Nvidia (NASDAQ: NVDA) is gearing up to unveil its fiscal 2025 second-quarter results on August 28, with analysts anticipating robust growth. Projections by LSEG Data & Analytics suggest a 112% year-over-year revenue surge to $28.6 billion, slightly higher than Nvidia’s $28 billion guidance for Q2. Despite a potential drop in adjusted gross margin from fiscal Q1 due to production capacity investments, Nvidia’s valuation remains attractive, making it a compelling consideration for investors.

Valuation Metrics Favor Nvidia Stock

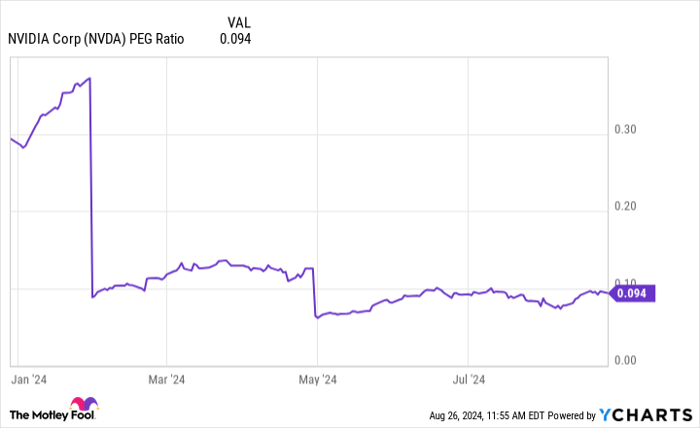

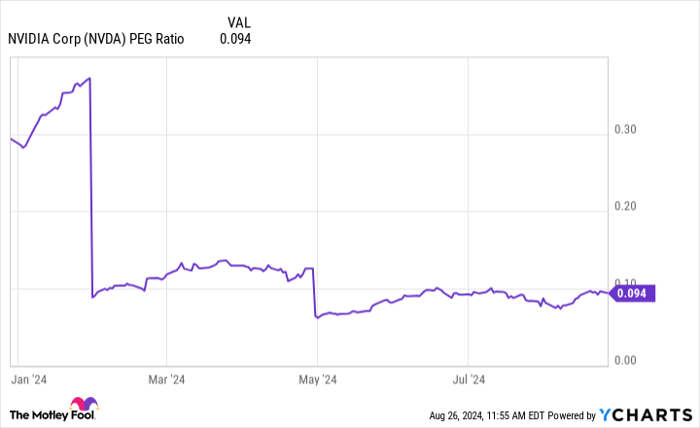

Nvidia’s current forward earnings multiple of 48 stands favorably compared to the U.S. technology sector’s average of 46, signifying a compelling valuation. Additionally, the stock’s undervaluation is highlighted by a PEG ratio below 1, indicating promising growth prospects relative to current earnings.

NVDA PEG Ratio data by YCharts

Nvidia emerges as a strong growth stock prospect, with indications pointing to a potential beat in upcoming results.

Positive Trends from AI Hardware Companies

Strengthening the case for Nvidia, recent performance from AI hardware companies like Taiwan Semiconductor Manufacturing (TSMC) and Super Micro Computer demonstrates significant revenue growth. TSMC’s enhanced packaging capacity for advanced chips aligns with Nvidia’s next-generation Blackwell chips, alluding to a potential revenue upsurge. Supermicro’s substantial revenue increase and strong guidance further support Nvidia’s growth trajectory, hinting at a solid outlook for the company.

Surge in Big Tech Capex Signals Opportunities

Major tech players’ increased capital expenditures, including Microsoft, Meta Platforms, Alphabet, and Amazon, bode well for Nvidia. This heightened spending on AI infrastructure underlines a promising future demand for Nvidia’s chips. With the anticipation of these giants transitioning to Nvidia’s innovative Blackwell processors, the company is poised to capitalize on the growing market needs, presenting an encouraging outlook for investors.

The Rising Demand for Nvidia’s AI Chips: A Closer Look

Speculations have rippled through the financial landscape lately, indicating a bountiful tale for Nvidia. The company’s AI chips seemingly possess a Midas touch, with a projected supply well into 2025. This promising trajectory has the potential to sustain the tech giant for numerous quarters and possibly years to come.

The Continuously Strong Demand for AI Chips

Evidently, the demand for Nvidia’s AI chips appears unwavering. This steadfast interest continues to fuel the company’s ability to yield outcomes that might surpass established consensus estimates and soar above expectations. If this outlook materializes, Nvidia’s shares could receive yet another injection of momentum, propelling them to new heights.

The Forecast and Investor Implications

Indicators point towards a favorable forecast, with ample evidence suggesting that Nvidia remains set to outperform in the market. This upbeat scenario beckons long-term-minded investors to contemplate acquiring a stake in this AI stock before potential further escalation post-August 28 unfolds.

Historical Context for Consideration

Reflecting on historical data may illuminate the path for potential investors. Recalling Nvidia’s absence from the Motley Fool Stock Advisor’s elite selection on April 15, 2005, highlights the substantial opportunity missed. A meager $1,000 investment back then would have exponentially ballooned to an awe-inspiring $792,725, underscoring the transformative power a well-timed investment can wield.

The Stock Advisor service by the Motley Fool extends a guiding hand to investors with its time-tested blueprint for success. Boasting a track record that has eclipsed the S&P 500’s return since 2002, such insights could prove invaluable in navigating the choppy waters of the ever-evolving market.

An enticing invitation to explore further possibilities is extended, beckoning investors to peer into the ten stocks identified by the Motley Fool for potential growth. Seizing the opportunity may herald profitable returns and a chance to ride the wave of evolving market dynamics.

Amidst these insightful revelations, an air of anticipation hovers over Nvidia’s trajectory. As the clock ticks towards a future potentially laden with promising prospects, the allure of investing in this technological maven grows ever more enticing.

Armed with historical acumen and contemporary insights, investors are challenged to read the tea leaves and discern the optimal course of action. The wind whispers tales of Nvidia’s impending fortunes – will wise investors heed the call and ride the tumultuous yet rewarding waves in the realm of AI chips?