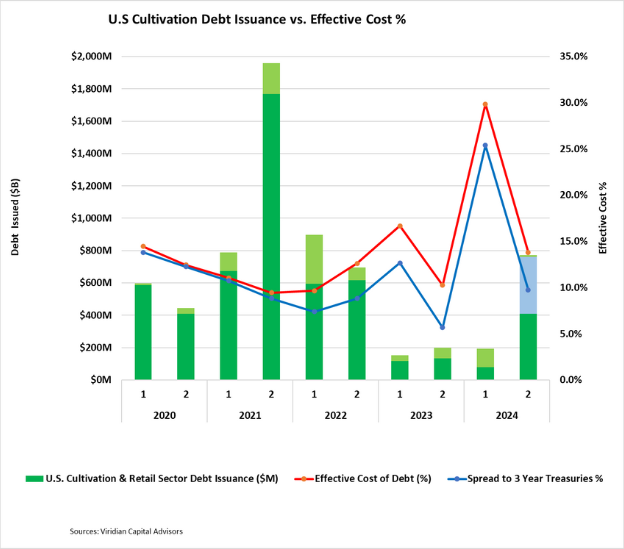

Debt issuance for the U.S. Cultivation & Retail sector in H2:24 is already surpassing levels seen since H2:22. With anticipated additional financing for the rest of the year, this period is projected to outdo all others except the latter half of 2021 and the first half of 2022.

-

In H2:24, the majority of debt issued has been for refinancing purposes, involving companies like Ascend, Jushi, and Terrascend. Despite having net debt over 3 times Debt/EBITDA, these companies secured financing at attractive rates, potentially based on optimism around forthcoming 280e relief.

-

Viridian evaluates debt issuance by considering various factors such as coupon, maturity, OID, convertibility, and warrants to calculate the effective cost accurately. This approach includes valuing conversion options and warrants as additional discounts during calculation.

-

Comparing historical effective costs, H2:23 featured unusually low figures due to a notable presence of bank debt. Conversely, H1:24 saw higher costs due to deals like AYR’s coupon at a 20-point OID with substantial warrant coverage, producing high effective costs.

-

However, the average effective cost has significantly decreased to 13.8% in H2:2024, reflecting more favorable financing terms. Recent transactions involved Ascend, TerrAscend, and Jushi at lower effective costs.

-

Notably, spreads to treasuries are trending downwards, indicating a potential further tightening in the future, especially with optimistic expectations around rescheduling.

The Viridian Capital Chart of the Week sheds light on critical investment, valuation, and M&A trends sourced from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker offers vital market intelligence for cannabis entities, investors, and acquirers in guiding capital allocation and M&A strategies. This proprietary service monitors and analyzes capital raise and M&A activities in the legal cannabis, CBD, and psychedelics sectors, segmenting deals based on key metrics.

Since its inception in 2015, the Viridian Cannabis Deal Tracker has meticulously tracked over 2,500 capital raises and 1,000 M&A transactions, totaling more than $50 billion in combined value.

Cannabis Industry on the Verge of Rescheduling?

Curious about what this potential shift means for the industry’s future?

Stay informed by hearing directly from top industry executives, investors, and policymakers at the upcoming Benzinga Cannabis Capital Conference in Chicago on Oct. 8-9.