The Anticipation of Nvidia’s Quarterly Report

As Nvidia (NASDAQ:) prepares to unveil its quarterly report, the financial realm is on tenterhooks. With a staggering market capitalization nearing $3 trillion, the company is poised to showcase a remarkable sales doubling compared to the previous year.

The Balancing Act of Investor Expectations

Surpassing such lofty expectations is no mean feat. Providing an optimistic revenue forecast for forthcoming quarters and years, while ensuring investor satisfaction remains a Herculean task for Nvidia.

The Impact of Nvidia on the Market

Given its colossal size and substantial influence on other stocks, Nvidia’s imminent report, scheduled for release post the closure of the primary US trading session on Wednesday, is a highly awaited event. The tech giant has a track record of both delighting and catching investors off guard in the past, setting the stakes high for the upcoming disclosure.

The Speculations in the Options Market

Rumblings within the options market hint at an expected price movement of around 10% post the report’s release. This aligns with the upward swings witnessed in the previous two reports in May and February, as well as last August.

The Potential Market Cap Surge

If these predictions hold true, the surge could propel Nvidia’s share price to unprecedented highs exceeding $141, pushing its market capitalization close to the $3.5 trillion mark. This would solidify its ongoing battle with Apple (NASDAQ:) for the coveted top spot.

The Ripple Effect on Equity Indices

A positive outcome could pave the way for major US equity indices to retest or breach their all-time highs once again, shrugging off the repercussions of the carry trade unwinding observed in late July and early August.

The Risk of a Market Downturn

Conversely, a disappointing report might trigger a slew of sell-offs across AI-related stocks, which have been on a robust rally for the past 20 months. Such a scenario could reignite concerns reminiscent of the dot-com crisis of 2000.

Potential Correction Scenarios

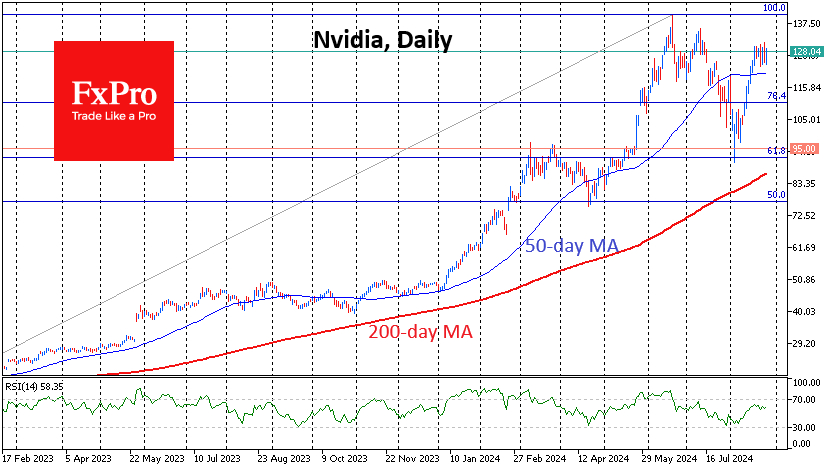

A significant downturn could initiate a deeper correction, affirming the disparity between price and RSI on daily timeframes. This would see the price potentially retracting to the $90 vicinity, revisiting the lows of this month and inching closer to the 200-day moving average.

Exploring Future Market Movements

However, a retreat from historical highs may not signal the culmination of Nvidia’s trajectory. Should this transpire, a setback akin to a 61.8% Fibonacci retracement from the global rally since early 2023 up to the high of 20 June might unfold, suggesting further market dynamics.

Should there be a breakthrough beyond this threshold, a potential ‘extension’ could be initiated, projecting an upward movement with a target of $220.