Apple Inc. typically showcases its new iPhone lineup annually in September, a momentous occasion applauded by millions globally. Apple aficionados eagerly anticipate each launch, eager to embrace the latest innovations in Apple’s premium smartphones.

Since its inception in 2007, the iPhone has evolved through 15 iterations. However, facing fierce competition, a scarcity of compelling features, and regulatory challenges in key markets like China, the reception for the September 2023 iPhone 15 release has faltered compared to its predecessors.

Recent data from Consumer Intelligence Research Partners (CIRP) illustrates a notable decline in the iPhone 15’s market share, dropping to 67% in the June quarter of fiscal 2024, down from 79% for the iPhone 14 models in the corresponding period last year. As Apple’s flagship product loses prominence, the company is placing its bets on innovative artificial intelligence (AI) features to rekindle consumer interest and boost sales, following the lead of rivals like Google and Samsung.

Subsequent to Apple’s long-awaited AI strategy announcement at the Worldwide Developers Conference (WWDC) in early June, investor and Wall Street confidence in the company’s future prospects has escalated. With the imminent debut of the AI-infused iPhone 16 model on September 9 at the “It’s Glowtime” event, should investors seize the moment to incorporate AAPL stock into their portfolios? Let’s delve deeper to find out.

An Overview of Apple Stock

Established in 1976, Apple Inc. has solidified its standing as a frontrunner in consumer tech innovation. Renowned for groundbreaking products like the iPhone, iPad, Mac, AirPods, Apple Watch, and Apple Vision Pro, this “Magnificent Seven” enterprise’s exceptional ability to integrate state-of-the-art design with seamless functionality places it at the vanguard of the tech industry. With a colossal market capitalization of approximately $3.5 trillion, this tech behemoth proudly holds the title of the world’s most valuable company.

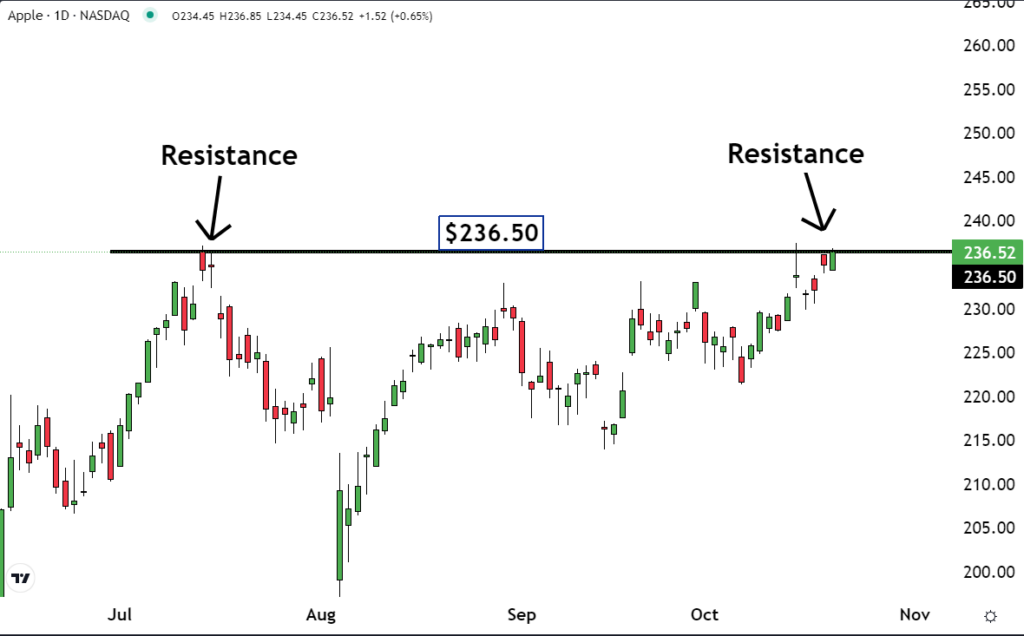

Following a sluggish start to 2024, shares of this mega-cap stock have surged by 18% year-to-date and by 27.2% over the past 52 weeks, closely mirroring the broader S&P 500 Index’s gains.

