The Anticipation

Nvidia Corp‘s imminent fiscal second-quarter earnings spectacle is poised to unfold after tomorrow’s market closure. While the majority of analysts are in the bullish camp regarding NVDA stock, a cloud of uncertainty lingers, setting the stage for a fierce tug-of-war. This ambiguity has created a fertile ground for swift-footed traders looking to capitalize on the market’s seesaw.

Market Projections

Surveying the Wall Street landscape reveals experts’ consensus on Nvidia posting an earnings per share (EPS) of 64 cents – a significant leap from the 25 cents figure recorded in the corresponding quarter of the previous year (adjusted for splits). Revenue projections stand at a hefty $28.68 billion, dwarfing the $13.51 billion revenue recorded in the same quarter of 2024.

Arguably, all gazes are affixed on the pivotal question of Nvidia’s prowess in articulating a compelling narrative around artificial intelligence (AI). Over the past five years, NVDA stock has spectacularly soared by over 2,918%, largely fuelled by its cutting-edge graphics processors. These specialized semiconductors underpin various AI mechanisms, anchoring Nvidia as a cornerstone player in the frenzied race towards developing machine intelligence.

Stirring Skepticism

Notwithstanding the prevailing optimism, lingering doubts shroud Nvidia’s trajectory. A recent revelation by trader and market sage Steve Grasso unveiled his selling off of all Nvidia holdings ahead of the Q2 report. Moreover, Grasso hinted at a cautious pause, stating intentions to let NVDA “find its footing” before contemplating a potential re-entry.

Equally noteworthy, financial behemoth Goldman Sachs unveiled its forecast of corporations funneling over $1 trillion into AI ventures in the coming years. However, the investment titan flagged concerns regarding the conundrum of whether the productivity yields will adequately rationalize such colossal outlays.

The Direxion ETFs

Amid the swirling uncertainties enveloping NVDA stock, the stage is set for endeavors through Direxion’s specialized exchange-traded funds (ETFs) honing the Nvidia mettle. Bulls entranced by Nvidia’s allure may find solace in Direxion Daily NVDA Bull 2X Shares NVDU. This leveraged ETF endeavors to replicate 200% of NVDA’s daily investment dynamics.

For those reveling in the contrarian narrative, behold Direxion Daily NVDA Bear 1X Shares NVDD, offering a seamless avenue to short the semiconductor stalwart with 100% inversed performance over NVDA.

Primarily, Direxion proffers a user-friendly conduit for retail traders to flex leverage or short securities sans the convolutions (and pitfalls) of option trading. Nevertheless, a word to the wise – leveraged and inversed ETFs are best-suited for positions held for brief durations, ideally less than a day. Extended holds can trigger value erosion.

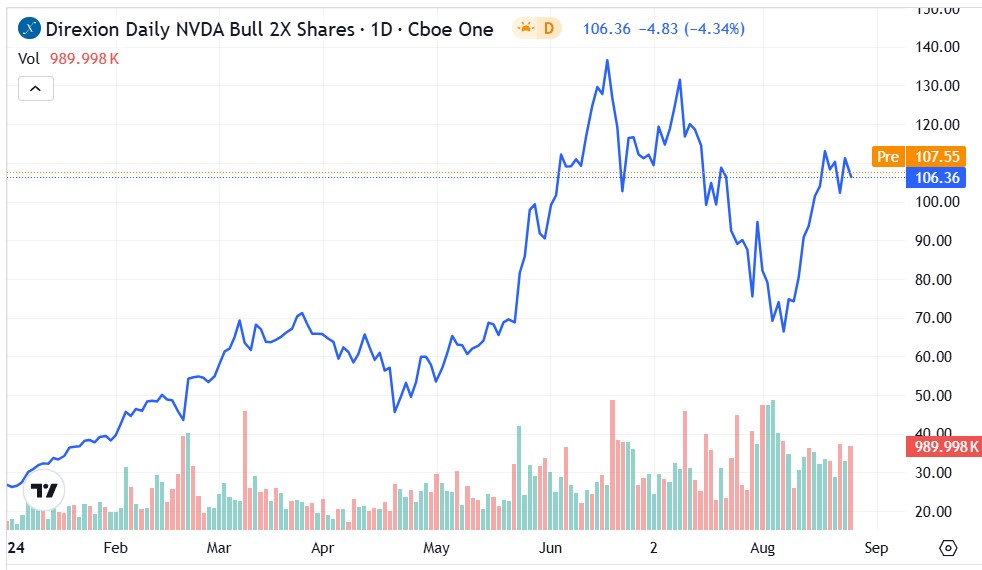

The NVDU ETF Odyssey

Unsurprisingly, NVDU’s trajectory mirrors that of NVDA stock with an amplified fervor. Since the year’s dawn, the 2X fund has surged by just under 298%, overshadowing NVDA’s 162.5% uptick within the same timeframe.

- NVDU boasts sturdy demand around the $70 mark. In a fascinating turn since June 18, this leveraged powerhouse has traced a pattern of ascending lows.

- Bulls eagerly eye breaking out of the sideways stagnation at $109, propelling towards the psychological milestone of $120.

- The accumulation volume has been steadily mounting since late December, symbolizing burgeoning interest.

The NVDD ETF Saga

Conversely, the NVDD ETF has weathered a turbulent 2025, relinquishing over 68% of its market worth since the year’s inception. Attempts to cling to crucial support thresholds faltered as NVDA stock mounted its northward crusade.

- NVDD languishes below both its 50-day moving average ($7.97) and the 200 DMA ($13.52). At a stalling $7.28 by Monday’s closure, NVDD hovers beneath the critical $7.50 support tier.

- The bears’ foremost objective is to reestablish support at $7.50, subsequently breaching the $8 threshold. An underwhelming showing in the Q2 earnings arena might tip the scales.

- Intriguingly, the acquisition volume for this contrarian vessel has been robust, hinting at a burgeoning interest in the bearish narrative as the bullish hordes potentially overcrowd the space.