactive chart below.

Image Source: Zacks Investment Research

The forthcoming visuals showcase the year-over-year earnings and revenue growth for 2024 Q2, juxtaposing the tapestry of preceding periods against the backdrop of what beckons in the next trio of acts.

Image Source: Zacks Investment Research

Journeying forward to the impending period of 2024 Q3, S&P 500 earnings unfurl a script projecting a commendable +3.9% leap from yesteryear, waltzing to the tune of +4.6% higher revenues.