Apple’s dedication to rewarding shareholders is exemplified by its decade-long streak of dividend increases. In a remarkable move, the tech giant made headlines in May with a record-breaking $110 billion share repurchase, the largest in U.S. history.

During fiscal Q3 alone, Apple distributed over $32 billion to shareholders, including $3.9 billion in dividends and an impressive $26 billion in share buybacks. On August 15, the company paid out a quarterly dividend of $0.25 per share, reflecting an annualized dividend of $1.00 per share, yielding a modest 0.44% at present levels.

Priced at 33.53 times forward earnings, AAPL stock is valued in line with some of its mega-cap peers like Amazon.com and Microsoft.

Apple’s Strong Performance in Q3 Earnings

Following Apple’s fiscal Q3 earnings report released on August 1, which surpassed Wall Street’s expectations, Apple’s stock closed slightly higher the next day despite a broader market downturn. The company reported a 5% year-over-year revenue increase to $85.8 billion, outperforming estimates marginally. Furthermore, its earnings per share (EPS) surged by 11% to $1.40, surpassing projections by 4.5%.

Apple witnessed a 24% boost in iPad sales, reaching $7.2 billion, buoyed by the release of new iPad models during the quarter, the first since 2022, sparking fresh upgrades and rejuvenating interest in the product line. Although iPhone sales experienced a slight dip year-over-year to $39.3 billion, the iPhone remains Apple’s top revenue generator, contributing a substantial 46% to the company’s total revenue in the quarter.

Apple’s Services segment, encompassing various offerings from hardware warranties to revenue from Google’s unit and Apple TV+ content, amassed $24.2 billion in sales, marking a 14% annual surge and underlining its pivotal role in augmenting Apple’s earnings. Ending the quarter with a robust cash position of $153 billion and a total debt of $101 billion, Apple’s leadership projected steady revenue growth in Q4 and anticipated operating expenses and gross margins for the quarter.

Analysts foresee Apple’s profit climbing to $6.70 per share in fiscal 2024, a 9.3% surge from the preceding year. This growth trajectory is expected to persist into fiscal 2025, with earnings poised to rise by 12.7% to $7.55 per share.

What is the Analyst Consensus on Apple Stock’s Future?

Revolutionary iPhone 16 Launch Sparks Optimism at Apple

The Excitement Builds

A recent analyst note from Wedbush Securities has set the financial world abuzz with anticipation. The AI-powered launch of the iPhone 16 in September is predicted to ignite a major growth phase for Apple in the upcoming year. Initial projections suggest that shipments of the iPhone 16 could soar beyond 90 million units, surpassing the market’s initial expectations of 80-84 million units.

Unprecedented Potential

According to analyst Dan Ives, this iPhone upgrade cycle is poised to be historic. With roughly 300 million iPhones globally not having been upgraded in over four years, the stage is set for a super cycle. Ives envisions a smooth transition between outgoing CFO Luca Maestri and his successor at Apple, asserting that Cupertino will reign as the gatekeepers of the consumer AI revolution with Apple Intelligence on the horizon.

Financial Projections

Wedbush Securities has set a $285 price target for AAPL, implying an expected upside of approximately 25% and a market cap well exceeding $4 trillion. Despite fluctuations, AAPL stock maintains a consensus “Moderate Buy” rating among analysts. Of the 31 analysts covering the stock, 19 advocate a “Strong Buy,” three recommend a “Moderate Buy,” eight label it as a “Hold,” and one suggests a “Strong Sell.”

The mean price target for AAPL stands at $241.68, signaling an upside potential of just 6% from current levels. However, the Street-high target price of $300, recently raised by Loop Capital, implies that the stock could rally by as much as 31.6% moving forward.