As NVIDIA is poised to unveil its fiscal second-quarter 2025 results, investors are on high alert. The tech giant has been on a tear, outperforming the industry with an impressive 18.7% surge over the past three months. The stakes are high, with the possibility of this positive trajectory continuing should NVIDIA exceed earnings expectations.

Anticipation for Earnings

With NVIDIA’s Earnings ESP currently at -2.25% and a Zacks Rank #3 (Hold), the company faces a pivotal moment. An earnings beat is more likely with a positive Earnings ESP combined with a Zacks Rank of Strong Buy or Buy. Analysts predict triple-digit growth in both earnings (33.3%) and revenue (109%) for the upcoming quarter, despite a slight negative earnings estimate revision.

Analysts’ Optimism Towards NVDA Stock

The optimism surrounding NVIDIA’s upcoming report is palpable among industry analysts. Projections indicate stellar performance, with Wedbush expecting a “drop the mic” showing, buoyed by soaring enterprise AI demand and major spending from industry stalwarts like Amazon and Google. Market sentiment is strong, evident in the rising average brokerage recommendation (ABR) of 1.20 and a target price range of $90.00 to $200.00 set by 40 analysts.

Potential in Data Centers

NVIDIA’s dominance in the AI landscape positions it favorably for a successful quarter. The company’s GPUs are lauded for powering AI systems, making it a go-to choice for industry giants like Microsoft and Amazon. As the leader in AI chips for data centers, NVIDIA’s growth potential remains robust, with positive forecasts indicating revenues of around $28 billion for the quarter.

Assessment of NVIDIA’s Valuation

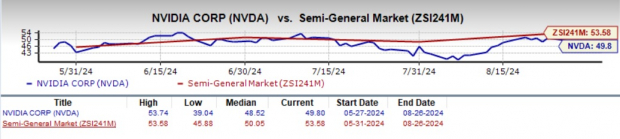

Despite concerns over NVDA’s pricey valuation, the stock’s impressive run since 2022 has mitigated these worries. Trading at a P/E ratio of 49.8 (versus the industry’s 53.58) and a lower-than-average PEG ratio of 1.25, NVIDIA emerges as a value play for investors, offering strong potential for growth.

ETFs on the Radar

Several ETFs with significant exposure to NVIDIA are under scrutiny ahead of the earnings release. Names such as Strive U.S. Semiconductor ETF, VanEck Vectors Semiconductor ETF, and Technology Select Sector SPDR Fund are in focus as investors gauge NVIDIA’s impact on their performance.

Diverse Investment Vehicles

For those seeking more targeted exposure, single-stock ETFs like T-REX 2X Long NVIDIA Daily Target ETF and GraniteShares 2x Long NVDA Daily ETF provide a concentrated play on NVIDIA stock, offering unique investment propositions.

Closing Thoughts

As NVIDIA gears up to unveil its Q2 earnings, all eyes are on the tech behemoth. The company’s innovative strides in AI and semiconductor technology have positioned it as a market leader, with earnings projections and analyst sentiment pointing towards a favorable outcome. Investors in NVIDIA-related ETFs are eagerly awaiting the earnings report, poised to capitalize on potential opportunities that may arise.